As rates headed higher, mortgage application volumes inched downward over Labor Day week, but

The MBA's Market Composite Index, a measure of loan application volumes based off weekly surveys of trade group members, declined for the second straight week, down a seasonally adjusted 0.8% for the seven-day period ending Sept. 8. A week earlier,

"Mortgage applications decreased for the seventh time in eight weeks, reaching the lowest level since 1996, said Joel Kan, MBA vice president and deputy chief economist, in a press release.

"Given how high rates are right now, there continues to be minimal refinance activity and a reduced incentive for homeowners to sell and buy a new home at a higher rate," he added.

The average 30-year fixed rate for conforming home loans with balances above $726,200 in most markets increased 6 basis points to 7.27% from 7.21% the previous week. Borrower points, used to help bring down the amount of interest paid over time, also headed higher to 0.72 from 0.69 for 80% loan-to-value ratio loans. The weekly average was 40 basis points above where it sat in late July, Kan said.

The 30-year jumbo mortgage for balances above conforming amounts, likewise, finished higher, averaging 7.25% compared to 7.21% seven days earlier. But points used came in lower at 0.72, down from 0.76 in the prior survey.

After falling to its lowest point since 1995, the seasonally adjusted Purchase Index saw a 1.3% gain from the previous week, increasing in two out of the last three surveys. Volumes, though, still came in 27.5% below where it sat over the same seven-day period of 2022. "Purchase applications increased over the week despite the increase in rates, pushed higher by a 2% gain in conventional loans," Kan said.

With limited inventory suppressing home buying activity for much of 2023, the recent rise in purchase application numbers coincided with

"What we didn't expect — especially considering 7-plus-percent mortgage rates — was more new listings. The inventory crunch is still far from resolved, but this was a small step in the right direction," said Jeff Tucker, Zillow senior economist.

The MBA's Refinance Index, though, took a larger-sized drop of 5.4% week over week and finished 31.1% below the mark reported in the same survey a year ago. The

Higher interest rates typically correspond to a rise in adjustable-rate mortgage activity, and borrowers responded to drive the seasonally adjusted ARM Index up 9.7%. The share of ARM loans versus total volume, though, remained at the same 7.5% mark compared to one week earlier in the trade group's research.

The first full week of September also brought in higher average loan sizes, which increased across all categories among MBA lenders. After sliding downward for two out of the previous three weeks, average purchase amounts crawled back up 1% to $412,900 from $408,800. Mean refinance sizes reported on new applications jumped 2.6% higher to $258,800 from $252,000. The average across total volumes last week landed at $368,100, rising 1.8% from $361,700 on a weekly basis.

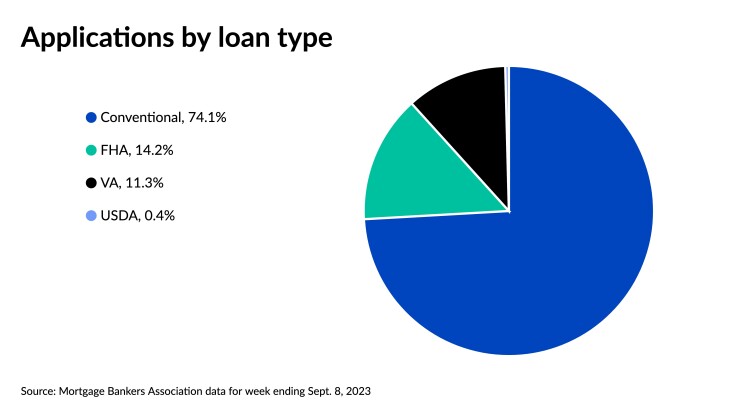

While volumes decreased on an overall basis, the Government Index managed to nudge up a seasonally adjusted 0.9% last week, with a 3.4% rise in refinance activity driving numbers higher. The share of government-backed loans relative to total volume similarly grew as a result, with Federal Housing Administration-sponsored applications garnering 14.2% compared to 13.7% one week earlier. That uptick offset the flat pace of Department of Veterans Affairs-guaranteed activity, which remained at 11.3% and the decline to 0.4% from 0.6% in applications coming through the U.S. Department of Agriculture.

Interest rates finished higher week over week across all loan types reported by the MBA, with 30-year averages all above 7%. The contract average of the 30-year FHA-backed mortgage inched up a single basis point among its members to 7.04% from 7.03%, while points increased to 0.98 from 0.95 for 80% LTV loans.

At the same time, the 15-year fixed rate mortgage climbed up 6 basis points to a contract average of 6.72% from 6.66% seven days earlier. Borrower points also jumped to 1.01 from 0.86.

The 5/1 adjustable-rate mortgage, which stays fixed before rising after a half-decade term, surged 26 basis points to 6.59% from 6.33%. Points came in at 1.16, a 5-basis-point increase from 1.11 one week earlier.