WASHINGTON — The Department of Housing and Urban Development on Monday took its first step toward overhauling a rule meant to guide local jurisdictions in how they comply with the Fair Housing Act.

To the dismay of housing advocates, the Trump administration in January suspended the Affirmatively Furthering Fair Housing rule, arguing that it was too prescriptive. The rule, drafted by the Obama administration, is meant to help locales meet obligations under the Fair Housing Act to provide affordable housing options and avoid housing discrimination.

In an advance notice of proposed rulemaking released Monday, the department sought comment on changes it says will reduce regulatory burden, provide greater control and increase the housing supply.

"HUD found that in contrast to its stated goals, the AFFH rule proved ineffective, highly prescriptive, and effectively discouraged the production of affordable housing," the department said in a press release.

In May, the department also withdrew a computer assessment tool that local governments had used to file affordable housing plans under the 2015 rule.

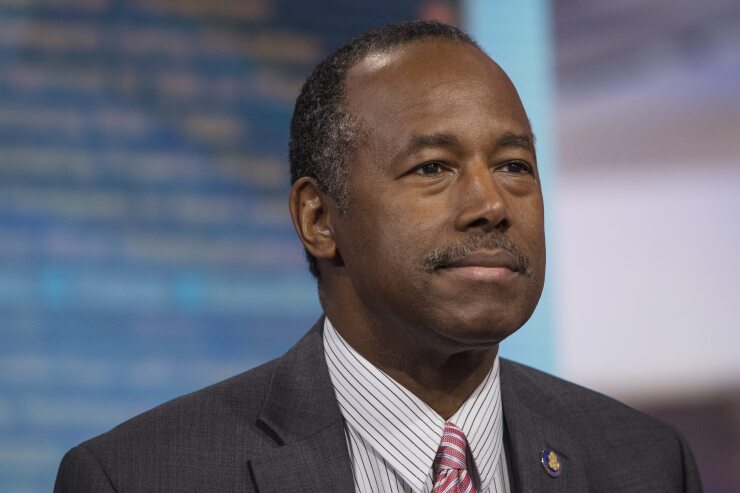

“It’s ironic that the current AFFH rule, which was designed to expand affordable housing choices, is actually suffocating investment in some of our most distressed neighborhoods that need our investment the most,” HUD Secretary Ben Carson said in the press release. “We do not have to abandon communities in need. Instead we believe we can craft a new, fairer rule that creates choices for quality housing across all communities.”

However, housing advocates disagree and argue that the rule was effective.

“This proposed action reveals yet again that the current administration fails to understand its civil rights obligations and the importance of the Fair Housing Act for the communities it is supposed to serve,” said Megan Haberle, the deputy director of the Poverty & Race Research Action Council. “Until suspended by HUD, the current rule was benefiting numerous localities by helping them construct meaningful fair housing goals, address discrimination, and broaden housing choice in ways that made sense for each community.”

Morgan Williams, the general counsel for the National Fair Housing Alliance, said the suspension of the rule was unfair yet the group is willing to work with HUD to ensure that any changes "guarantee meaningful outcomes."

"Any reconsideration of the rule must account for the fact that HUD has a track record of more than 40 years of failing to properly ensure compliance with its affirmatively furthering fair housing mandate," she said. "While the rulemaking process is underway, HUD should continue to vigorously enforce the current rule, which went through extensive piloting and public comment and is designed to produce real results."

Advocacy groups including the Poverty & Race Research Action Council, the National Fair Housing Alliance, the American Civil Liberties Union and the NAACP filed a lawsuit against the department in May, asserting that the suspension of the rule was unlawful. HUD and Carson had filed a motion to dismiss the case, but a judge for the U.S. District Court of the District of Columbia heard oral arguments in the case on Thursday.

The public can comment on the proposed regulations for 60 days after the proposal is published in the Federal Register. HUD will also be looking at comments submitted in response to the suspension of the local government assessment tool in its consideration of potential changes, the department said.