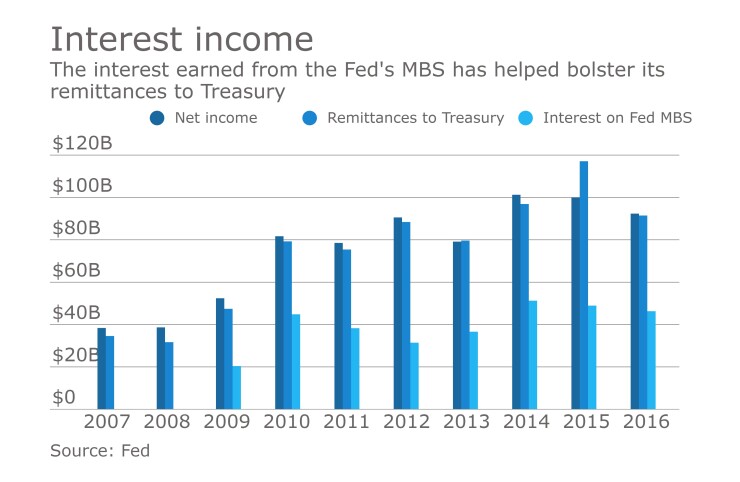

WASHINGTON — The Federal Reserve remitted more than $91 billion to the U.S. Treasury in 2016, according to the results of the central bank’s annual independent audit released Friday, with a substantial portion of that income being generated by assets acquired after the financial crisis.

The audit, conducted by KPMG, estimates that the Fed generated roughly $92.3 billion in income in 2016 and sent just under $91.5 billion to the Treasury in the form of remittances. That income in large part reflects the Fed’s earnings on the performance of the assets in its balance sheet, which expanded substantially after the financial crisis to more than $4.45 trillion in 2016.

The $91.5 billion in remittances is down from $117 billion in 2015, but last year’s remittances were uncommonly high because of a one-time disbursement of more than $19 billion in operating capital that was remitted as part of the 2015 Transportation Bill. That

The results of the audit will likely serve as a counterpoint to a growing concern in Congress that the central bank’s balance sheet is unacceptably high — an issue that came up repeatedly during Fed chair Janet Yellen’s most recent testimonies before Congress in February.

Senate Banking Committee chairman Mike Crapo, R-Idaho, said during the hearing that he looks “forward to hearing from Chair Yellen on how the Fed plans to normalize monetary policy and wind down the Fed’s balance sheet.”

House Financial Services Committee chairman Jeb Hensarling, R-Tex., similarly said last June that it is “It is way past time for the Fed to … systematically shrink its balance sheet and get out of the business of picking winners and losers in the credit markets.”

In response to the financial crisis, the Fed lowered interest rates to nearly zero — an unprecedented accommodative policy — and also undertook several round of so-called quantitative easing, whereby the central bank purchased securities from firms and kept them on their own books as a way of propping up the sagging market for mortgage-backed securities.

The Federal Open Market Committee, which manages monetary policy, has opted to continue to roll over existing securities as they mature rather than letting them expire, keeping the Fed’s balance sheet at its present size.

Yellen has repeatedly said that the Fed will shrink its balance sheet, but described that timetable during her Senate testimony as “far off” and said she would be waiting until the FOMC has “confidence the economy is on a solid course” before beginning to roll the balance sheet back.