Banks' efforts to explain new regulations covering opt-in policies for overdraft protection appear to be working, according to Mintel Comperemedia.

In a report released this month, the Chicago research company found that 60% of 1,000 U.S. consumers polled online in July were aware of the changes in debit card overdraft services on existing accounts mandated by new federal rules. In a similar poll in May, only 40% said they knew about the changes, which took effect Aug. 15.

Banks have blanketed consumers with direct mail, e-mail and online messages to communicate the changes, and encourage them to opt in to the services.

Susan Wolfe, Mintel's vice president of financial services, said the results of these efforts were mixed. "The fact that 60% of consumers were aware of changes in their debit overdraft policies is not bad because it's been covered pretty well by the media, but when you drill down to see what consumers really understand about their options, most are hazy," Wolfe said in an interview. "The fact that consumers are not completely aware of these services, or clear about the details, means banks have more work to do in promoting these services."

Bank customers now must agree to receive debit overdraft coverage on existing accounts — those who do not will have their debit transactions declined at the point of sale if they do not have enough funds in their accounts. Most banks' new overdraft coverage programs require the customer to link their debit account to a savings account or credit card. Fees typically average about $10 for each day the account is overdrawn.

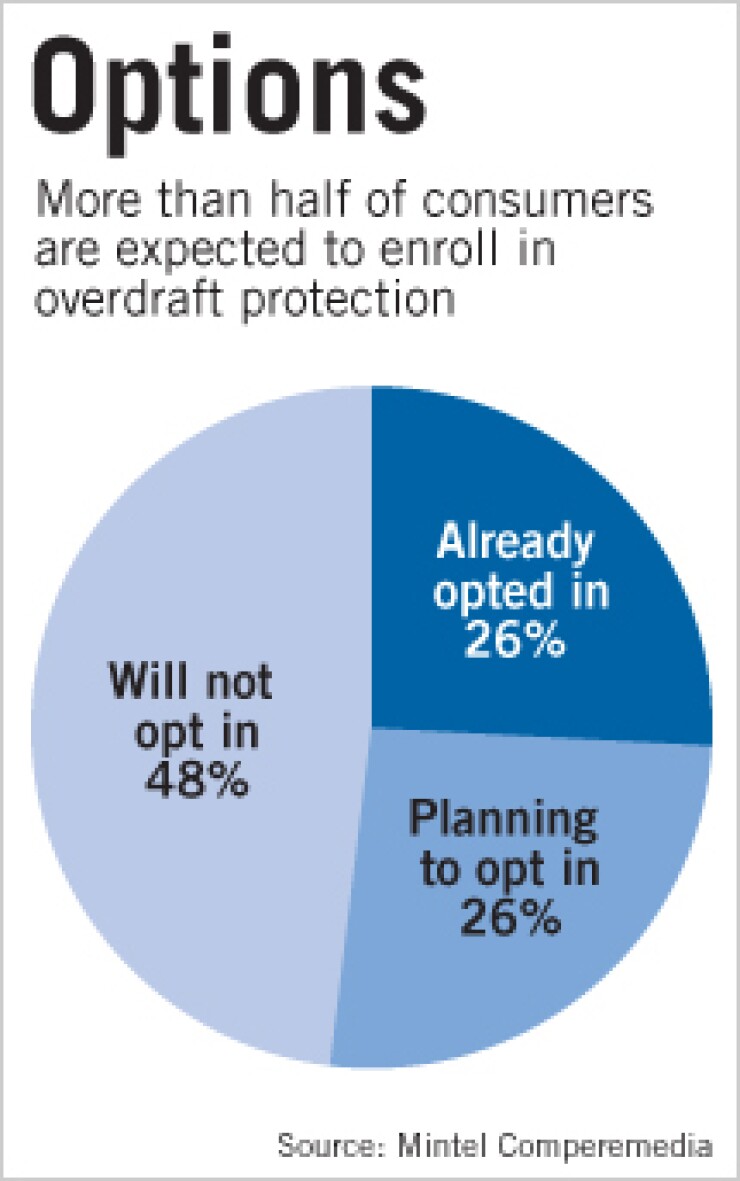

Mintel found that 26% of consumers surveyed in July had opted in to receive overdraft protection, and another 26% said they planned to do so. The remaining 48% did not plan to enroll in the services.

The findings were in line with expectations, Wolfe said, noting that only 18% of respondents said they had overdrawn their debit accounts within the previous six months. "Typically, a small portion of all debit customers — less than 20% — drive about 80% of overdraft fee revenue for banks," Wolfe said. Banks still have "significant opportunities" to promote debit overdraft protection to consumers that have not yet opted in to receive it, she said.

"Some banks did a better job than others of communicating options to customers," Wolfe said. "We found that each customer has a preferred channel, whether it's a message delivered through the ATM, a message when the customer logs on to the banking website or direct contact with a branch employee. Banks should make sure they are reaching out to all customers through appropriate channels to clearly explain the options, because there are many consumers who apparently are still unsure of their choices."

Many banks previously offered overdraft protection automatically and charged fees averaging about $35 per overdrawn transaction. The overdraft changes are the result of new Federal Reserve Board rules.