Asset-backed bonds pooling streams of income from unusual sources like billboard advertisements, franchise loans, cell tower leases and tobacco settlement fees are making a comeback.

In some cases, the securities may serve as lifelines for companies that cannot readily borrow from banks or issue unsecured debt.

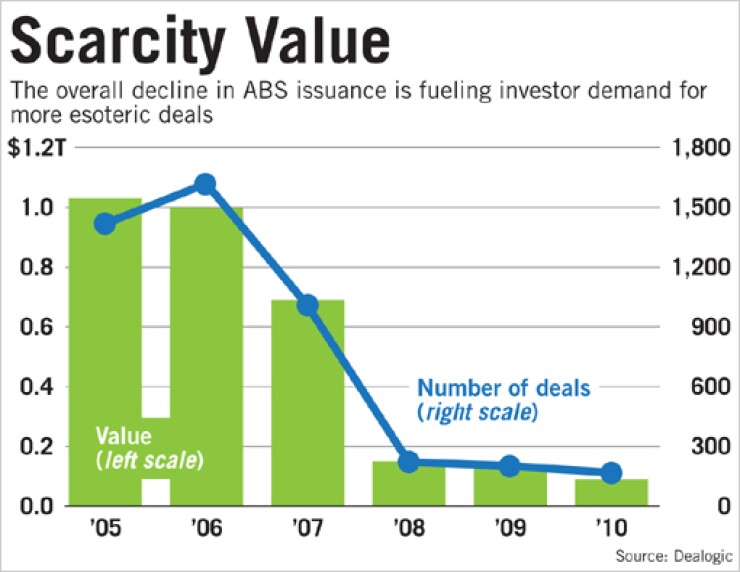

Issuance in the broader asset-backed securities market continues to decline, notwithstanding the support of the Term Asset Backed Securities Loan Facility. Lenders are making fewer of the consumer loans that back traditional asset-backed bonds. But dealmakers say investors who want more generous returns are embracing so-called off-the-run deals.

This new breed of non-traditional asset-backed bonds reflects some profound changes in the market around them. Basic ingredients like insurance wraps from bond insurers are not around, and today's investors seem to prefer it that way.

"Most non-bank sponsors are low- or non-investment grade," said Paul Jablansky, senior non-agency MBS and consumer asset-backed strategist at RBS Securities. "Funding on an unsecured basis is relatively expensive. And there's just not that much of it available."

Jablansky said the decline in issuance of more traditional asset backed bonds "has created room for some off-the-run asset classes to grow. If typical ABS investors can't put all of their money to work in a more generic product, the next step might realistically be to expand their horizons to a new asset class."

Cory Wishengrad, co-head of the Americas securitized products origination group at Barclays Capital, said esoteric asset-backed issues have attracted an investor class that previously avoided the sector, either because they were not familiar with the products or found the yields too low.

"It's largely insurance companies and other investors who are less concerned about liquidity than more traditional ABS investors, who see very short-term ABS as an alternative to other cash-like instruments," he said.

Wishengrad said that, from 2005 to 2007, between $25 billion to $30 billion of non-traditional deals (defined as anything excluding mortgage, auto loans, student loans, credit card debt) were being completed annually. At that time, most of the issuance relied on bond insurance to attract investors.

But during the financial crisis, when bond insurers were downgraded, investors fled the market. As a result, there was little in the way of issuance in 2008. Barclays estimates issuance came back in 2010, to between $10 billion and $15 billion, and the firm expects it to grow to between $15 billion and $20 billion in 2011. (The figure excludes expected issuance of $8 billion to $10 billion of securities backed by equipment leases, which Barclays does not consider off-the-run, but many participants do.)

Remarkably, if this year's off-the-run issuance reaches the top end of Barclays's estimated range, it will outstrip issuance of bonds backed by student loans and credit card receivables, which, along with auto loans, have been the mainstay of the asset-backed issuance since the mortgage market imploded. Barclays expects issuance of bonds backed by student loans and credit card receivables to fall between $12 billion and $15 billion this year.

Dealmakers say that one sign that this niche of the credit market has regained acceptance is a transaction Adams Outdoor Advertising completed in November. The Atlanta company sold $355 million of notes pooling income earned from billboards and other displays. Barclays was the lead underwriter of the transaction, which dealmakers call the first whole business securitization since the financial crisis shook up Wall Street.

Participants said that many of today's deals tend to be small and tailored to a small investor base that is willing to perform its own credit analysis, now that monoline insurance is no longer available to boost ratings. The Adams Outdoor transaction may be a source of cheer for banking teams, but it does not come close to the $1.7 trillion raised in the landmark 2007 securitization of franchise fees and real estate leases owned by Dunkin' Brands.

Esoteric transactions remain a niche in the asset-backed market (where 201 deals worth $91.6 billion were completed last year, according to Dealogic), but dealmakers expect continued demand for novel transactions for a variety of reasons. For example, some observers say a sunnier outlook on the global economy suggests an increase in the use of bonds backed by equipment leases. Weili Chen, senior director, U.S. structured credit, at Standard & Poor's, said the shipping container sector is experiencing a "v-shaped recovery." Container lessors have been tapping the securitization market for financing since the mid-1990s, and demand for the containers "re-emerges with the [improved] flow of the economy."

TAL International Group completed a $197 million container lease offering in July. Bankers say it was the first such offering to come to market since the credit crisis without the benefit of an insurance wrap.

There were no aircraft leasing securitizations last year, but this sector is also expected to benefit from the economic recovery. Chen said issuance could be "fairly active" this year. Several aircraft leasing outfits have started up in the past couple of years, including Avalon Aircraft and Jackson Square Aviation. Chen said these companies are likely to shift away from short-term funding like warehouse lines of credit with banks and may rely more on securitization. He said the market may also see some transactions motivated by efforts to rationalize a lessor's fleet or refinance more expensive debt.

Some esoteric deals, including catastrophe bond issues, are driven by factors completely independent of the economy. Insurance companies use catastrophe bonds to pass along their exposure to damage caused by natural disasters. Over the past couple of years, issuance of these bonds has been robust, because pricing has improved following several benign hurricane seasons. However, some market participants say issuance is probably nearing a peak.

Some transactions are taking place simply because the issuers are using the securitization market to bridge budget gaps. Last month, the State of Illinois securitized $1.5 billion of tobacco settlement fees at what seemed to be an inopportune time. There had not been a similar deal in more than two years, and a few months before that deal came to market, the National Association of Attorneys General had reported a serious decline in tobacco consumption, threatening the collateral supporting such deals. The collateral is regular payments made by the tobacco industry as part of a national settlement. Nevertheless, Chen said he "wouldn't be surprised if other states follow suit."

Law firms are also securitizing the annual payments they receive from the tobacco industry as part of the settlement. Ronald Borod, a partner in the corporate and finance group at DLA Piper, specializes in such deals; his law firm advised on three private ones last year, each worth less than $100 million. Borod said these are examples of deals where investors can "look through" the sponsor to the counterparty or obligor — in this case, the tobacco companies — to asses the risk involved.

For law firms, securitizing the payments offers a way to get cash up front or simply reduce exposure to a sector that generates a significant portion of their net worth, Borod said.

As always, off-the-run securitization is competing with other forms of finance available to sponsors. In October, DineEquity, which owns the Applebee's and IHOP restaurant brands, paid down a $1.4 billion asset-backed bond deal with proceeds raised in the high-yield markets. Jack Tierney, DineEquity's chief financial officer, said in a press release at the time that its goal was to "eliminate refinancing risk and to put in place a new capital structure with attractive interest rates, extended maturities, and with the ability to reduce debt and leverage over time from our cash flow."

Winston Chang, managing director, U.S. stuctured credit at S&P, said sponsors of whole business securitizations and certain other types of off-the-run deals are "typically evaluating their options, traditional corporate high yield bonds and bank loans verus securitization, in terms of the trade off in pricing, flexibility and ease of execution."

Market observers warned that securitization of off-the-run assets could run into some regulatory headwinds. The Dodd-Frank Act now requires asset-backed issuers to disclose asset- or loan-level data about the collateral supporting each tranche with the same level of detail that would apply if the deal was beng registered with the Securities and Exchange Commission. Bruce Bolander, a partner at Gibson, Dunn & Crutcher, said complying will likely be time-consuming and add to the expense of deals. Moreover, for some kinds of assets, "there's no template" for the disclosure required.

Another regulatory issue that may impact this special pocket of the asset-backed world is the SEC's change to Rule 17g-5, which requires securities issuers to post information about the underlying collateral on a secure Web site. The rule, which took effect in June, requires that the data on the collateral is made available to rating agencies the issuer hasn't hired.

In addition, a Dodd-Frank provision requires sponsors to retain 5% of the risk of assets used as collateral, but Bolander and Borod call this a "non-issue." Both said sponsors of off-the-run securitizations already hold on to the equity in their unique deals. Bolander recalled that, even when monline insurers were still active, "they wouldn't provide a credit wraps for deals unless they believed they had been structured so that the lowest tranche covered by their insurance would have been rated BBB/Baa on an uninsured basis."