While the past decade has seen the

Coinciding with recent

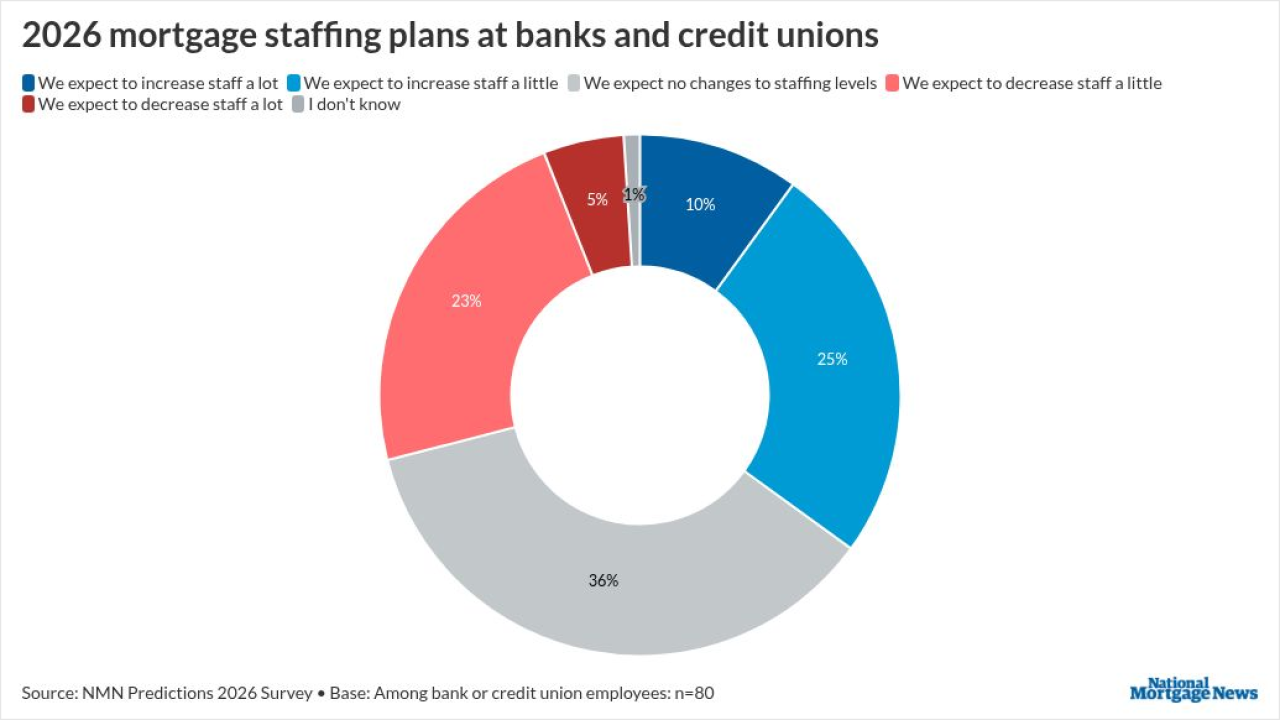

In a recent National Mortgage News survey of industry professionals, a minority share of 29% of banks and credit unions expect to lower mortgage headcount in 2026. Meanwhile, near equal percentages said they either planned to hold the status quo or increase staff, with shares of 36% and 35%.

The survey polled over 150 mortgage industry professionals, with approximately 80 from depository institutions.

The conversation started to shift once the mortgage industry approached a level of employment that is

While AI has some in mortgage still concerned about elimination of their positions, the conversation today is now pivoting toward using it to

Today, staff optimization, by and large, is where mortgage lenders at depository institutions are looking to achieve maximum benefit as

"With the advances in AI, there's a lot of opportunity to figure out ways in which to optimize processes, be more efficient. And the technology is now there," said John Geertsema, managing principal at bank and technology consulting firm Capco.

Many technology providers have shown their value when it comes time to promote their tools, he added.

"They're coming to the table saying, 'We did this at bank A, bank B and bank C. There's momentum, and there's lots of experience to build upon."

Contributing to their headcount strategy is the ability of the newest tools to scale quickly, thereby avoiding the dramatic swings in hiring and firing that have been the mark of a cyclical industry like mortgage, according to Craig Rebmann, product evangelist and managing director at Dark Matter Technologies.

While technology, especially with AI behind it, is up to the task, the onus falls on the employer to best implement it and gain value.

"No technology provider is going to bring you volume. They're only going to bring you capacity. The lender is then responsible for determining what they're going to do with that capacity," Rebmann said.

For institutions looking to tap into digital advancements to scale up, today's innovations heighten the need to train and diversify staff skills, he added.

"You're automating a particular use case. It's bringing capacity to a particular role. It's not necessarily bringing capacity across your entire business," noting that leaders need to think ahead to how to fully benefit from technology's breakthroughs.

"Being able to cross-train people is probably more important now than it has ever been in order to allow lenders to maximize their capacity gain," Rebmann said.

While the software tools themselves might not be the driving force behind bank decisions to invest in operations, the innovation that has occurred in the past several years is offering opportunities to ramp up production that now meets or surpasses their anticipated demand.

San Antonio-based Frost Bank,

"I don't know that technology is influencing goals, but it certainly is allowing us to achieve those in a manner that we probably couldn't if we didn't have what we have," said Beverly Hankinson, senior vice president and mortgage loan advisors manager for the unit of Cullen/Frost Bankers, about the tools in its stack.

She pointed to the ease today with which mortgage software communicates with other systems to keep all parties informed, boosting the lender's relationship with the bank customer.

"They're systems that integrate. They allow us to be more efficient. We can move applications through quicker and keep tabs with our clients and our bankers."

"Throughout the process, we've integrated it with our other systems as well, so our bankers know what's happening with their client," Hankinson continued.

Individual processes where new technology is expected to prove transformational this year runs the gamut from automated document uploads and real-time asset verification, which 43% of respondents in the National Mortgage News survey see as most impactful, to credit scoring analysis and AI-backed underwriting where more than 50% expressed the same opinion.

In the middle were tasks, such as digital closings and fraud detection. Although percentages were smaller, tasks such as natural language processing and remote online notarizations should bring change to the industry in 2026, according to some.

Rather than one specific tool turning into a game changer for mortgage professionals, it is the sum of the parts that can propel mortgage technology growth this year, especially with agentic artificial intelligence in the mix.

When coupled with

"Anywhere where quality is being assessed, anywhere where you just need alignment across the team, I think those are golden opportunities," Rebmann said.