The coronavirus pandemic has had an immediate and negative impact on many businesses including financial services firms and fintechs, with long-lasting repercussions as consumers change how they use their money and companies adapt to managing a remote workforce.

Arizent, the parent company of American Banker, this week released a broad industry survey on both the impact of the crisis and emerging responses. The survey found the pandemic has forced many companies to implement new or modified business continuity plans, appoint executive response teams and invest in new technologies to enable a remote workforce. The pandemic is also expected to lead to a greater investment in technologies that reduce the reliance on face-to-face interactions for both coworkers and clients.

Unfortunately, there is a consensus among most companies surveyed (72%) that the COVID-19 crisis will have a negative impact on the economy over the next 12-24 months, as well as on their individual businesses (82%).

“We are a merchant services provider. As our merchants' sales are impacted, so are our residuals,” said one financial services executive in the survey.

Arizent, which also publishes PaymentsSource, The Bond Buyer, Financial Planning and other titles, conducted a survey of 304 executives on March 19-20 across an array of sectors including financial services, wealth management, fintech, professional services, government, education, consulting and other areas to understand how businesses are dealing with the crisis, their sentiments about the future and potential plans to change how they operate going forward. About half (49%) of the respondents were C-level executives, more than one-third (38%) represented middle and senior management and the remainder (13%) represented staff positions.

The unprecedented actions taken by governments and nations across the globe to restrict travel, nonessential office and factory work and social/sporting events in an attempt to control the global coronavirus pandemic — which has already infected nearly

“Activation of multiple backup sites and compartmentalization of teams has resulted in a significant drop in efficiency,” said one financial services executive in the Arizent survey.

For businesses that depend on face-to-face interactions, the crisis is creating obstacles that seem insurmountable.

For example, mortgage providers must deal with government offices or conduct in-person appraisals. These are areas that will likely require significant rework to reduce their dependencies on human interaction, in order to safeguard against future pandemics.

“So far not significant [about COVID-19 impact] but the concerns about county recording office availability and appraising are at the top of the list. If recorders cease operation business has to stop. No closings. If appraisers cannot enter houses their work cannot be done and there can be no transaction in most cases,” noted one mortgage executive.

Key findings

On the whole, financial service firms and fintechs were prepared to deal with a crisis — half or more implemented existing or modified business continuity plans (BCPs), and most of the remaining ones created new BCPs customized for the current situation.

About one-quarter of financial services firms (25%) and fintechs (24%) implemented existing BCPs and 38% of financial service firms and 24% of fintechs modified existing plans for dealing with the crisis. One-third (33%) of financial services firms and over four-tenths (44%) of fintechs created new plans specific to the coronavirus. Overall there appeared to be a high level of preparedness, which likely stems from the fact that financial companies are heavily regulated and dependent on technology.

“Although our firm had a Business Continuity Plan [BCP] in place, the plan did not cover a pandemic like this and we were not prepared to handle the extra volume of remote users,” noted a wealth management advisor in the survey.

About 90% of financial services firms and 79% of fintechs established executive response teams to address the implications of the coronavirus on their businesses (excluding sole proprietorships). One additional factor that played a role in whether or not an executive crisis team was placed in charge was the span of the business — about 33% of local companies had failed to place an executive team in charge while only 7% of global firms failed to do so (a statistically significant finding at the 95% confidence level when excluding sole proprietorships).

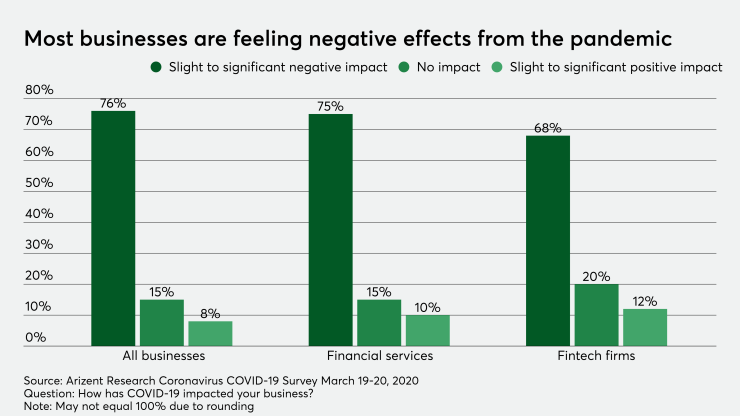

The rapidly evolving nature of the crisis has made many companies feel an immediate negative effect on their business. Three-quarters (76%) of all businesses surveyed reported having a slightly negative to significantly negative impact on their business from the coronavirus. Financial services (75%) and fintech firms (68%) reported similar negative sentiments about the impact on their businesses.

“Technology spend is on hold while financial institutions begin to assess impacts to their organizations," reported one fintech executive.

Most companies expect a negative impact on the economy (72%) and their businesses (82%)

Most financial services (85%) and fintech (80%) firms believe that COVID-19 will probably or definitely have an impact on the future sales or revenue of their business. Half (52%) of financial services firms definitely believe COVID-19 will have a future impact on sales or revenue of their business while only 33% believe it probably will and 15% are not sure at this time.

There is the potential that this sentiment may worsen the longer and more widespread the crisis becomes. If for some reason the situation improves immediately, the sentiment may improve as well.

There is a consensus among most companies surveyed (72%) that the COVID-19 crisis will have a negative impact on the economy over the next 12-24 months, as well as on their individual businesses (82%). While financial services executives almost exactly mirrored the consensus, fintech executives were slightly more optimistic — yet their overall outlook was still negative for both the economy and their businesses. One factor raised by fintechs was the potential negative impact on the fundraising environment, as many of these companies are private and rely on venture capitalists, private equity firms and the IPO market.

“Raising our seed round of funding has suddenly become a lot more difficult, so cash is definitely tight. There has also been a recent slowdown in the sales pipeline, as B2B software buyers seem to have paused their buying activity while they get their own affairs in order and adjust to what's going on. [We need to] make sure the business is able to survive until we close our funding round,” said one fintech executive.

Fintechs report they were better prepared to adapt to remote work than financial services firms

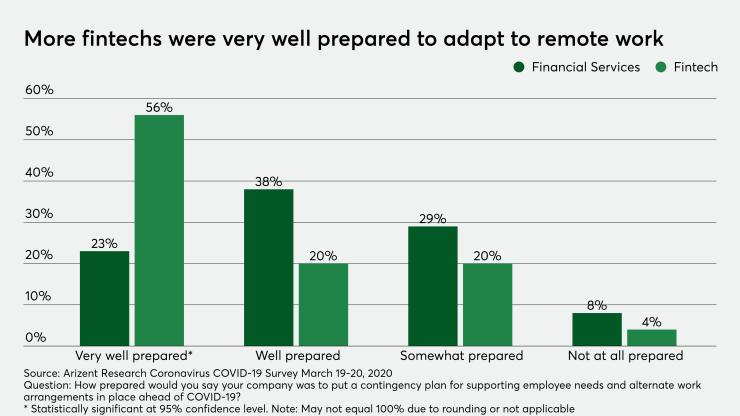

Over half (56%) of fintech executives reported that their businesses were very well prepared for the crisis, the highest of any industry including financial services, which reported only 23% were very well prepared.

In general, both fintechs and financial services claim they were better prepared than other industries such as professional services. Three-quarters (76%) of fintechs and six in ten financial services executives said their companies were well to very well prepared for the crisis, in comparison to just 34% of professional service executives feeling the same way about their firms (a statistically significant finding).

When looking at all businesses surveyed, national (22%) and global (33%) firms reported to be very well prepared at a statistically significant level, in comparison to local (5%) and regional (13%) companies. This is more likely due to the nature of having a larger, more dispersed organization which typically requires them to have a more structured command-and-control type infrastructure in place.

Most employees appear to be adapting well to the new remote working and distance customer service changes in response to the pandemic — at least for now. About 84% of all businesses surveyed reported that their employees are adapting pretty well to very well to their organization’s response to COVID-19. Similarly, 92% of financial services and 84% of fintech executives responded that their employees are coping with the changes in the same positive manner.

Financial services companies say human interaction is important — but their clients disagree, and are going digital

One area that is bound to be changed as a result of this crisis is the mindset of financial services firms around the human interaction with their clients.

Most (88%) financial services firms feel that face-to-face interactions are somewhat important to critical for sales and servicing. Other industries are impacted as well, and will need to rethink their general business model. It will also force branch-centric banks to reconsider the mobile-only challenger bank business model as an option.

“Elderly clients cannot or will not come in to drop off or pick up their taxes. We normally go into the nursing homes to gather the information and visit with our clients and we cannot do that,” said one tax preparation professional.

Despite the perceived need for face-to-face human interaction by financial executives to sell and service their customers, many consumers are rapidly leveraging distance-enabled sales and servicing tools.

Customers are changing how they interact with their financial services providers by resorting to fewer branch visits (73%) and making more telephone calls (60%), as well as increasing their usage of digital services (52%) such as online banking or mobile bill payments.

This rapid shift to voice, digital and even video channels can only be expected to increase in the next few weeks as more cities and states issue “shelter in place” mandates, which are forcing more consumers to conduct business from home. An examination of the recent shelter-in-place mandate issued in

Companies are investing in remote work, digital customer service for the future

Going forward, there is a general expectation that companies will either permanently change how they do business or how they will be able to pivot their business model in a future time of crisis where remote work becomes the requirement again.

About half of all companies surveyed (46%), including financial services (53%) and fintechs (56%), felt that remote work/telecommuting policies will likely be altered as a result of COVID-19. This was the single largest expected change from the survey.

The second biggest expected change is the approach to in-person meetings or events, with one-third of financial services (33%) and fintech (32%) executives stating this was their expectation.

Given these two findings, it should be no surprise that the biggest areas of investment financial service companies are making right now to deal with the crisis is for technology that can enable remote work, at 61%. Other actions being taken to deal with the crisis — which could have lasting effects on respondents' business models — include restricting non-essential business travel (59%), implementing optional telecommuting (57%) , mandating remote work (51%) and temporarily closing offices (45%).

The change in customer interaction, particularly using distance tools and platforms, is inspiring financial services executives to consider investing in new technology, although no single platform rises above the others.

In other words, there is no silver bullet. There are just certain technologies that leverage digital channels to create a safe distance to conduct business during a pandemic.

Over one-third of financial service executives expect that their businesses will invest in a number of digital tools to reduce the need for human interaction for sales and servicing, including mobile banking (37%), online banking (35%), online mortgages (35%), digital payments (33%) and videoconferencing (33%). Other tools include document sharing (28%) and instant messaging (21%).

Conclusions: How work culture and business models need to change

The remote work environment — created by shelter-in-place mandates and temporary office/branch closures in response to the pandemic — has shaken the financial services and fintech industries in ways that could hardly have been predicted. Companies that lacked remote work policies and infrastructure are suffering the most, particularly when company culture has dictated in-person meetings and nonessential business travel.

Overall, financial services and fintech companies will need to adapt to a new normal of remote work on an ongoing basis in order to have the infrastructure, command-and-control skills, and culture that is able to conduct business no matter where employees are at any given time. Companies that go back to the old way of managing a workforce risk being at a competitive disadvantage when a new pandemic forces work to be done from home.

Certain industries such as airlines, hospitality and restaurants will need to come to grips with how they operate and assure the safety of their customers. The ever-shrinking airline seat is most likely going to disappear, but costs will likely rise. Other industries, such as conferences, should expect to be reborn with more virtual and distance participation.

Finally, the business model that requires customers to visit a bank branch to open a checking account and obtain a debit card will need to be re-evaluated. Bank branch closures and government stay-at-home policies have forced traditional banks to support another option. Providing an option to open and service all accounts remotely is becoming a critical need, rather than a way to service a tech-savvy subset of customers.