Small home lenders — whose ranks have already thinned over the last two years as the market has contracted — could have an even tougher time now that Fannie Mae has tightened its eligibility requirements for loan sellers and servicers.

The new standards for doing business with Fannie cover such things as minimum net worth and capital ratios. They were released last week and drew less attention than they might have were it not for the week's tumultuous events.

On Friday the spotlight was on Treasury Secretary Henry Paulson's plan to help financial institutions unload illiquid assets. (See

In a Sept. 16 memo to lenders, Michael Quinn, a single-family risk officer at Fannie, wrote that it was revising some of its eligibility requirements and clarifying others "to ensure that Fannie Mae's funds are protected and that business partners are capable of fulfilling their obligations." Fannie would not discuss the changes Friday.

A spokesman for the Mortgage Bankers Association said it did not know how many lenders would be affected by the changes. But Joe Garrett, a principal at Garrett, Watts & Co., in Berkeley, Calif., said they could affect "hundreds" of small lenders and servicers.

However, John Socknat, a member of Weiner Brodsky Sidman Kider PC in Washington, said Fannie already had an informal minimum-net-worth requirement, and lenders with only $250,000 "weren't getting approved unless they had really good relationships."

"This change really has taken away the 'good ol' boy' network, but as a practical matter the impact is not going to be that significant," he said. "Small players were locked out anyway."

Mr. Socknat said that since taxpayers are now "on the hook," Fannie is being "more careful about who they're doing business with."

"This is all part of their attempt to add greater transparency to their risk assessment and analysis," he said. "They want to make sure that lenders have the financial wherewithal to repurchase loans and still be around."

James Deitch, the chairman and chief executive of the $247 million-asset American Home Bank in Mountville, Pa., said the minimum capital requirements would give Fannie a cushion for "counterparty risk up front," he said.

"The same issues of counterparty risk that we're seeing on Wall Street exist for Fannie and Freddie seller-servicers," Mr. Deitch said. "What most of these changes are doing is raising the ante [so] that banks and lenders have to have sufficient capital to absorb losses on repurchases."

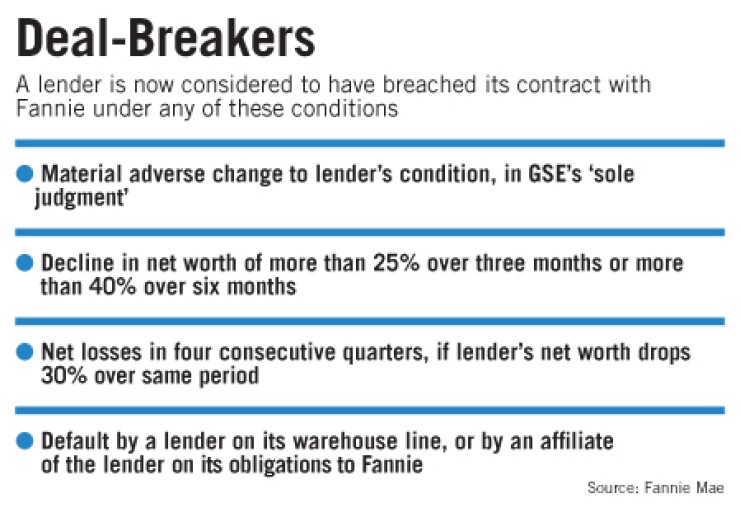

Dan Ferris, a senior vice president of secondary marketing at NetMore America Inc., a lender in Walla Walla, Wash., said he was particularly concerned with the remedies Fannie suggested for lenders in breach of contracts. In addition to requiring additional and more frequent financial reporting, Fannie may require that a lender indemnify it "for actual and prospective losses."

"It raises concerns about how they're going to define 'prospective losses,'" he said.

Mr. Ferris also questioned whether the minimum-net-worth hikes would have the desired effect of raising loan quality. "Guys that have a $250,000 net worth could actually be a better risk, because they can't afford buybacks — they'd be out of business."