Academy Bank in Kansas City, Mo., has reversed course on branch banking.

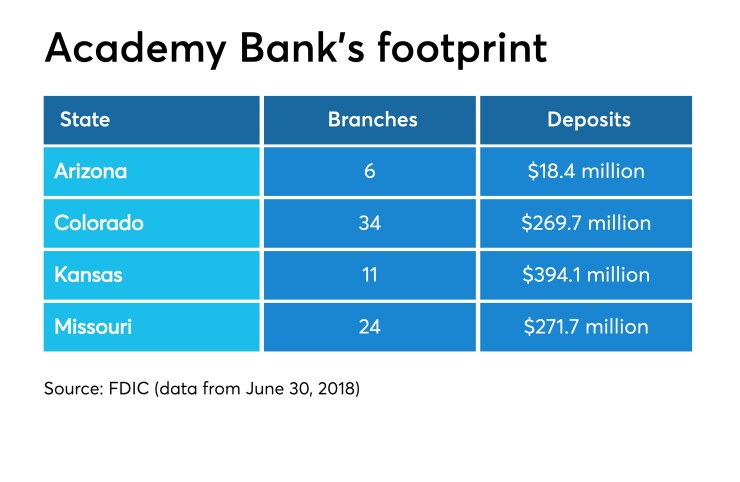

The $1.6 billion-asset unit of Dickinson Financial closed nearly a quarter of its offices between 2015 and mid-2018, whittling its network down to 75 locations, based on data from the Federal Deposit Insurance Corp.

In recent months, Academy has shown an interest in adding branches in high-growth markets like Kansas City, Denver and Scottsdale, Ariz. The bank is also investing in technology to increase customers’ digital transactions.

Paul Holewinski, the bank’s chairman, president and CEO, said the effort reflects a realization that branches still play a vital role attracting customers and opening bank accounts.

“Getting more new clients, that’s really driving the need for new branches,” Holewinski said in an interview.

Dickinson, where Holewinski is chairman and CEO, also owns Armed Forces Bank, a $1.1 billion-asset unit with nearly 40 branches spread across the country.

Academy, which plans to open six branches this year, will gain another five locations as part of its pending purchase of KCB Bank in Kearney, Mo.

Those efforts come at a time when overall branch totals are dwindling. Banks closed a record 3,023 branches last year, or nearly triple the number of openings, based on data compiled by S&P Global Market Intelligence. Roughly 1,000 additional branches were shuttered through the first five months of 2019.

Holewinski discussed his interest in branches and acquisitions as part of a broader conversation. Here is an edited transcript of that discussion.

You’re opening branches at a time when many banks are closing them. What are seeing in branches today?

PAUL HOLEWINSKI: We definitely see the value. We have to pair high-tech with in-person service. We definitely have seen a shift to digital from a service standpoint, from remote deposit capture to online banking to services on mobile. We’re seeing all of that grow. Still, most of our new relationships are opened at the banking centers, and that’s really the rationale behind new locations: getting into new markets and getting to more clients. We’re trying to do it in an efficient way — smaller branches, fewer people, more technology — but we still see the value in the physical location.

What do the smaller branches look like?

In most locations, we can make the most of new technology. The legacy branches are about 5,000 square feet versus anywhere from 1,200 to 2,200 square feet at newer ones. It depends somewhat on the real estate you can get. An ideal scenario for us, which recently played out in one of our markets, is we went into a former Starbucks location, very high traffic, very good visibility, and we took up 1,400 square feet. Starbucks moved across the driveway. It brings in a lot of traffic, and we benefit from that.

You noted meshing tech with in-person service. What does that look like?

Video banking, for example. You start by touching the screen, then you choose the ATM or to talk to a live banker, who walks through all your questions. It’s pretty slick and easy to use. Our client base has really adapted well to it. It’s an efficient way to get questions answered or to get help with transactions. We also have several retrofitted branches within Walmarts. I’d say 30% to 40% of our banking centers have a strong element of tech and our goal is continue to selectively add that across the footprint.

Do you anticipate more branch expansion?

We’re looking for new markets to go into with banking centers. We’re trying to grow the footprint, whereas others maybe are looking at branch rationalization. We’re still very much in growth mode to increase our coverage.

Taking a broader look, the Fed cut rates in July and left open the possibility for more. Your thoughts on the rate environment?

It certainly makes things challenging. Loan rates are adjusting quicker than deposit rates, so certainly the environment is set up for shrinking margins. We have to adapt and that’s through more efficient operations. At the end of the day, you need to originate good credit, and our model is to bank repeat customers with really good track records. If we have to do it at a little lower rate, then so be it.

How would you characterize loan demand compared to six to 12 months ago?

For us, it’s been strong in all of our markets. It’s been about the same as last year. We’ve really not seen a drop off by any stretch. That may be coming with what has transpired with the trade talks and macroeconomic challenges [globally], but so far it has been strong.

So sentiment among your clients remains generally positive?

I think favorable, but a little cautious. You can’t open up a newspaper or turn on the TV news without hearing about trade or possible issues, so we’re seeing some folks take a wait-and-see approach. There’s no doubt we’re in a bit of a tricky environment, but any real slowdown is still out on the horizon. What we’ve seen just this summer is favorable.

Any cracks in credit quality?

We’ve really not seen that. That’s really not been an issue. Our growth strategy has been very deliberate. If conditions remain strong, we’ll continue on our path. If they deteriorate some, we’ll certainly readjust.

You have a pending deal in Kansas City. What are you hearing in terms of overall interest in bank M&A?

We’re hearing a lot more. We’re having more conversations, and we expect that to continue into the future. Costs, capital constraints, succession planning, competition, that’s all driving sales.