WASHINGTON — Concerns about credit concentrations at the Federal Home Loan banks are opening the door to a wider conversation about — and likely rulemakings on — stricter regulation of these government-sponsored enterprises.

Federal Housing Finance Agency Director Mel Watt sketched a regulatory vision this week that included greater scrutiny of large exposures to single borrowers and of funding mechanisms used by the 11 banks, as well as serious consideration of new risk-based capital and liquidity rules.

Watt appears particularly concerned about Home Loan banks' reliance on short-term funding for longer term advances.

"Overreliance on short-term funding can strain the system's capacity to issue short-term debt at attractive spreads. Currently, market demand appears to be large enough to accommodate ample amounts of FHLBank short-term debt, but that may not always be the case," Watt warned in a speech Tuesday to a meeting of board directors at the banks. "Entering a future downturn with extensive short-funded, long-asset positions would be imprudent as it would pressure the FHLBanks to exacerbate that funding mismatch."

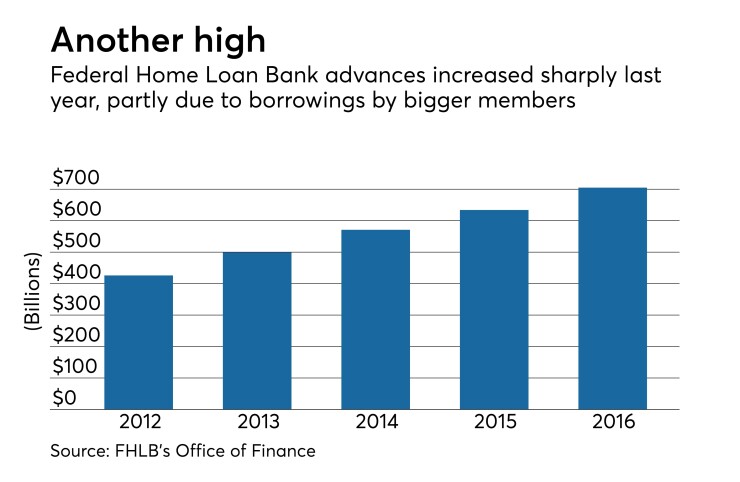

To be sure, the Home Loan Bank System is not in immediate crisis. Its $3.4 billion in net earnings in 2016 were its most profitable year. Advances held by the 11 regional FHLBs increased by $71.2 billion to $705.2 billion.

But there has been a renewed focus on long-term risks facing the system after reports that Wells Fargo Bank received $40.1 billion in advances from the Federal Home Loan Bank of Des Moines last year. At yearend, the Des Moines bank had $131.6 billion in outstanding advances, of which Wells Fargo accounted for 59%, or $77.1 billion.

Home Loan bank officials have sought to downplay such concerns.

"We meet our members' funding needs while prudently managing our liabilities," said Angie Richards, a spokeswoman for the Des Moines bank, after Watt spoke at the meeting. "The maturity of our debt issuance is tied to the maturity of our assets. If advances with maturities of one year or less are needed based on member demand, we will meet that demand by issuing liabilities (debt) with maturities of one year or less.”

Yet the FHFA is worried about the fact that the system's 10 largest borrowers accounted for 80% of the increase in advances last year.

"It remains a focus of FHFA's supervisory and examination work," Watt said. "We want to ensure each FHLBank is pricing their advances to large members appropriately and that the FHLB has appropriate contingency plans if a large member decreases demand for advances or is unable to repay its advances.”

Watt's concerns about a mismatch in funding advances are also opening the door for the FHFA to update its capital and liquidity rules.

"We have had numerous discussions with FHLBank representatives, and we understand that the liquidity and funding challenges facing the FHLBanks differ from those facing depository institutions,” Watt said. “While we are still working on the details, we intend to issue a proposed liquidity rule by the end of this year.”

The FHFA is also working to revise the current risk-based capital rule. "We believe there is an opportunity to take advantage of new data and modeling improvements that have become available since 2001” when the current rules were written, Watt said.

Watt's new regulatory focus encompasses new standards for interest rate risk, capital, and liquidity, according to a Federal Financial Analytics report. That could have a big impact on the system overall.

It could lead to a "hike in risk-based [capital] ratios and accompanying earnings stress," the analysts warn in a May 23 report. "If FHFA now really wants to clip the wings of the FHLBs in this business, profit will suffer.”