KeyCorp finally returned its bailout money last week, but the bank is still behind its Midwestern rivals.

U.S. Bancorp, Fifth Third Bancorp, Huntington Bancshares Inc. and others that paid back the government sooner have greater means to buy banks or steal customers. Why? KeyCorp's shares are less valuable than those of its rivals, and it is less efficient in generating revenue.

The inefficiencies give KeyCorp, of Cleveland, less room to lower borrowing rates to attract customers, experts say. The weak share price, relative to tangible book value, makes doing acquisitions harder because stock is the primary deal currency.

Fixing those problems, analysts said, will be the top priority for Beth Mooney, the $92 billion-asset lender's former community banking head and now chief-executive-in-waiting. She is scheduled to succeed Henry Meyer 3rd as the chairman and CEO in May.

Meyer — in returning the $2.5 billion of federal aid on the eve of his retirement — has bought his handpicked successor time to prove whether KeyCorp can be a consolidator and market share winner in the increasingly cutthroat Midwest, experts say. There are signs that the region's manufacturing sector is poised for a rebound, which raises the stakes for KeyCorp to get its house in order in time to go on the offensive.

Fred Cummings, the president of the financial services-focused investment firm Elizabeth Park Capital Management Ltd., said Mooney probably has up to 18 months to make strides before KeyCorp's board feels pressure from investors and an expected consolidation wave to find a buyer or a partner in a merger of equals. There is almost constant speculation that KeyCorp will be taken over by U.S. Bancorp, Toronto-Dominion Bank or another relatively healthy bank.

For now, however, "they aren't going to be a forced seller from a position of weakness," Cummings said. KeyCorp, like a number of other big banks that were early to struggle and late to rebound from the crisis, has "an opportunity to execute," he said.

The big question, Cummings said, is: "How much momentum have they lost as they've been internally focused?"

Cummings and other investors and analysts are modestly optimistic about KeyCorp's prospects for a number of reasons. Though it has a reputation as one of the industry's problem banks, it actually has a number of things going for it that various rivals don't. Its core capital levels are among the highest in banking, and its levels of delinquent loans are among the lowest.

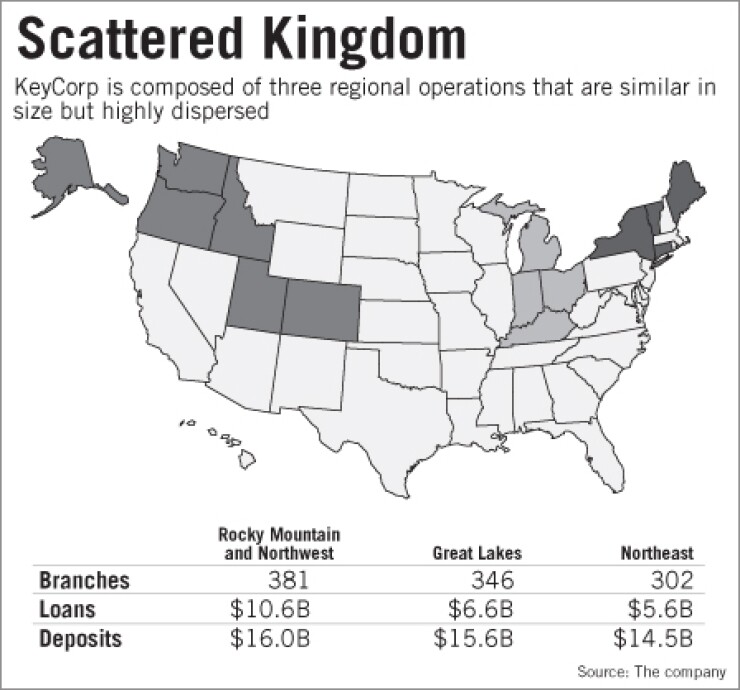

KeyCorp, which earned $390 million last year after losing more than $3 billion in 2008 and 2009, is more diverse than Huntington and Fifth Third. It is involved in more nonlending businesses like investment banking and asset management. So it has more chances to sell the same clients loans and other services like corporate advice or wealth management. It also has unusual geographic reach for a company of its size, with more than 1,000 branches scattered across 14 states. That means it has more opportunities to pick and choose where it wants to take share from smaller banks by opening branches, trying to buy them or by hiring relationship bankers.

"Key has a fabulous market presence in banking, both in lending and underwriting and advisory services to middle-market" real estate investors, said Jeff Davis, an analyst with Guggenheim Securities LLC.

KeyCorp officials are bullish on their ability to grow from New York to Seattle.

"We will look for opportunities to be a potential acquirer," Mooney told The Plain Dealer of Cleveland in February.

"With three consecutive profitable quarters and continued signs of increased economic activity … we believe that we are positioned well to compete with other businesses," KeyCorp said in its annual report filed in March with the Securities and Exchange Commission. Mooney refused to comment for this article.

Analysts say KeyCorp has work to do to even the competitive landscape for deals and acquisitions.

Bolstering its efficiency would add to its earnings power, which would in turn benefit its stock valuation.

Its earnings potential looks weak: A reliance on relatively high-priced deposits and a shrinking loan portfolio has squeezed its margins, which are narrower than at most of its immediate rivals. The downside to its considerable number of fee-based businesses is unstable revenue.

Its efficiency ratio is worse than most of the other big banks going after new business in the Midwest. Those include Huntington, U.S. Bancorp, Fifth Third, PNC Financial Services Group Inc., JPMorgan Chase & Co. and Wells Fargo & Co. What that means, basically, is that KeyCorp has to spend more than all of them for every dollar of revenue it generates.

That problem can be fixed by lowering the cost of loans to rev up revenue, but right now KeyCorp doesn't have much room to compete on price, experts said. At the end of last year, KeyCorp was spending 66 cents per every dollar of revenue; U.S. Bancorp, in turn, was spending about 54 cents. U.S. Bancorp increased its commercial and industrial loan book last quarter by about 2%, in part because it lowered rates. KeyCorp kept rates steady and its similar portfolio of loans shrank by 2%.

Charging people lower rates can hurt the efficiency ratio in the near term but improve it down the line by bringing in new customers. That's something KeyCorp might find difficult because its ratio is already relatively high. The ways to lower it are to boost revenue, reduce expenses or both. A KeyCorp spokesman said in an email that it has been aggressive in both areas, reducing expenses by $228 million since 2008 while increasing revenue in 2010, "despite reducing its loan portfolio by exiting riskier" loans. KeyCorp is targeting another $72 million to $147 million in cost-cutting in 2011 and 2012.

The spokesman declined to comment beyond the email, or provide executives for interviews, because the company doesn't speak to the media before releasing earnings. It is scheduled to report first-quarter earnings April 18.

KeyCorp's other big hurdle is its relatively weak share price, which increased about 2.5% in the two weeks since it announced plans to get out of the Troubled Asset Relief Program. It did so March 30 after raising $625 million in equity and $1 billion of debt.

Getting out of Tarp eased some, but not all, of the pressure on its shares, which closed Monday at $8.92. That was essentially equal to the value of its tangible book. U.S. Bancorp trades at nearly three times book, according to data from Guggenheim. Huntington and Fifth Third were trading at close to one and a half times book each.

This is a problem for KeyCorp because those are the banks it will have to compete with to do deals, experts say. Right now, they can afford to handily outbid KeyCorp because their stock is worth more.

The main thing holding back KeyCorp's share price is that it needs to show muscular growth in revenue excluding taxes and bad-loan costs. While loan costs are expected to keep falling after declining sharply in 2010, the outlook is murkier for the revenue it can collect from loan interest and fees. KeyCorp's loan portfolio — and therefore, interest income — is expected to keep shrinking because it has a lot of construction, maritime and student loans running off its books. Regulatory changes that curb fees it can collect in the retail side of the business may offset any gains in the corporate bank.

One thing working in KeyCorp's favor is that it is poised for some easing of its borrowing costs. It has about $7.6 billion in high-cost certificates of deposit maturing in 2011, which could save $54 million to $106 million over the course of the year, JPMorgan Chase analyst Steven Alexopoulos said in a research note on March 23.