WASHINGTON — The Federal Housing Administration's mortgage insurance fund has rebounded notably in the past year despite continued challenges with the agency's reverse mortgage program, according to a report on the FHA's health.

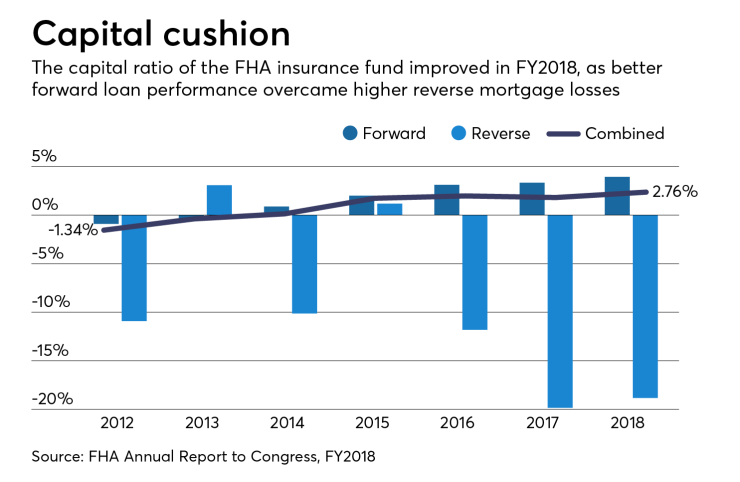

The FHA said Thursday in its annual actuarial report that the fund's capital reserve ratio increased nearly 60 basis points to 2.76% in fiscal year 2018, up from 2.18% a year earlier. The previous year’s ratio was

The economic net worth of the FHA’s mutual mortgage insurance fund increased to $34.86 billion, which is almost $10 billion more than the figure reported in fiscal year 2017.

However, the FHA reverse mortgage — or home equity conversion mortgage — program continued to hamper the agency’s finances, with the capital ratio of the program declining to negative-18.83%, and an economic net worth of negative-$13.63 billion.

The reverse mortgage product

“HECM continues to be a significant drain on FHA’s insurance fund,” said Department of Housing and Urban Development Secretary Ben Carson on a call with reporters Thursday. “Younger borrowers with forward mortgages continue to subsidize senior borrowers in our HECM program to an unsustainable degree.”

Meanwhile, the forward mortgage portfolio continued to grow and make up for losses in the reverse program. The capital ratio for the forward program rose to 3.93%, up from 3.33% in fiscal year 2017.

“The solid performance of our forward book … continues to carry us over the threshold, thanks in part to a solid economy and strong housing market,” FHA Commissioner Brian Montgomery said on the press call.

Rising interest rates combined with rising home prices in an overall sturdy economy have likely contributed to the growth of the FHA insurance fund, said Karen Shaw Petrou, a managing partner at Federal Financial Analytics.

“The reason the MMI is found to be sound despite increased FHA risk and HECM losses is the economic assumption that the current good times in the housing market can only get better,” she said. “I sure hope they’re right, but one might have been more cautious in projecting FHA resilience under adverse scenarios.”

While the industry had been bracing for severe losses from Hurricanes Harvey, Irma and Maria as well as last year’s wildfires in California, the impact of the natural disasters wasn’t as pronounced as some had originally feared.

The early payment default rate did spike during the summer of 2017 in hurricane-affected areas, but returned to normal levels by November 2017, according to FHA’s report.

Hurricanes Florence and Michael as well as this year’s wildfires in California occurred too late in fiscal year 2018 and could not be estimated as of the release of the report, though the agency does anticipate future losses stemming from these events.

Although the MMI fund is trending upward and appears financially sound, Montgomery has not changed his stance regarding mortgage insurance premiums. A price cut was originally proposed under the Obama administration but suspended by President Trump when he took office.

“While the MMI fund is sound at this point and time, I think we’re still far away from being in a position to consider any reduction in our mortgage insurance premium,” Montgomery said.

However, after release of the report, trade groups renewed calls for premium cuts and other reforms. Currently, FHA customers pay insurance premiums for the life of their FHA loan, which many in the industry say should be changed.

“There’s a strong case that could be made for lowering the premium based on this report,” said Brian Chappelle, a partner at Potomac Partners and a former FHA official.

Scott Olson, the executive director of the Community Home Lenders Association, also encouraged the FHA to cut its annual premiums based on the agency’s “strong financial performance,” and called for the premium to be restructured.

“FHA’s actuarial report reaffirms the need for action to end the FHA’s Life of Loan premium policy, a major factor in loan runoff, which reduces the revenues FHA receives,” said Olson in a statement.

The National Association of Realtors agreed that the report showed the FHA was appropriately and effectively managing its risk, which would warrant changes to the mortgage insurance premiums.

“Given the strength of the forward program, NAR believes it is time for the administration to revisit the requirement that FHA borrowers must pay premiums for the life of the loan,” John Smaby, the Realtor group's president, said in a statement.

Montgomery also highlighted several trends that the agency is carefully paying attention to, which include a rapidly growing number of cash out refinances, higher debt-to-income ratios and decreasing average credit scores.

Cash out refinances comprised more than 63% of refinance trends this year, compared with just 39% in 2017.

“Despite a decrease in our overall refinance volume in FY 2018, an increase in cash outs poses a potential future risk for us, but also challenges the core tenets of FHA’s taxpayer-backed mission,” Montgomery said.

Additionally, almost a quarter of the FHA’s purchase business consisted of mortgages where a borrower had a DTI ratio of above 50%, which is the highest level since 2000, according to Montgomery.

He said the agency will be making “additional changes soon” to address some of those concerns, but declined to provide further details.