For Dime Community Bancshares in Brooklyn, N.Y., reducing a dependency on commercial real estate is a lot like trying to turn an ocean liner around.

The $6.4 billion-asset company, long known as a multifamily lender in New York, is about a year into an effort to diversify its loan portfolio by focusing more on business banking. While the going has been slow, Dime is showing signs of progress.

Dime has hired several business bankers, and in June it completed a core conversion to improve service for commercial clients. It was approved to become a Small Business Administration lender and it securitized a batch of its multifamily loans.

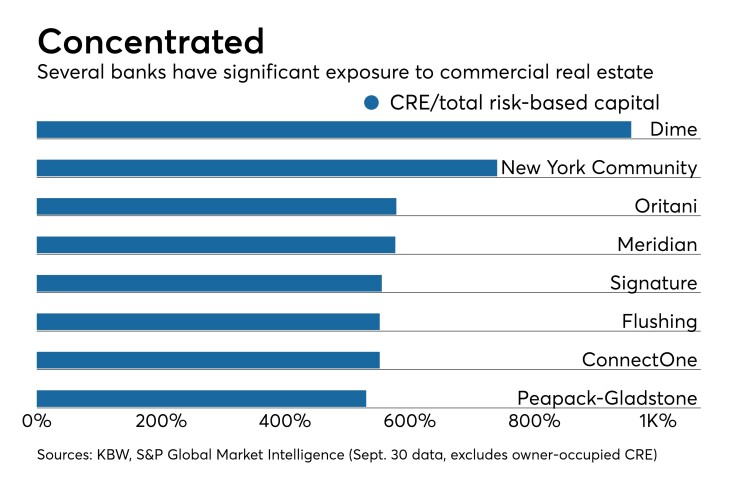

This year Dime will try to build on that momentum by further reducing its CRE exposure, which stood at 956% of total risk-based capital at Sept. 30, excluding owner-occupied properties.

“While they’ve done [CRE lending] well over a long period of time, unfortunately [Dime has] stuck out as having a high ratio,” said Mark Fitzgibbon, an analyst at Sandler O’Neill who once expressed skepticism that Dime could build a successful business bank.

“I think I’ve been proven wrong,” Fitzgibbon added. “They’ve already made great strides in the beginning to transition the balance sheet in reducing that commercial real estate concentration.”

The biggest part of Dime’s strategy has been a focus on identifying talented bankers with strong customer relationships, said Kenneth Mahon, who became Dime’s president and CEO about a year ago.

Dime’s relatively new business banking division, which hit its growth targets last year, should be able to keep growing in 2018, Mahon said. A more in-depth update is expected when Dime reports its quarterly results on Jan. 25.

The division has seven lenders, including Alan Green, who had recently run the middle-market commercial banking unit in New York for M&T Bank.

Dime originated $86 million in business banking loans in the third quarter, representing a 33% increase from a quarter earlier, and its commercial-and-industrial loan portfolio rose by 63% to $111 million. Still, C&I loans made up only 2% of total loans.

The company is continuing to actively recruit lenders.

“You just can’t put out a sign and expect people to show up,” Mahon said. “We're working hard to bring some new people in this year.”

Dime is also planning to rev up efforts to offer business banking services to existing customers. That means adjusting the company’s culture to be more relationship-oriented, Mahon said.

“You just can’t put out a sign and expect people to show up. We're working hard to bring some new people in this year.”

It will still take more time to see how the business banking effort plays out, and what impact it will have on the balance sheet, Fitzgibbon said. To succeed, Dime must hire the right people, stay disciplined on credit quality and offer solid products, he said.

Dime is introducing more products and hiring bankers capable of serving clients. Credit quality remains pristine; nonperforming loans at Sept. 30 totaled $806,000, or 0.01% of total loans.

“They have the three legs of the stool in place,” Fitzgibbon said. “Now it’s just a question of executing and generating the business.”

Dime is also taking steps to remove some CRE loans from its balance sheet, including a recent $280 million securitization of multifamily loans through a program sponsored by Freddie Mac. The securitization was expected to lower Dime’s CRE concentration ratio to 807% from 849% and its loan-to-deposit ratio to 130.4% from 136.8%.

Mahon said he was pleased with the transaction and would consider another one.

“We know Freddie has the appetite and has experience with us now,” Mahon said. “We haven’t made a commitment yet, but may do that this year as well.”

Banks that have CRE concentration ratios below 300% tend to get more scrutiny from regulators.

Dime has also been willing to scrap plans that seemed likely to fall short of expectations.

The company had filed an application with the Federal Deposit Insurance Corp. to form Dime Municipal Bank. Dime will likely withdraw the application after realizing there was more red tape than it originally thought.

Rising deposit rates would also make it more daunting for a new venture to compete, Mahon said.

“We’re going to take a step back,” he said. “We have a lot of irons in the fire and a lot we’re focused on.”