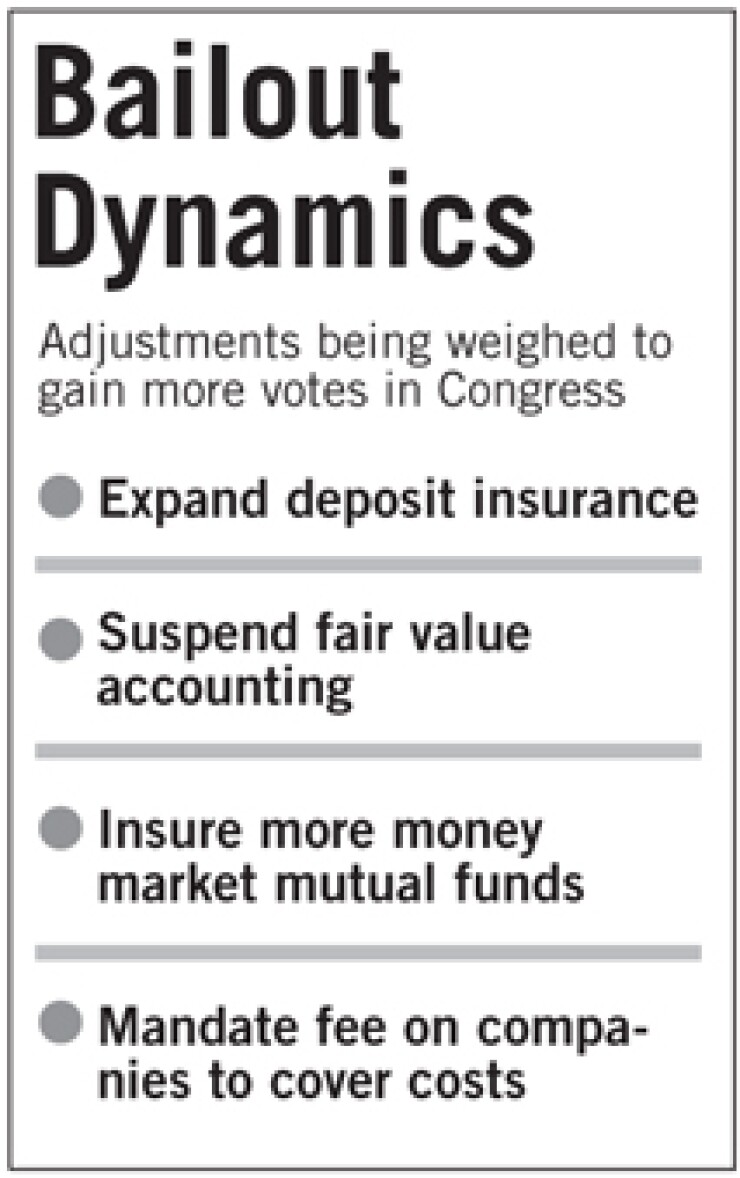

WASHINGTON — Lawmakers are considering raising the deposit insurance limit, suspending fair-value accounting, and giving more support to money market mutual funds in an effort to persuade 12 members to change their votes on legislation designed to calm the financial markets.

The changes are aimed at House Republicans, two-thirds of whom voted against the bailout bill on the House floor Monday. House leaders need to persuade just a dozen lawmakers to change their minds in order to gain a majority for the legislation.

The proposed adjustments "should be enough to get the votes," Brian Gardner, a political analyst at KBW Inc.'s Keefe, Bruyette & Woods Inc., said on Tuesday. "They also have to keep the political rhetoric down, and if they do both of those, then I think it will be enough to get the votes. I don't think it passes overwhelmingly, but it does better than what we saw yesterday."

Though Congress was adjourned Tuesday in observance of Rosh Hashanah, policymakers' efforts to corral support continued.

Chief among the proposals was the increase in deposit insurance — an idea endorsed by both presidential candidates on Tuesday. Lawmakers were considering a provision that would give the Federal Deposit Insurance Corp. temporary authority to back any deposit in the event of a bank failure. (See

Though that addition is seen as a way to placate angry consumers who otherwise see no benefit from the costly bill, lawmakers were also eyeing a provision to suspend mark-to-market accounting as a way to entice more Republican support. Fair-value accounting has been blamed for worsening the crisis by forcing banks to write down the value of assets whose value is difficult to determine.

The bill defeated Monday had a provision to let the Securities and Exchange Commission study the effect of mark-to-market accounting and to suspend it. During the debate on Monday, however, Republicans said this did not go far enough.

The SEC released guidance Tuesday on fair value accounting and how to treat certain assets. The agency noted that the Financial Accounting Standards Board is preparing additional guidance on fair value measurement to be released later this week.

The Treasury's plan to insure money market funds also may be expanded in the bailout bill.

The Treasury announced Sept. 19 that it was creating a $50 billion fund to guarantee such portfolios but, at the behest of the banking industry, limited coverage to funds in existence on or before that date. Lawmakers are weighing whether to broaden that timeframe.

Congress could also beef up a provision calling for a fee on the financial services industry if the proposed bailout facility — which would be allowed to buy and hold up to $700 billion of troubled assets — does not recoup its costs.

The defeated bill would have required the president to consider instituting such a fee on all financial institutions in five years if the facility produced a loss to the government. Some have argued that the fee should be mandatory.

Sen. Barack Obama, the Democratic presidential nominee, appeared to embrace that position during a campaign stop in Nevada Tuesday.

"If this is managed correctly, we will hopefully get most or all of our money back, possibly even turn a profit on the government's investment," Sen. Obama said. "If we do have losses, I propose to institute a financial stability fee on the entire financial services industry so that Wall Street foots the bill, not the American taxpayer."

Adding to the uncertainty is which chamber, House or Senate, would take up a revised measure first.

The Senate had been scheduled to take up the original legislation Wednesday, but this is unlikely, given the House's rejection. Several analysts said House leaders would have to revise the bill first. A vote in the House could come as early as Friday, they said.

Policymakers spent much of the day trying to drum up support. In a morning address, President Bush promised to push ahead; he pledged to call members throughout the day.

"I'm disappointed by the outcome, but I assure our citizens and citizens around the world that this is not the end of the legislative process," he said.

Treasury Secretary Henry Paulson reached out to congressional leaders and members on Tuesday to persuade opponents. He also held a conference call with roughly 200 bankers, including the American Bankers Association's board and state executives.

"He had some tough questions from the bankers, but he was very clear: We need the legislation," said Diane Casey-Landry, the trade group's No. 2 executive. "The equity markets are up, but people need to focus on the fact the credit markets are still frozen."

Some questioned, however, how much leverage President Bush and Mr. Paulson possess to resurrect the bill. "The calls have to come from constituents," said Laurence Platt, a lawyer at K&L Gates. "The leaders are being tuned out."

That did not stop them from trying, however. House and Senate leaders in both parties held conference calls Tuesday to plan a path forward.

"The market sent us a strong message yesterday that no-action is not a solution," said Senate Minority Leader Mitch McConnell, referring to Monday's 777-point stock market drop, during a press conference. "We're not going to sit around and point fingers. We are going to get the job done, and we are going to get it done this week."

Sen. Obama and Sen. John McCain, the Republican presidential nominee, joined the calls Tuesday for a resolution to be reached. Sen. Obama said the bill failed in part because of a poor sales job. Most Americans believe the government will spend $700 billion and never get it back, he said.

"When it's called a bailout, no one is in favor of a bailout," he said. "But this is not a plan to just hand over $700 billion to a few banks on Wall Street."

Sen. McCain said, "We have to act. Even though we failed yesterday... we will go back to this."