Google Inc. is getting serious about generating leads for mortgage lenders.

Five months after the Internet giant's furtive experiment in the business came to light in court papers, Google formally acknowledged its partnership with Mortech Inc. on Tuesday. Moreover, lenders that have been participating in Google's tests say the search-engine company is not just dabbling.

"Google has a history of trying lots and lots of things to see if they work," said Philip Kneibert, the president of Mortgage Lenders of America in Overland Park, Kan., which has been buying leads generated by Google's Comparison Ads service. In this case, "it seems like they are pushing more and more resources behind it."

Because of its name recognition, Google's interest in the business has been widely perceived as a threat to established lead generators like LendingTree LLC. But Google's real advantage may be its ability to bring in higher-quality leads — ones that are likelier to result in a closed loan.

"With other lead providers, you get a lot of shoppers who aren't really interested," Kneibert said. Google's service provides names of people who are "more serious about getting a home loan."

Analysts said lead aggregation is a natural progression for Google — and a logical niche for the company in financial services. "They can certainly play a role as a facilitator," said Ali Raza, executive vice president at the consulting firm Speer & Associates Inc. "I'm not so sure we'll see Google actually lending money or taking deposits, but leveraging that search capability and bringing buyer and seller together … those are the areas we'll see Google playing."

Now is an opportune time to offer such a service to lenders, analysts said.

"The customer is back," said Rodney Nelsestuen, senior research director at TowerGroup Inc. "The focus on retaining and getting new customers and growing existing relationships exists almost everywhere in the industry."

Deanna Yick, a Google spokeswoman, emphasized that the mortgage-leads service is still in beta testing. "We're trying to see if this new format where we give folks real-time information … if that is something that is helpful for both users and advertisers," she said. "We really can't say whether or not this will be expanded."

Details of Google's plans first emerged in August when LendingTree sued Mortech, alleging that the vendor was selling its technology to Google in defiance of its LendingTree contract. The lawsuit was settled in September on undisclosed terms.

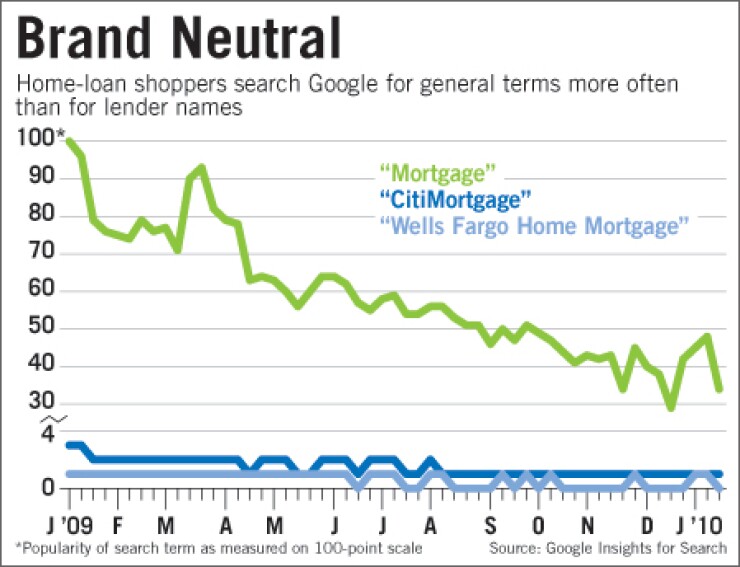

Google first described its service in a post on one of its blogs in October, saying it was part of a broad effort to make advertisements more targeted and relevant to consumers. One of the ways Google makes money is by selling advertisements that appear on its search Web site when users type in certain keywords. The Comparison Ads feature, which Google is testing exclusively with mortgage-related searches, presents consumers with offers on the occasions when search terms like "mortgage rates" are vague.

If a consumer searches for mortgage rates in California, for example, up pops an option to compare rates from different lenders. Users can enter a limited amount of information, including their income and credit score, to narrow the results.

Yick, the Google spokeswoman, said it does not require consumers to provide a lot of personal information up front, because "we want the control to be with the user and not force them into anything, and also to maintain their privacy."

Prospective borrowers decide whether they want the lender to contact them or if they want to contact the lender themselves. Lenders pay Google a fee when a customer calls them or requests a quote.

This feature is designed to provide lenders with the best leads, said Don Kracl, Mortech's president. "Consumers are in control of the process, so by the time they get really serious and contact the lender, they are ready to go," he said. "Some of the lead aggregators that are out there are just based on volume, and they really don't do much filtering."

Kneibert, of Mortgage Lenders of America, agreed. "It's a constant search for good quality leads," he said. "There are a ton of small lead-service providers out there … that are a little sketchy." Aside from Google, his company uses other lead generators; since June it has been the top originator of home-purchase loans on LendingTree.

Mark W. Fowler, LendingTree's senior vice president of exchange sales and operations, said he is confident that the quality of his company's leads "will continue to surpass all providers," including Google's. LendingTree is still using Mortech's technology "for now … as several of our lending partners are on the Mortech system," Fowler said.

Currently, Google's mortgage-comparison service is available to consumers in 15 states. Licenses are pending in another 30 states, Mortech said.

Nearly all the participating lenders so far are Mortech customers, the vendor said. In addition to Mortech, Google is working with other lead-management technology vendors, including Leads360 Inc. and Kaleidico LLC.