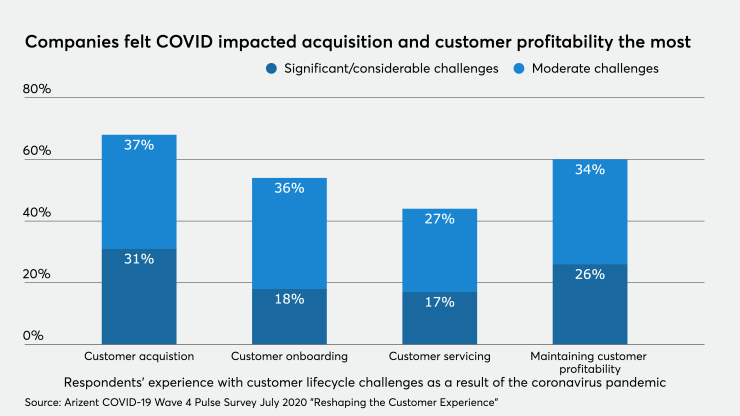

While many companies simply struggled to stay afloat as the coronavirus pandemic raged, one thing became clear in the later months of the crisis: It's become harder than ever to acquire new customers as well as to onboard those newly acquired ones.

Two-thirds (68%) of respondents to the latest Arizent survey of 450 executives say their companies experienced moderate to considerable challenges on customer acquisitions due to the impact of COVID-19. This is the most impacted area of the customer lifecycle being affected by the virus.

Five months since the World Health Organization

Key findings

- Two-thirds (68%) of respondents’ companies have experienced moderate to considerable challenges on customer acquisitions due to the impact of COVID-19.

- About 6 in 10 (64%) professional services respondents and 7 in 10 (69%) financial services executives (excluding insurance) reported that they have experienced moderate to significant challenges in maintaining customer profitability, albeit a little over half in each group stated that the challenge was only moderate.

- Low use of digital tools and channels by customers, increased cybersecurity risk and staffing challenges due to remote work were the top three challenges faced by companies overall to support customers during the pandemic.

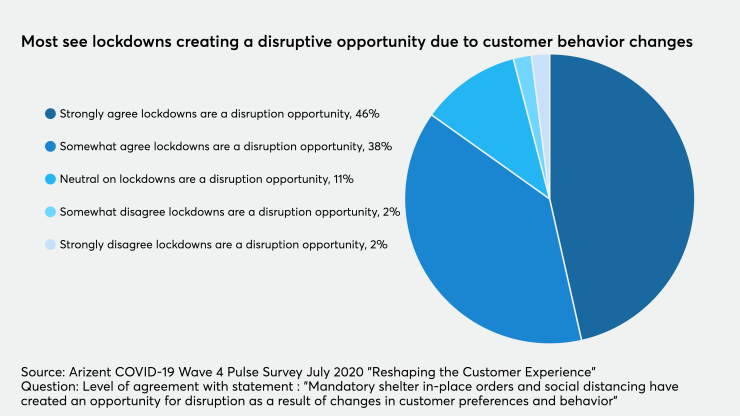

- Most (84%) survey respondents agreed somewhat or strongly that the lockdowns are creating a disruptive opportunity since customers have been forced to change their everyday behaviors.

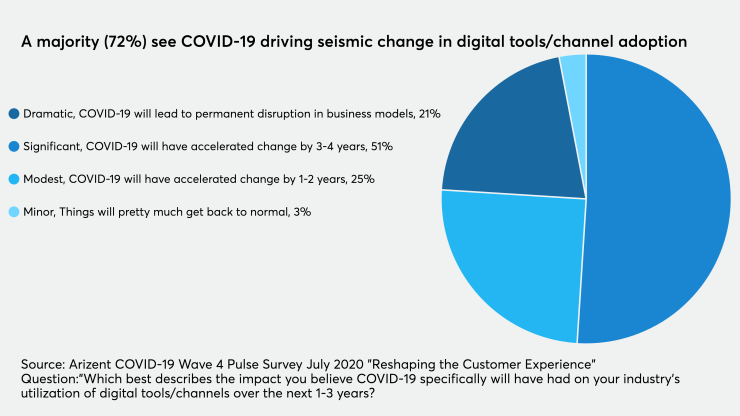

- Almost three-quarters (72%) of survey respondents reported that they believe COVID-19 will drive dramatic or significant change in their industry’s utilization of digital tools, leading to permanent change in business models; or at least accelerate that change by three to four years.

In the next one to three years, companies are planning to use a variety of technologies, some of which they have already implemented to an extent, to better engage their customers. These include cloud services, video and text messaging.

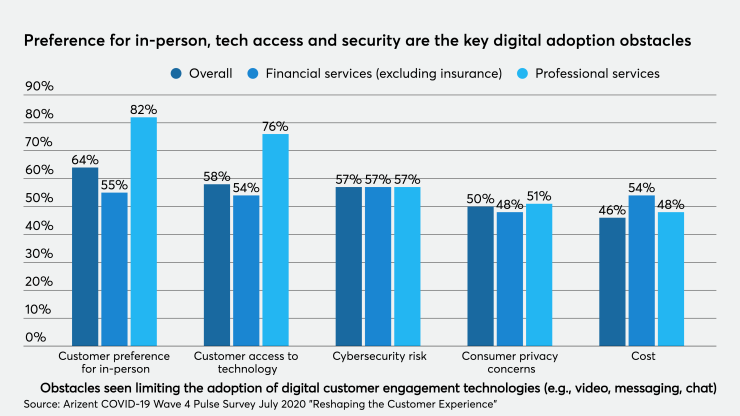

Customer preferences for in-person meetings, access to technology and cybersecurity risks represent the top three digital adoption obstacles companies will face in the future. Almost two-thirds (64%) of the 450 survey respondents felt customers preferring to have in-person meetings would represent a key obstacle to their industries’ driving customer digital adoption.

COVID-19 has impacted many companies’ customer acquisitions, especially certain sectors

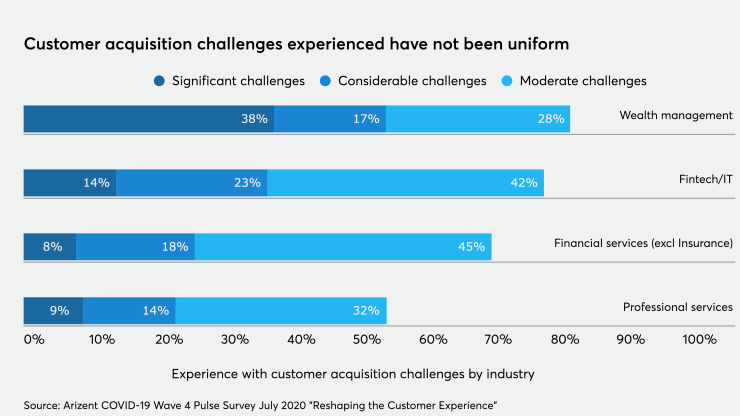

The coronavirus pandemic hit customer acquisition hardest, out of all aspects of the customer lifecycle, but the effect was not felt evenly across all sectors.

Directionally, wealth management and Fintech/IT have seen their customer acquisition efforts impacted at a greater level than other sectors such as professional services.

About 83% of wealth management and 79% of Fintech/IT respondents reported moderate to significant challenges to their customer acquisition activities due to COVID-19, compared to just over half (55%) of professional services executives. Financial services, excluding insurance, reported moderate to significant challenges to their acquisition activities at a rate of 71%. Additionally, the level of significant challenges faced in wealth management customer acquisitions was the highest, at almost one in four (38%).

One of the challenges many companies experienced was the need to replicate the “in-office” environment as a “work from home” (WFH) or remote environment, a process which was much more complicated than some expected.

For some companies, it involved adding or augmenting VPNs, securing additional software seat licenses, allowing remote access to sensitive customer data that had never been done before and permitting staff to use non-company-issued (personal) devices to access the company network and databases.

“[We] offered free additional licenses to accommodate customers that may have not planned for remote working, as well as additional free training seats,” said one IT/Software vendor.

All of these factors made the entire customer acquisition process more complicated than before. Take, for example, an automated credit card underwriting process that creates an exception requiring a manual decision. Simply asking a staffer to review and approve or decline an application from home brings a whole host of risks, including remote access to sensitive data that may have been done only in an office environment before.

Maintaining customer profitability during COVID-19 has been challenging for some sectors

About 6 in 10 (64%) professional services respondents and 7 in 10 (69%) financial services (excluding insurance) executives reported that they have experienced moderate to significant challenges in maintaining customer profitability, albeit a little over half in each group stated that the challenge was only moderate.

From a directional perspective, it appears that wealth managers and fintech respondents have not experienced the same level of profitability challenges with existing customers as they reported moderate to significant challenge levels of 24% and 39%, respectively.

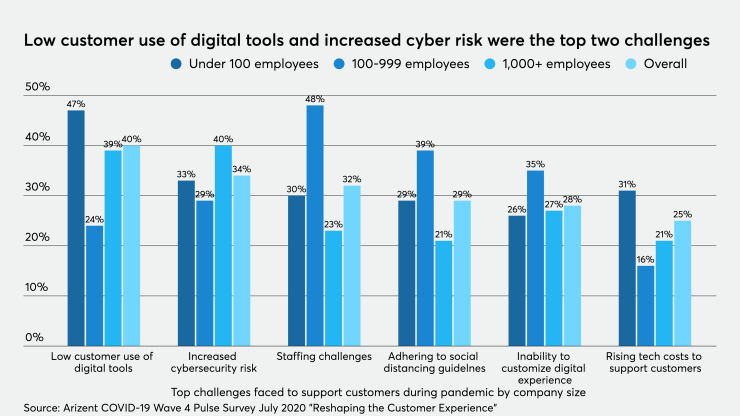

Low digital tool usage by customers was a top challenge caused by COVID-19

Among the top three challenges facing companies as a result of COVID-19, two were most likely unexpected and difficult for companies to plan for — low customer use of digital tools and increased cybersecurity risks — and one could be expected, but may not as easily planned for — staffing challenges.

Low use of digital tools by customers was the top factor impeding customer support as reported by 4 in 10 (40%) of survey respondents. However, from a directional perspective, 47% of smaller organizations (under 100 employees) reported this difficulty when compared to 24% of mid-sized firms (100-999 employees) and 30% of larger firms (1,000+ employees).

This challenge could be partially attributed to some customers who had previously relied on in-person channels, such as branch and office visits, to conduct business and service their accounts being suddenly forced to use digital means. For those unable, inexperienced or unwilling to delve into the digital channel it largely meant two different courses of actions — pick up the phone to conduct business or go into the online channel and attempt to chat or text message for help.

The impact of these actions had two profound effects. First, the rash of volume literally flooded telephone call centers and caused extraordinarily long wait times across many industries. Phone operations were suddenly overwhelmed by an unexpected deluge of volume that persisted for weeks. The same experience was also felt by those attempting to use text and chat features as those agents were similarly overwhelmed.

The second impact was that it forced customer service agents, brokers, salespeople and others into the unexpected role of training their clients in how to use digital tools, such as online banking, to service their accounts. Had companies been able to predict that their customers would be expecting to get hands-on training on digital tools usage en masse, they would have prepared front line agents with the proper training and perhaps enhanced any existing self-service tools available, along with creating some where none existed.

“Our front-line staff is walking clients through their digital connection and providing phone support for clients who struggle with the tools,” said one wealth management executive.

Increased cybersecurity risk was a major COVID-19-induced challenge for companies

The second biggest challenge faced by companies, increased cybersecurity risk, was an unexpected obstacle that tested the limits of fraud and risk detection systems as a result of positive, desired customer behavior that companies generally want to encourage — digital channel adoption. The challenge arises when patterns drastically change or when many of the customers who had rarely or never used a digital tool want to do so, all at the same time. It also relates to how employees changed their access methods to sensitive information on company networks as a result of being forced out of their primary office locations.

An example would be employees who may have accessed financial accounts from offices or used work-issued devices and were now conducting business from home, using personal devices which may have heightened potential cybersecurity risks. In some cases, the lack of a VPN to provide a secure connection to a remote location may never have been made available since the expectation was that staff would need to access systems only in the office environment. Now with many working remote, not having a VPN created an increased cybersecurity risk that needed to be addressed quickly.

Since risk and fraud engines use patterns to identify potential threats, the change of an employee shifting their access to a sensitive database from an office location to a home/remote one can trigger a false-positive risk signal based on the change in IP address used and/or device used such as going from a work-issued laptop to a home computer. In other words, the system has indicated that a potential threat exists when one does not. Common practice may be to temporarily cut off access to that individual while a fraud analyst attempts to contact the staffer. Once the legitimacy has been confirmed, the fraud analyst can manually override the system and re-establish the connection. Yet these actions cannot be taken when an entire department or an organization is forced to work remotely within a short period of time.

The same drastic transition taken by customers who had never used digital tools now being online had a similar effect on increased cybersecurity risk. Having a handful of customer accounts adopting a digital channel on a daily basis is a reasonable business expectation for which risks can be managed. However, if 10%, 20% or more of a customer portfolio decides to “go digital” in the span of a few days or weeks, the risks are magnified.

Overall, 34% of companies reported the increased cybersecurity risk as a top-three challenge in supporting customers during the pandemic, with large companies (1,000+ employees) reporting at a higher level of 40%, although not statistically significant.

This risk is further compounded when training needs to be shared with customers on sensitive tools or basic security measures need to be explained to customers and staff.

An executive at an accounting firm said it is “training clients to use encrypted data exchange, teaching them skills to rely less on paper.”

COVID-19 is a massive disruptor, but also represents an opportunity

Half (49%) of all businesses ranked COVID-19 first as the single biggest disruptive force as to how they will operate over the next three years, and another one in five (22%) ranked it as the second biggest disruptor.

When viewing a combined top-three rankings for disruption, COVID-19 came in first at 82%, followed by technology advancements at 67% and then the global economy at 52%.

The presidential election and fintechs/new entrants posed the next level of disruption, albeit at a much lower level. One potential explanation that these issues have been less disruptive is that they represent known threats and companies have had to deal with them before.

For example, in the case of presidential elections, tax, regulatory and compliance factors can be expected to ease or increase depending on the party elected, forcing companies to dial-up or dial-down their responses. In the case of fintechs, partnership and outright purchases have long been in company playbooks should a new entrant be particularly successful in an incumbent’s industry, such as

Changes in customer behaviors as a result of the lockdowns can create opportunities, as the rulebook for dealing with the pandemic is unscripted. Most (84%) survey respondents agreed somewhat or strongly that the lockdowns are creating a disruptive opportunity since customers have been forced to change their everyday behaviors. Almost half (46%) felt strongly that COVID-19 lockdowns are creating an opportunity because companies have been forced to adjust — and in those changes some are seeing new business flock to their doors.

“We have implemented wellness checks for the credit unions, contacting their business members to see if they have any questions re: PPP or other items the CU can assist with,” said one merchant services firm executive. “We've found that this check-in is bringing businesses closer to their CUs, which increases the referrals from the CU to our business.”

COVID-19 will cause transformative change in digital tools and channel adoption

Almost three-quarters (72%) of survey respondents reported that they believe COVID-19 will drive dramatic or significant change in their industry’s utilization of digital tools, leading to a permanent change in business models, or at least an acceleration of that change by three to four years.

As just one example of this dramatic shift to digital, one need look no further than the remittance market where

For those companies that insisted that bank accounts needed to be opened in bank and credit union branches, mortgages need to be signed at a mortgage officer’s desk, and so on, COVID-19 has been a rude awakening. At the same time it has been a rare, unexpected boost for fintech and challenger banks that operate in a digital-only, mobile-first environment.

“We've accelerated usage of DocuSign for handling various customer signature forms. We've launched a digital support tool with chatbot functionality to provide self-service capabilities. And we launched [an] online account opening for checking accounts,” said one bank executive.

Adjusting future plans to meet with the evolving needs to serve customers and prospects

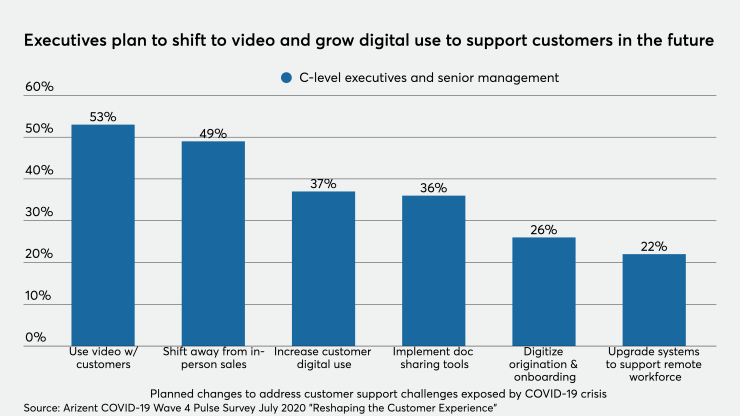

In a recognition of how things have changed, about half of all C-level executives and senior managers reported that they were planning to increasingly use video connections between staff and customers (53%) as well as shift away from a reliance on in-person sales (49%) as the top two actions to address customer support challenges exposed by the COVID-19 crisis.

In the next one to three years, companies are planning to use a variety of technologies, some of which they have already implemented elements, to better engage their customers including cloud services, video with customers, enhanced security and text messaging. About half of the executives surveyed reported that they had already implemented cloud services (54%) and video with customers (48%) while another 17% and 18%, respectively, stated that they had planned to deploy those technologies.

The aforementioned technologies (cloud, video, security and text) are rapidly becoming table stakes as the combination of responses in “implemented” and “planned” stages is approaching a 50% to 70% range of companies. Companies that haven’t already deployed or planned a deployment of these solutions need to strongly consider their implementation in the next few years or risk being left behind by their peers.

The next generation of technologies, which may be still a few more years out from widespread adoption, include a tier of solutions that stand at a combined adoption and planning rate in the 45% to 60% range — APIs, big-data analytics and instant payments. The technologies are being tested, and in some cases deployed, with major initiatives behind them, such as the Federal Reserve’s 2023-24 deployment of its FedNow instant payments network. These are the technologies that companies should consider investing once they have fully implemented and leveraged the four “table stake” solutions.

While the future customer service is becoming clear, obstacles still remain

Customer preferences for in-person meetings, access to technology and cybersecurity risks represent the top three digital adoption obstacles companies will face in the future.

Almost two-thirds (64%) of survey respondents felt customers preferring to have in-person meetings would represent a key obstacle to their industries’ driving customer digital adoption. This was reported at a higher level for professional services, at 82%, and slightly below the total for financial services (excluding insurance) at 55%.

Overall, 58% of survey respondents reported that customer access to the necessary digital tools to acquire and service their accounts was the second obstacle to digital adoption. The so-called digital divide where lower income, rural and older consumers may not have access to Wi-Fi, broadband and/or lack the funds to purchase laptops, tablets, software, etc., represent a major issue for companies seeking to convert their customer portfolios to an all-digital one. About 54% of financial service (excluding insurance) and 76% of professional service executives reported that this represented an obstacle for them.

Cybersecurity risk was also a top obstacle standing in the way of digital adoption with companies overall, financial services (excluding insurance) and professional services respondents all reporting at a 57% level. The new reality of consumers using multiple devices on multiple IP addresses, along with the “have-nots” of the digital divide using shared personal and public devices has forever raised the complexity for CIOs and IT executives in managing cybersecurity risks and mitigating potential fraud.

Conclusion

COVID-19 exposed critical weaknesses in the customer interaction model, particularly in the areas of acquiring and onboarding new customers. Many companies have come to realize that they lack the tools and infrastructure to operate in a completely remote, digital environment. The fact that most executives believe COVID-19 has permanently changed or accelerated by three to four years the digital shift in their industries should serve as fair warning to those expecting a return to normal.

That said, almost three-quarters of respondents felt that the pandemic will create a market disruption opportunity for their companies. Thus, the customers that are having trouble opening accounts at one company will likely find a more streamlined, digital-friendly way of doing business at a competitor.

As painful and expensive as it may be to originate checking accounts digitally, banks and credit unions that lacked that capability discovered that they are at a disadvantage. Similarly, mortgage companies and auto lenders that continue to rely on paper-based documents are living on borrowed time. Digital solutions that exist today and are in widespread use, such as DocuSign, and companies that are completely digital-only such as Rocket Mortgage or Chime highlight the clear path of what can be achieved.

The next technological issue addresses digital holdouts and the have-nots of the digital divide. Closing a branch and realizing some of a bank’s customers in that community have been cut off — since they can’t digitally access their accounts — is not a plan for future success.

Simply adding new features to a mobile app does nothing to help customers unable or unwilling to download it. The same goes for adding video for someone who doesn’t have Wi-Fi or a spare iPad. One area worth exploring may be how to maximize the use of smart TVs and digital assistants such as Alexa.

Finally, executives should plan and invest for change. Since the initial impact of the pandemic has caught many businesses off guard, there is general sense that all are equally suffering in their ability to interact with their customers. However, as the pandemic soldiers on, much like a rogue wave going back out to sea only to return a few moments later, it’s the businesses that adapt first that could gain the most from the disruptive opportunities that have been created.

This research is the fourth installment in an ongoing series conducted by Arizent, parent company of American Banker, PaymentsSource, The Bond Buyer and other titles. In March,

This fourth survey was conducted in partnership with Celent, a leading research and advisory firm and division of Oliver Wyman focused on technology for financial institutions globally. The survey was conducted with 450 executives from July 9-27, 2020, across an array of sectors including financial services, wealth management and professional services. About 351 of the survey respondents were C-level executives and senior managers representing employers with decision-making abilities on their companies’ strategies and investments. The remaining 99 respondents were midlevel managers and staff employees who would be involved in executing those plans and implementing the investments.