Consumers will put billions of pretax payroll dollars into health savings accounts in the next few years to cover out-of-pocket expenses connected to high-deductible health insurance plans, experts say.

Naturally, banks are anxious to hold those funds and sell other products and services to the consumers who can build up their balances in these tax-advantaged accounts. A big question is whether the banks that hold those funds, and issue the debit cards for accessing the funds, will be traditional financial institutions or banks created by health insurance companies.

Celent LLC of Boston projects there will be $62 billion in these HSAs by 2010; the consulting firm BearingPoint Inc. says there will be $100 billion in HSAs by 2012.

Established retail banks have the advantage of experience with handling other tax-deferred savings accounts and debit transactions, while insurance companies know how to provide such health-related services as determining eligibility status, claims adjudication, and medical provider payments.

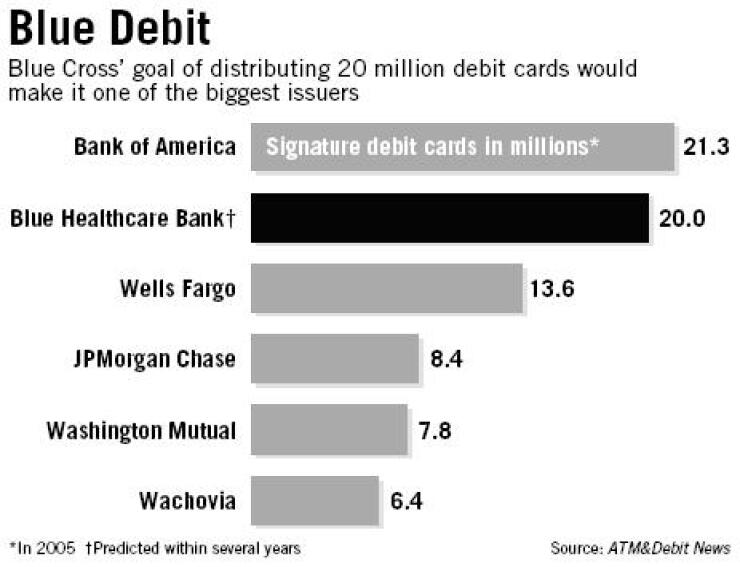

Terrence J. Cooney, an executive with the Blue Cross and Blue Shield Association, the trade group for the independent Blue Cross and Blue Shield health insurance firms, recently predicted that HSAs would make the group's new Blue Healthcare Bank one of the largest debit card issuers in the nation.

Mr. Cooney, the marketing executive for the group's banking subsidiary, HealthBenefit Corp., told participants at the Federal Reserve Bank of Chicago's recent payments conference that the new bank will issue 20 million debit cards "in the next several years."

Blue Healthcare Bank will open under a Utah industrial loan charter in a pilot test program beginning next month and is expected to be in full operation by January, Mr. Cooney said. It will offer a full range of banking products services for tax-deferred health account holders, including a trust department, investment services, and overdraft protection, he said.

The bank will issue Visa-branded cards.

If it makes good on Mr. Cooney's prediction of issuing 20 million debit cards, it would be one of the top U.S. debit card issuers.

Bank of America is the largest debit card issuer, with about 21 million signature-based debit cards, according to this year's edition of the "ATM&Debit News EFT Data Book."

The group hopes to attract to its bank a sizeable chunk of the 90 million consumers participating in Blue Cross and Blue Shield health plans, Mr. Cooney said.

Despite its access to tens of millions of insured consumers, some observers say the group may be overly optimistic about its debit card.

Celent projects that by 2012 there will be about 21 million debit cards attached to HSAs, and about 15 million debit cards attached to tax-deferred flexible-spending accounts. Workers can put pretax dollars into the flexible accounts to cover out-of-pocket health-care and dependent-care expenses, but they lose the money if it is not spent within a certain time. Unspent funds accumulate in HSAs.

The Blue Cross group faces stiff competition on a number of fronts, including from other insurance companies.

UnitedHealth Group, which has about 22 million health plan participants, already is offering health-account services through its banking unit, Exante Financial Services. Morgan Stanley's Discover Financial Services LLC plans to issue debit cards for Exante.

Moreover, leading processors of health-related transactions are partnering with issuers to offer HSAs with debit cards.

BB&T Corp., for example, recently announced it would offer Evolution Benefits Corp.'s Benny health-benefits card to employees who hold debit cards attached to FSAs. The Winston-Salem, N.C., company also will offer the card to customers who open HSAs at its bank.

Scott Qualls, BB&T's senior vice president of deposit access products, said it selected Evolution Benefits' product because it lets users debit funds from multiple types of health-related accounts handled by his company.

Metavante is aggressively marketing transaction services to hundreds of its financial institution clients. Its MBI Benefits claims to be the largest processor of tax-deferred health-account transactions.

So far about 120 of Metavante's transaction processing clients offer HSAs, said Frank D'Angelo, an executive vice president at the Marshall & Ilsley Corp. unit.

They have established about 100,000 consumer accounts, most of them with debit cards attached. The number of accounts has grown by about 50% in the past year.

Mr. D'Angelo is skeptical that Blue Healthcare Bank will issue 20 million HSA-attached debit cards within a few years.

"I don't think" HSA growth "is going to be a stampede," he said.

Debit transactions tied to HSAs are complicated, Mr. D'Angelo said, often requiring interaction among employers, third-party plan administrators, insurance claims adjudicators, processors and financial institutions to ensure that transactions are authorized in a seamless manner.

Mr. Gosnell is the editor of ATM&Debit News, where this article was first published.