Seven months into its legal showdown with the Securities and Exchange Commission, Ripple Labs faces an uphill battle against the government's case that it sold unregistered securities, according to a number of experts.

That said, the San Francisco cryptocurrency company has assembled a high-priced legal team including former SEC commissioner Mary Jo White that has come out swinging. It has scored several early points, including getting U.S. Magistrate Judge Sarah Netburn's approval last week to depose a former division director of the SEC over the agency's objections.

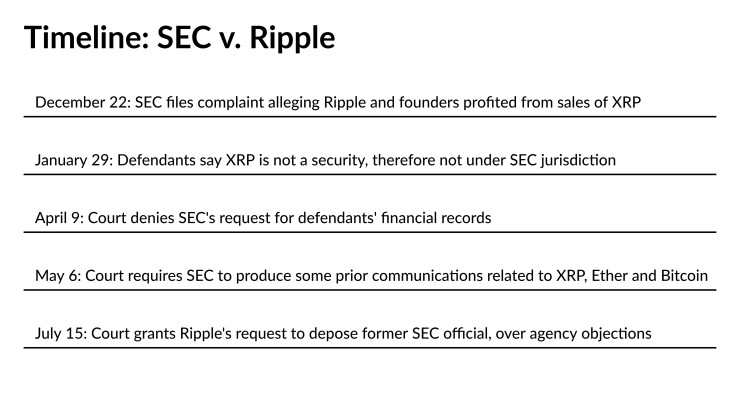

An SEC lawsuit filed in December

Ripple's lawyers have sought to put the SEC on the defensive by focusing attention on statements and actions by the agency related to digital assets that might contradict its argument, rather than on what Ripple and its founders did or didn't do.

The case matters for a few reasons. It could help define nebulous digital assets like XRP and whether they fall under securities law. It could influence investors’ willingness to invest in lesser-known digital coins. And it

Ripple declined a request for an interview for this story, as did BofA.

Edmund McCormack, a market analyst and CEO of DChained, an investing tools and education site, echoed other observers when he questioned the strength of Ripple's defense.

“If there could be a company that could be in the worst position to feign ignorance, it would be a financial tech company with deep relationships in the financial world,” said Edmund McCormack, a market analyst and CEO of DChained, an investing tools and education site. “It's hard to claim ignorance if you're a fintech and you don't know what the Securities Act of 1933 states, even more so the Howey test, which says if you go into an investment that is overseen by a third party with full intention of generating a profit, that is a security.”

McCormack acknowledges that the definition of an investment contract has become murky.

But, he said, “if you are a CEO of a fintech company and you raise capital with external investors being able to participate, you should at least be mindful” of the federal laws that govern the securities market.

The case so far

The SEC c

In its official response, Ripple said that XRP “is not a security, and the SEC has no authority to regulate it as one.”

In an

“The fact that we are still in a place in the U.S. where we’re left to guess what may be considered good and what may be considered not good and having regulators like the SEC pick winners and losers is just not a sustainable framework for an industry to operate in,” he said at the time.

Since the complaint was filed, Ripple has retained more than two dozen prominent lawyers for its defense, including White, who was an SEC commissioner during President Barack Obama’s second term and is now an attorney with Debevoise & Plimpton in New York. Another is Andrew J. Ceresney, also a partner at Debevoise & Plimpton, who formerly worked at the SEC and in the U.S. Attorney’s Office for the Southern District of New York, the district in which the case is being heard.

Garlinghouse hired six attorneys from the Washington firm Cleary Gottlieb Steen & Hamilton. Larsen hired seven lawyers from the firm Paul Weiss in New York.

The SEC has a total of seven attorneys on this case.

Ripple’s attorneys have won several points during the discovery period:

- The SEC asked for bank records for Garlinghouse and Larsen, to get a clearer picture of how much money they have made from XRP sales. Ripple’s lawyers said this was “pure regulatory overreach,” and Netburn agreed.

- Ripple’s lawyers asked for some communications among SEC staff about XRP, Ether and Bitcoin. Netburn granted that request over the SEC’s objections.

- The SEC asked to see messages among Garlinghouse, Larsen and attorneys who allegedly warned them that XRP could be considered a security. Netburn did not allow it.

- Garlinghouse and Larsen asked the court to issue letters of request for international judicial assistance to central authorities of the United Kingdom, Northern Ireland, the Cayman Islands, the British Virgin Islands, Hong Kong, Singapore, Seychelles, Korea and Malta. Netburn allowed it.

On that last motion, it’s likely that Ripple hopes regulators in other countries will say XRP is not a security. According to online publication

Deposing former SEC official

Ripple's lawyers on Thursday got the go-ahead from Netburn to conduct a deposition of William Hinman, former director of the SEC’s division of corporation finance, on July 17. Ripple’s lawyers had said they wanted to ask him about remarks he made about Ether in a 2018 speech.

“Putting aside the fundraising that accompanied the creation of Ether, based on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales of Ether are not securities transactions,” Hinman said in the speech. The speech included a disclosure that it expressed Hinman’s own views and did not necessarily reflect those of the commission.

In hearings, Ripple’s lawyers have argued that XRP is a decentralized digital currency, just like Bitcoin and Ether.

The SEC’s attorneys have argued that XRP is not decentralized. All 100 billion XRP in existence were created by Ripple’s founders in 2012 and are controlled by them, according to the SEC.

“In contrast, Bitcoin and Ether are mined on an ongoing basis, meaning that totally unrelated people from around the world performed calculations with computers that unlock new coins which those people can then hold or sell themselves,” SEC attorney Dugan Bliss said during the April hearing. “And unlike Bitcoin and Ether, Ripple and Mr. Larsen, and later Mr. Garlinghouse, themselves offered and sold XRP all from that 100 million XRP that was originally created that was part of an ongoing offering that continued from at least 2013 to the filing of the complaint and raised about $1.4 billion for Ripple and enriched Mr. Larsen and Mr. Garlinghouse by about $600 million. The point is there was never a central promoter profiting from an ongoing offering of Bitcoin or Ether, so XRP is nothing like those other digital assets.”

In the same April hearing, Ripple’s lawyers said SEC officials failed to give Ripple, Garlinghouse and Larsen fair notice that XRP is a security.

“We have already found documents from third parties, various market participants like cryptocurrency exchanges and hedge funds, that met with the SEC specifically seeking guidance on whether they could list and transact in XRP along with Bitcoin and Ether or whether XRP had to be treated as a security,” said Michael Kellogg, a partner at the Washington, firm Kellogg, Hansen, Todd, Figel and Frederick who represents Ripple. “They presented their own analysis to the SEC about why XRP was not a security. And after the meeting they proceeded to list XRP on their exchanges or invest in XRP in their funds. So obviously they reached the conclusion that XRP was not a security.”

Outlook

The fact that Ripple’s lawyers have prevailed with the magistrate judge so far does not necessarily mean Ripple will win in court, noted Preston Byrne, partner at Anderson Kill who is not involved in the case.

“It's still really early to draw any conclusions about what the outcome of the litigation is going to be,” Byrne said. “From Ripple's standpoint, they don't have great facts, so they're trying to argue about the law. The facts in Ripple's case are, they sold hundreds of millions of dollars of tokens into the market, and every precedent that we've seen that's come through the federal courts has said that if you sell tokens, and you're running a scheme that depends on those tokens appreciating in value, you're engaged in securities transactions. So it doesn't surprise me that they’re trying really novel arguments.”

Several scenarios are possible: Ripple and the SEC could settle. Ripple could register XRP as a security. Ripple could be ordered to destroy XRP. Ripple could leave the U.S. and focus on other countries. The XRP ledger code could be forked and a portion of it could be decentralized.

This case could be resolved through a summary judgment, according to Stephen Palley, partner at Anderson Kill in Washington who is not involved in the case. This is a process through which the court looks at the facts, determines which facts are undisputed, and based on those undisputed facts decides if one side is entitled to judgment as a matter of law.

“In a way, this case is an interesting counterpoint or bookend to the Telegram case,” Palley said.

If it gets past summary judgment, Palley said, then it would likely be tried before a jury, which would decide fact questions.

“If this case makes it to trial and the allegations in the complaint prove true, a skilled trial lawyer would make a very persuasive case against the defendants, despite their talented and high-priced lawyers,” Palley said.