Banks purged a ton of bad loans this year, but considerable cleanup still looms in 2010.

For most of 2009, bankers were hesitant to forecast when credit woes might peak, but there is a growing consensus that credit problems could be largely resolved a year from now.

But how big will the bottom-line hit be? Several analysts and economists say credit losses have already topped $1.5 trillion, but the ultimate cost could be twice that figure.

Frederick Cannon, the chief equity strategist at KBW Inc.'s Keefe, Bruyette & Woods Inc., said he believes banks "are just past the halfway point" in terms of losses.

"Through most of this year, the issues remained largely regional," he said. "I think most of the credit problems as we get into 2010 may be more broad-based than what we've seen to date" as high unemployment and other economic problems permeate the entire country.

Goldman Sachs Group Inc. researchers offered a more optimistic estimate than Cannon's, saying two-thirds of losses in the current credit cycle have already taken place.

Either way, banks still face substantial losses, chargeoffs and capital hits next year. Impending losses could force bankers to make fewer loans as a means of holding on to more capital despite political pressure to lend.

"It is nice to think that the worst is behind us, but $1 trillion is still a large number," said Gary Schlossberg, a senior economist at Wells Fargo & Co.'s Wells Capital Management. "It is probably going to get worse before it gets better," with losses peaking in the first half of 2010. "A lot depends on the strength of the recovery. That will clearly affect the time line."

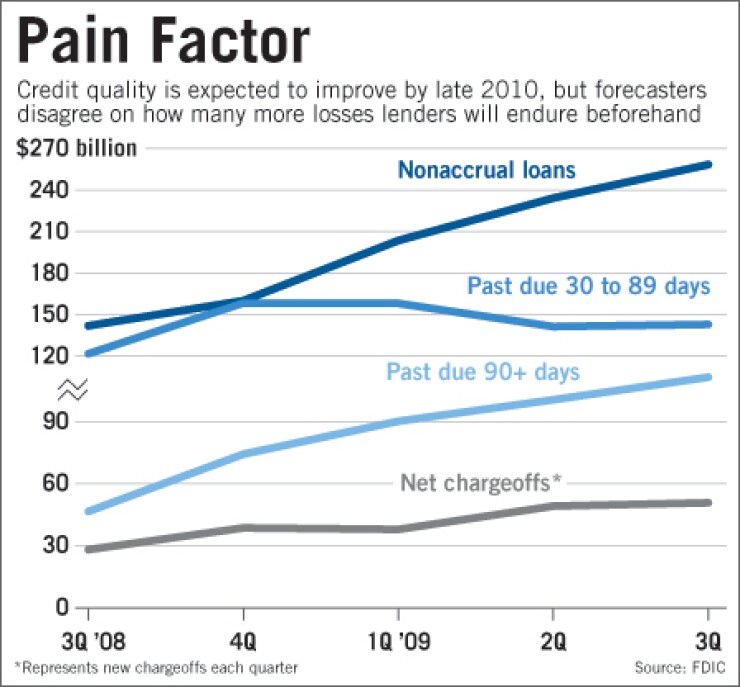

There are some hopeful signs. Loans 30-89 days past due were flat in the third quarter from a quarter earlier and were down 9.8% from a cyclical peak in the fourth quarter of 2008, according to data from the Federal Deposit Insurance Corp.

Bankers hope that will translate into lower levels of past-due loans and nonperforming assets in coming quarters.

RISK FACTORS

Yet caution levels remain high.

Charles Hyle, the chief risk officer at KeyCorp of Cleveland, said at a Goldman conference this month that though the $97 billion-asset company had seen "general improvement" for certain types of loans, "we are still fairly wary, depending on how the economy plays out over the next number of months."

The more pessimistic observers note that the FDIC continues to add to its list of problem banks, which reached 552 during the third quarter. Others remain concerned about the impact of unemployment, which fell slightly in November, to 9.4%, according to the Labor Department, but which many economists expect will be close to 10% for most of next year.

"Traditionally, unemployment hasn't peaked until more than a year after the recession is over," said Kevin Jacques, who chairs the finance department at Baldwin-Wallace College.

"Unemployment may not peak until the latter half of 2010," said Jacques, who is also a former economist with the Treasury Department. "Losses tend to reflect that, so anyone with heavy consumer lending may still have losses embedded in their portfolios."

John Kottmeyer, an economics professor at Samford University's Brock School of Business, agreed. "There is no relief on the labor front," he said. "With economic growth expected to be in the 3% range, that isn't strong enough to prevent consumer and commercial real estate hurdles."

Refinancing activity among commercial clients also remains a wild card.

Banks have dialed back lending in the past year, with many saying that they are seeing less creditworthy borrowers apply for loans. Observers said an inability to refinance existing loans could put more strain on borrowers, to the point that defaults rise.

That could be the case with commercial real estate. Analysts and economists are most concerned about surging losses in CRE, particularly retail and office projects, and fear that a subpar shopping season could force many businesses into bankruptcy. That would put equal strain on developers that rent space to such tenants. Earlier this month Goldman raised its forecast for CRE losses to 8%-10%, from a 7%-9% projection in March.

CEO WARNINGS

Stephen Steinour, the chairman and CEO of Huntington Bancshares Inc. in Columbus, Ohio, recently discussed the uncertainty surrounding the $52.6 billion-asset company's CRE book.

"Retail has a significant reliance on the current holiday season, and so I don't yet have a view of what that season's going to look like," Steinour said at the Goldman conference.

"So we're being very guarded with our CRE book overall and the outlook going into 2010, especially on the retail side, which could have more volatility than other components."

Steven Sandler, the CEO of Crosswind Capital LLC, which specializes in buying distressed assets, said banks are continuing to face difficulties selling problematic real estate loans, which could keep loss rates high.

"There is no product line or market that is insulated from further erosion," he said. "Credit certainly will not be better next year and most likely will be slightly worse."

Credit card portfolios also have people concerned, though there are mixed views on how bad things will get in that asset class next year. Jobless claims will be a major factor, given that card losses tend to mirror unemployment rates.

Jamie Dimon, the chairman and CEO of JPMorgan Chase & Co., forecast this month that first-quarter losses in the $2.04 trillion-asset company's card portfolio could hit 11%.

"We don't know what is going to happen to losses going forward," he cautioned during an appearance at the Goldman conference. "I can give you a lot of arguments that if unemployment stops growing, then these losses start coming down a little bit. But we really don't know."

Richard Fairbank, the chairman and CEO of the $168.5 billion-asset Capital One Financial Corp., was more upbeat. At the same conference, he said there is "a stable credit environment" for cards and that the McLean, Va., company's problems could peak in the first quarter.

Economists and analysts also expressed concerns about the lingering effects of residential mortgage problems and high unemployment throughout the country, not just overheated markets like California and Florida. Issues have also spread into prime mortgages — Goldman raised its loss estimates for such loans to 5%-6% from its March forecast of 3%-4%.

Cannon said that such problems could find their way into the home equity market, too.

"It will be interesting to see how home equity is impacted by hits to prime mortgages," he said. "Home equity held up surprisingly well this year, but we had a negative surprise in prime mortgage. How do we square those trends in 2010?"

Perhaps the most positive sign is that CEOs and other executives are again forecasting, something they did not do over the past 18 months. The shift gives the impression that bankers have a better handle on credit and, barring a double-dip recession, are charting a pathway out of the crisis.

"The fact is that [credit quality] is not yet improving, but certainly the level of deterioration is slowing," Andrew Cecere, the vice chairman and chief financial officer at U.S. Bancorp, said at the conference.

"I will also tell you that our level of comfort with our ability to predict has increased dramatically and is at a very high level."