WASHINGTON — Senate Banking Committee Chairman Sherrod Brown has spent months advocating for his legislation to offer all consumers free government-backed digital bank accounts available through bank branches and U.S. Postal Service offices.

While the proposal has been met with widespread opposition from the banking industry, Brown argues the legislation will not only bring new customers into bank branches, but also help smaller banks build their technology infrastructure.

“It’s getting harder and harder for small banks to compete for new customers when big tech companies can afford to spend billions on marketing and technology,” the Ohio Democrat said in statement to American Banker. “Under my proposal for no-fee accounts, small banks would be reimbursed for the operating costs of providing these accounts, giving them an affordable way to attract and retain new customers for the long run.”

The financial industry remains skeptical of Brown’s bill, which was introduced in the early months of the

But advocates of the legislation contend it could be a boon for the industry.

Saule Omarova, a professor of corporate law and financial regulation at Cornell Law School, said that the proposal would help smaller banks that are struggling to keep up with advances in technology.

“For small banks this really is their kind of best chance of longer-term survival in the current environment within the industry itself … with all of this technology and digitization,” she said. “Big Wall Street banks, like JPMorgan and Bank of America, or big tech companies, like the Amazons and Facebooks of the world, have a structural advantage that cannot be eroded.”

Other advocates say that banks will be able to cross-sell to new customers who walk through the doors of their branch locations to access FedAccounts.

“I think that Sen. Brown is totally correct to say that his legislation would be an avenue for strengthening the business model of community banks,” said Lev Menand, an academic fellow at Columbia Law School who co-authored a 2018 paper outlining the benefits of a public banking option. “It would bring in millions of households that are currently not in the system. … And that sort of thing, entrance into the mainstream money and payment system, means that there are more people who are able to enter the market for financial products.”

Mehrsa Baradaran, a professor at University of California, Irvine School of Law and author of "How the Other Half Banks," said that offering free FedAccounts to consumers at bank branches ultimately would increase banks’ lending opportunities.

“You can ask most bankers and they would say that the deposit gets you in the door, but the real money, of course, is in lending,” Baradaran said.

Jesse Van Tol, CEO of the National Community Reinvestment Coalition, said that FedAccounts could help banks attract customers who don’t trust banks with their money.

“I do think that historically products that have the imprimatur of the federal government are helpful in overcoming that trust deficit,” Van Tol said.

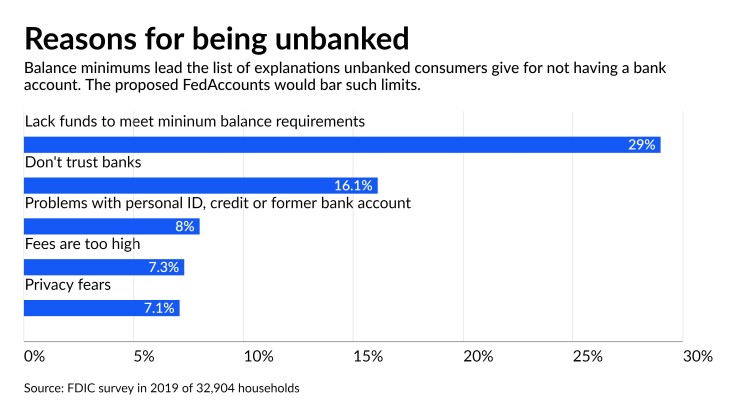

Roughly 16% of unbanked consumers cited a lack of trust in financial institutions as the main reason why they don’t have bank accounts, according to the FDIC survey.

Minimum balance requirements were an even bigger factor — 29% all unbanked cited balance minimums at financial institutions as the main reason they don't have bank accounts. Other reasons include high fees, credit or personal identification issues, and privacy concerns. FedAccounts would have not minimum balance requirements or account fees.

Brown’s legislation still faces an uphill climb to enactment. Sen. Pat Toomey, R-Pa., the top Republican on the Senate Banking panel,

Skeptics of Brown’s proposal have argued that it wouldn’t necessarily increase banks’ account holders or lending opportunities, because the deposits in the accounts would ultimately be held at the Federal Reserve. Karen Petrou, managing partner at Federal Financial Analytics, said that the proposal could pull customers away from traditional bank accounts.

“The big decision that customers will make is bank versus Fed,” said Petrou. “The overall proposal really reconstructs the window into the payment system in favor of the central bank, which is a hard competitor to beat.”

And bankers continue to lobby against the proposal.

“I think the banking industry in general … they have real misgivings about the public sector getting involved” in banking, said Ian Katz, a director at Capital Alpha Partners.

Paul Merski, group executive vice president for congressional relations and strategy at the Independent Community Bankers of America, said that banking services should be left to the private sector.

“The Fed is an independent agency not designed to be involved in retail banking,” Merski said. “It's in charge of monetary policy and watching inflation. It's not designed to be involved in retail bank accounts.”

Jonathan Mintz, CEO of Cities for Financial Empowerment Fund, a New York-based nonprofit that sets national standards for low-fee bank and credit union accounts through its Bank On initiative, said that Congress should focus on encouraging unbanked consumers to open up affordable accounts that are already available at banks.

“There are safe and deeply affordable national Bank On certified bank and credit union accounts … available in tens of thousands of branches all across the country today,” Mintz said. “Why is [Brown] ignoring them, rather than using them?”

Still, consumer advocates who believe that lower-income Americans need easier access to the financial system say that Brown’s FedAccounts legislation would be a win-win for customers and community banks.

“There’s something in this bill for everyone,” said Porter McConnell, campaign director at Take on Wall Street. “The ability to have foot traffic coming through that you can market your accounts to is a considerable advantage.”