Hartford Financial Services Group Inc. is infusing $20 million into a troubled Florida thrift to keep it afloat, buying time in hopes the Treasury Department will allow insurers to participate in the Troubled Asset Relief Program.

Hartford could lose the investment if ts deal to buy Federal Trust Corp. in Sanford falls through, observers said. But with regulators threatening to seize the $585 million-asset thrift — and eliminate Hartford's best chance at government capital — the gamble is worth taking, they said.

"It is a heavy price to pay to continue to play, but the rewards here can be significant," said Robert Klingler, an associate at the law firm Bryan Cave LLP.

Hartford is one of five insurers that agreed to acquire a struggling bank or thrift to qualify for Tarp funds. Each deal is contingent on receiving those funds, but the Treasury has not decided whether it will let insurers into the program, nor has it given a reason for its long delay.

The holdup cost one insurer its deal last week. Protective Life Corp. of Birmingham, Ala., said Wednesday that the $246 million-asset Bonifay Holding Co. in Florida called off the agreement they struck in November, citing "uncertainty" about Tarp.

Debora Raymond, a Hartford spokeswoman, said Friday that the Connecticut company had not heard anything from the Treasury about its request for funds.

Hartford has said it would be eligible for $1.1 billion to $3.4 billion through Tarp.

John Nadel, an analyst at Sterne, Agee & Leach Inc., said Hartford's effort to keep its deal alive is smart.

"In my view, Hartford needs more capital," he said. "If this helps them buy more time for the Treasury to perhaps make a positive decision as it relates to Tarp for life insurance companies that have applied, then it's good."

But Michael Paisan, an analyst at Stifel, Nicolaus & Co. Inc., said he doubts the Treasury will allow insurance companies to access Tarp, mostly for political reasons. "People are a little bit tired of the U.S. government throwing around money the way it has been for people who may not need it."

Though Moody's Investors Service cut the credit ratings on Hartford and several of its key units last week — citing pressure on earnings and capital — Hartford is not so weak that it needs a bailout, Paisan said.

After the downgrade, Ramani Ayer, Hartford's chairman and chief executive officer, issued a statement saying that he "disagrees" with Moody's and that its capital is stronger than the ratings reflect.

Paisan said such talk makes him question Hartford's pursuit of Tarp money. Still, he said, given the goal, injecting $20 million into Federal Trust — even if Hartford is at risk of losing the investment — makes sense. "They've placed bigger bets than that," he said. "It's $20 million. To Hartford, it is really not that much money."

The agreement Hartford and Federal Trust announced in November allowed either side to walk away if the acquisition had not been completed by Feb. 27. They later extended that deadline by two months.

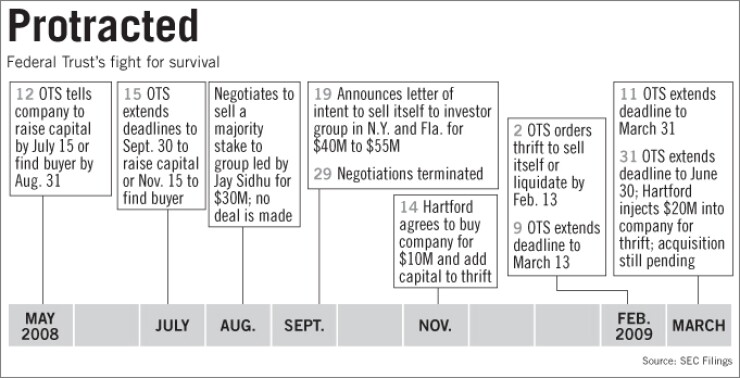

But regulatory actions have threatened to derail Hartford's deal for Federal Trust repeatedly.

The Office of Thrift Supervision issued a prompt corrective action Feb. 2 that ordered the critically undercapitalized Federal Trust to sell or liquidate itself by Feb. 13. It has granted two extensions since then.

The most recent one came Tuesday, the same day as the Hartford investment, and gave Federal Trust until June 30 to comply.

In a filing Thursday with the Securities and Exchange Commission, Federal Trust said Hartford issued it a $20 million note, with an annual interest rate of 10%. The company contributed the proceeds from the note to its thrift unit.

The note would be due in March 2010, unless Federal Trust defaults, in which case it would be due immediately. Several scenarios would be considered a default, including regulators seizing Federal Trust's thrift unit.

Raymond said the note makes Hartford an investor in Federal Trust. She said the insurer acted because its acquisition target needed capital.

She did not directly respond to a question about whether regulators would have seized the thrift otherwise, though observers said that it likely was the case.

They also said Hartford is taking a risk few other buyers would.

"It is certainly unusual," Klingler said. "But we're dealing in unusual times and unusual circumstances."