Investors are showing less tolerance for banks that have frequent run-ins with regulators, and now the industry is also starting to hear from credit rating agencies on the same topic.

Shortcomings in risk controls, which often stem from governance problems at the top of banks, have “significantly contributed” to a recent string of negative ratings actions, according to a paper published by Fitch Ratings in May.

The company’s analysts noted that the costs of governance problems have climbed higher since the 2008 financial crisis. With more investors shying away from companies that have problems with risk management or a poor culture, those factors are carrying more weight in Fitch analysts’ scores.

“Tolerance by stakeholders has declined over the years,” said Sabine Bauer, who is part of Fitch’s credit policy group with a focus on financial institutions. “If you come out now with a governance failure, that would more severely have consequences for either your funding or profitability.”

The Fitch analysts noted that fines have been mounting against the financial industry in recent years. Globally, financial institutions paid an estimated $23.4 billion in fines from 2018 to 2020, which was up from $13.6 billion during the previous three years, according to Fitch data.

“Oftentimes, there is a governance failing, that is a bit of a root cause, if you will, of whatever issue seems to be out there,” said Fitch Managing Director Christopher Wolfe, who focuses on banks in North America.

Fitch is not alone in elevating the role of governance issues.

Moody’s Investors Service said last year that environmental, social and governance issues were growing in importance, and were cited in about one-third of its rating actions in 2019. Standard & Poor’s in April announced it was launching a new group, S&P Global Sustainable1, that would focus on ESG issues for clients.

For advocates who want banks to be held to loftier ESG standards, the decisions by the major credit rating agencies to put more weight on these issues is a major development.

“It’s an exciting time, seeing the credit agencies getting involved,” said Louis Coppola, co-founder of the G&A Institute, a consulting firm that works with companies looking to boost their ESG profiles.

While ESG issues have typically gotten more attention in equity markets, he said, the topic is of growing importance among bond investors now that credit rating agencies are weighing in, especially on governance topics.

“ESG should have really been GES,” Coppola said. “Governance is really the cornerstone of all of this.”

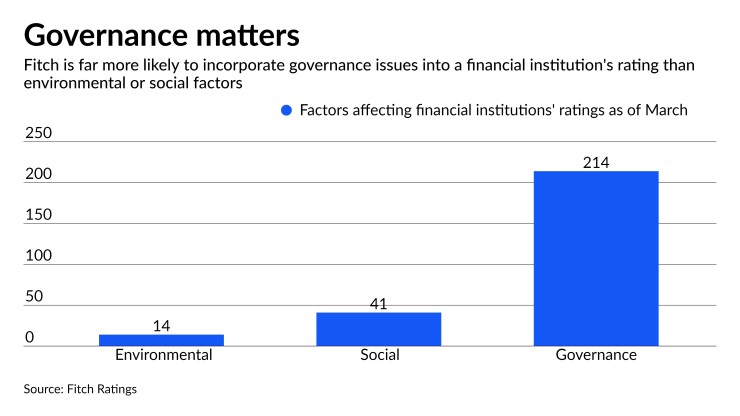

Governance issues are far more likely to impact a financial institution’s Fitch credit ratings than environmental or social factors. As of March, governance issues were the main driver behind or a major contributing factor to ratings decisions for 214 financial institutions, compared with 41 instances in which ratings were impacted by social issues and just 14 actions tied to environmental considerations.

Fitch said in its report that it is specifically judging banks on the effectiveness and makeup of their boards of directors, their financial transparency, and the controls they use to monitor the business they do with customers and other outside parties.

The most recent example of a governance failure leading to a downgrade came in April, when Fitch downgraded Credit Suisse’s outlook to negative from stable, citing poor governance controls in connection with a major loss stemming from the Archegos Capital blowup.

Fitch has also cited governance failures in ratings actions taken against Wells Fargo during its string of regulatory problems, and against U.S. Bancorp after the $554 billion-asset bank was fined over anti-money-laundering problems.

While financial services companies are also focused on climate change, as well as efforts to improve diversity, equity and inclusion, the foundational underpinnings of an effective ESG program involves governance, said Amy Matsuo, ESG and regulatory insights leader at KPMG.

Matsuo noted in an email that a break in governance can quickly result in both financial and nonfinancial damage to a company.

Still, it is unlikely that Fitch would cite governance issues as the basis for a downgrade before those problems are made public, the company’s analysts said.

Credit rating agencies were criticized for being too slow to sound alarm bells in the years leading up to the mortgage crisis. Fitch executives acknowledged that if more focus had been placed on governance in the runup to 2008, the downturn may have been less severe.

“If the regulators and others had as much of a focus on, say, governance, at that time, I suspect things would not have gotten as out of hand as they ultimately did,” Wolfe said.