Democratic presidential candidate Hillary Clinton vowed at a campaign rally Monday to crack down on corporate abuse, specifically taking aim at Wells Fargo for allowing ex-employees to open roughly 2 million phony accounts.

The former secretary of state sharply criticized the San Francisco bank, linking it to other firms accused of greedy behavior, such as the drugmaker Mylan, which has been blasted for jacking up the price on Epi-pens.

In doing so, she effectively elevated the Wells scandal to a presidential campaign issue, using it to call for tougher standards on Wall Street, defend the Consumer Financial Protection Bureau and propose restrictions on forced arbitration clauses, which she said are stopping consumers from suing Wells.

"We are not going to let companies like Wells Fargo escape responsibility," Clinton said at a campaign rally in Toledo, Ohio.

While Clinton has previously criticized Wells in a statement released shortly after the scandal broke, her comments Monday were far more expansive.

"Consider the recent example we've seen of egregious corporate behavior. Look at Wells Fargo. It's really shocking, isn't it?" Clinton said. "One of the biggest banks bullying thousands of employees into committing fraud against unsuspecting customers, secretly opening up millions of accounts for people without their consent — even their knowledge — misusing personal information and then sticking customers with hidden fees.

"It is outrageous that eight years after a cowboy culture on Wall Street wrecked our economy we are still seeing bankers playing fast and loose with the law," Clinton said.

Clinton said the case demonstrated the need for more restrictions on forced arbitration clauses. If elected president, she wants Congress to give the Federal Trade Commission, the Federal Communications Commission and the Labor Department broad and clear authority to rein in the use of such clauses, arguing they are inherently unfair.

"The Wells Fargo scandal shed light on another threat to consumers that we have to address," Clinton said. "When the scam's victims — you and me — tried to sue, they were shocked to learn there was a provision in the fine print of the contracts that kept them from going to court to sue the bank for how they were being treated. Instead, they were forced into a closed-door arbitration process that kept them from a court of law."

The CFPB has already issued a proposal that would greatly restrict the use of arbitration clauses in financial contracts, but Clinton noted she wanted to target their use in all consumer dealings, not just with financial institutions.

Arbitration clauses have emerged as one of the many flashpoints during the Wells matter. The bank's chief executive, John Stumpf, was criticized by lawmakers last week for the use of such clauses.

"Mr. Stumpf, some people assume that you changed your customer agreement to add forced arbitration clauses for checking accounts and that these clauses proved to be incredibly helpful when you use them to dismiss multiple customer lawsuits. Is that true?" Rep. Maxine Waters, the top Democrat on the House Financial Services Committee, asked during a hearing Thursday.

Stumpf replied, "That's not true."

"Actually, I think arbitration does make sense," he said. "But in this case, for any customer that might have been harmed in this situation, we're also paying for a mediation process so they have a mediator."

During her speech, Clinton also heaped praise on the CFPB, saying consumer protection would be a top priority in any future Clinton administration.

"We're going to protect consumers. No American should be taken advantage of like thousands were at Wells Fargo," Clinton said. "As president, I will make consumer protection a top priority across the entire government and that starts by defending and empowering the CFPB."

Clinton lauded CFPB Director Richard Cordray, the former Ohio attorney general, for enforcing the Wells settlement and lambasted Republicans for trying to restructure the agency or shut it down entirely.

"The agency has already returned more than $11 billion to Americans who were ripped off by predatory lenders," Clinton said. "It is the one to make sure the defrauded customers of Well Fargo will get their money back. Because of its success, Republicans in Congress want to shut it down. And Donald Trump agrees with them."

GOP presidential candidate Donald Trump has never mentioned the CFPB publicy by name during his campaign, but he has endorsed a repeal of the Dodd-Frank Act, which created the agency.

Clinton said that she would "build on the Dodd-Frank financial reforms" and that she planned to pass a tax, named after Warren Buffett, to ensure CEOs do not pay lower tax rates than their secretaries.

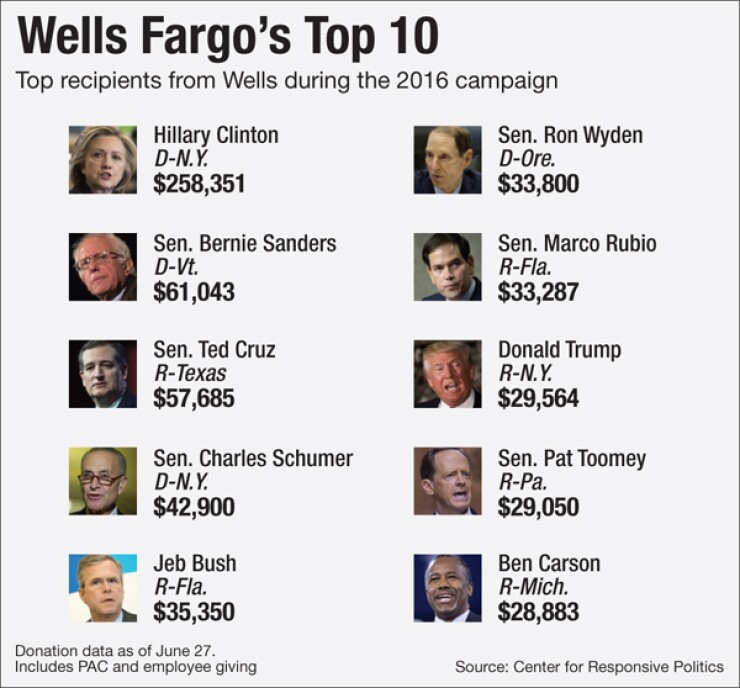

Ironically, Clinton is the No. 2 recipient of campaign contributions from Wells Fargo, behind only the Republican National Committee.

Wells gave $287,665 to the RNC in 2016 and $258,351 to Clinton, according to Opensecrets.org, the nonprofit research arm of the Center for Responsive Politics. Wells contributed $29,564 to Trump, less than the bank gave to Democratic candidate Bernie Sanders and Republican candidates Ted Cruz, Jeb Bush and Marco Rubio. Trump ranked seventh among the candidates who received campaign contributions from Wells, behind Democratic Sens. Chuck Schumer of New York and Ron Wyden of Oregon.