As most banks try to figure out a plan for the next few years, First Place Financial Corp. in Warren, Ohio, continues to dwell on the past.

The $2.8 billion-asset company spent last year re-evaluating results spanning from mid-2007 to mid-2010. Its big dig continues; the company said in a late December filing with the Securities and Exchange Commission that a plan to complete restatements by yearend had fallen short.

"Considering the efforts required to complete the multiple restatements, the company has determined that completing the restatements" by Dec. 31, 2011, "will not be feasible," the Dec. 29 filing said. "The Company has been and continues to work diligently to address the restatements and will file all current and restated consolidated financial statements with the SEC as soon as practicable."

Reinstatements are time consuming and open everything up to questioning, says Daniel Trigg, a partner at McGladrey & Pullen LLP in Chicago. "Once you reopen the results it starts a snowball effect. You want to make sure you're clean on everything," he says.

"One year is bad enough, but when you start rolling back two or three years, it is terrible to get through," Trigg adds. "You are trying to get it all together. You're already in a timeout with the SEC, so you want to make sure you get everything."

Trigg says more restatements from other banks are likely, as investors demand greater clarity and as companies get a clearer picture as to what has occurred in the last few years.

"There is not much tolerance for financial data that doesn't have integrity," Trigg says. "I think we will see more restatements rather than less because companies want to be able to tell a clean story to the investing public."

On Friday, United Community Banks Inc. in Blairsville, Ga., said it would restate results from 2010 and the first three quarters of last year afer an SEC inquiry into its deferred tax asset. By establishing a valuation allowance against the full deferred-tax asset, the company's 2010 results will swell to a loss of $502.3 million from a previous loss of $345.6 million, for instance.

At First Place,

It appears that once First Place began to yank the thread, it also unraveled the previous two years of results. Throughout 2011, the company said it would restate fiscal 2009 and 2008. It had previously reported a $10.8 million profit in 2008 and a total loss of $147.3 million in 2009 and 2010.

While it looks back, First Place has fallen behind for 2011. The company has not reported results since June 30, 2010. The lack of information coming out of First Place has landed the company in trouble with the Nasdaq. On Friday,

While restatements are overall challenging, First Place's situation might be particularly daunting, industry observers say.

During that time, First Place company was chatty and its executives were easily accessible, says Theodore Kovaleff, an analyst at Horwitz & Associates who also owns First Place shares.

First Place "was quite open and then they went silent," Kovaleff says. "I've put in phone calls to them and you get an answering machine because the president is never there and the calls go unreturned. … I would like to know what is going on with this festering cancer. My last set of numbers is for June 2010."

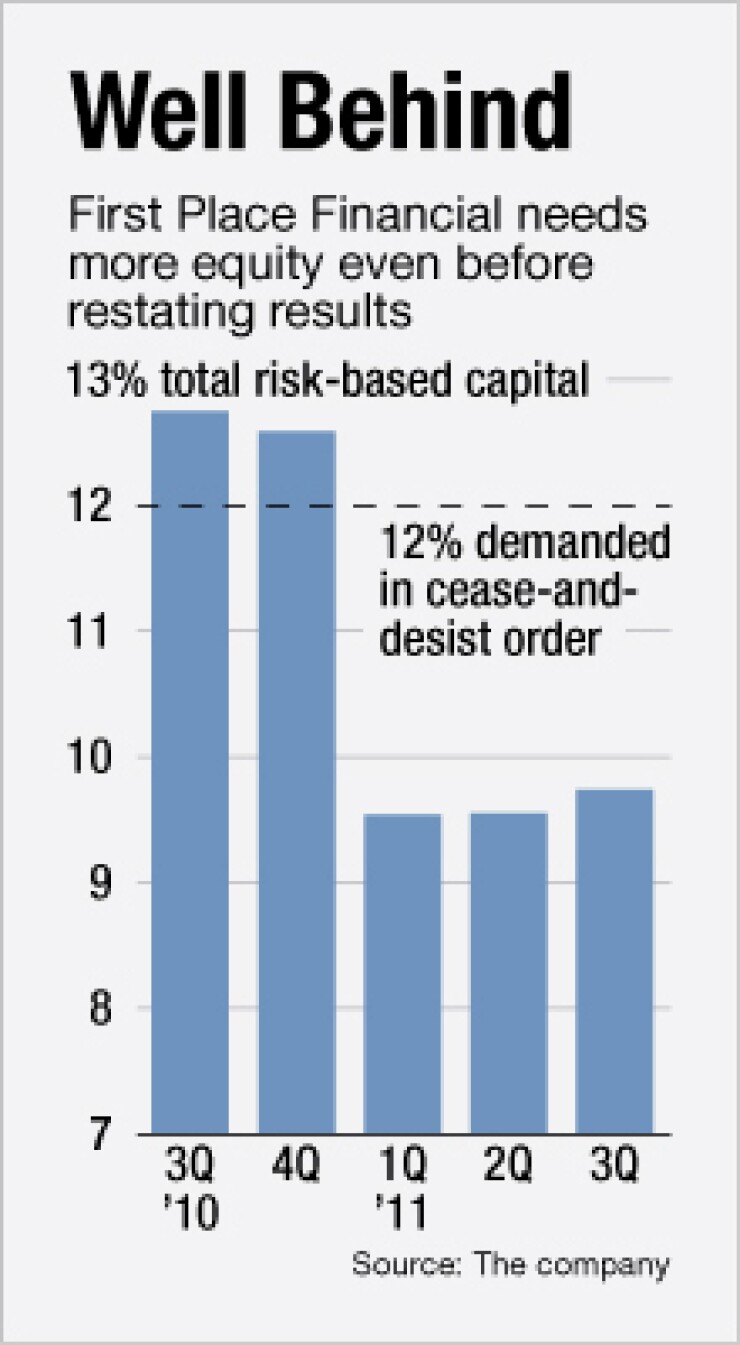

First Place Bank, the company's thrift, is reporting quarterly results. Data from the Federal Deposit Insurance Corp. show the thrift was adequately capitalized at Sept. 30, with a total risk-based capital ratio of 9.74%, or 26 basis points below well-capitalized status. A July cease-and-desist order from the OTS, now administered by the Office of the Comptroller of the Currency, called for that ratio to be at 12% by Dec. 31, 2011.

The thrift is profitable, based on FDIC data, earning $1.5 million in the quarter that ended Sept. 30, as it nearly halved its loan-loss provision from a year earlier, to $8.9 million.

Trigg says he wouldn't rely too much on the FDIC data, though, until the company's restatements are complete. "The bank itself might be filing its call report the best it can," he says.

Karen Dorway, the president of BauerFinancial Inc. in Coral Gables, Fla., estimates that the company will need to raise roughly $70.5 million in new capital, based on the Sept. 30 data from the FDIC data, to comply with the consent order.

First Place will likely have to wait until the restatements are completed before pursuing any kind of capital raising.

Michael Iannaccone, the president of MDI Investment Inc., said that while First Place will have a great view of its condition once the restatement is done, investors may remain doubtful about the company's results, as they would be about any other target.

"The byproduct of the restatement will be that you can trust the numbers a little bit more," Iannaccone says. "But you don't typically trust management when it is the same team that had to do the restatement. Whether it was fraud that you didn't find out until later or it was just something you missed, restatements don't do anything for trust."