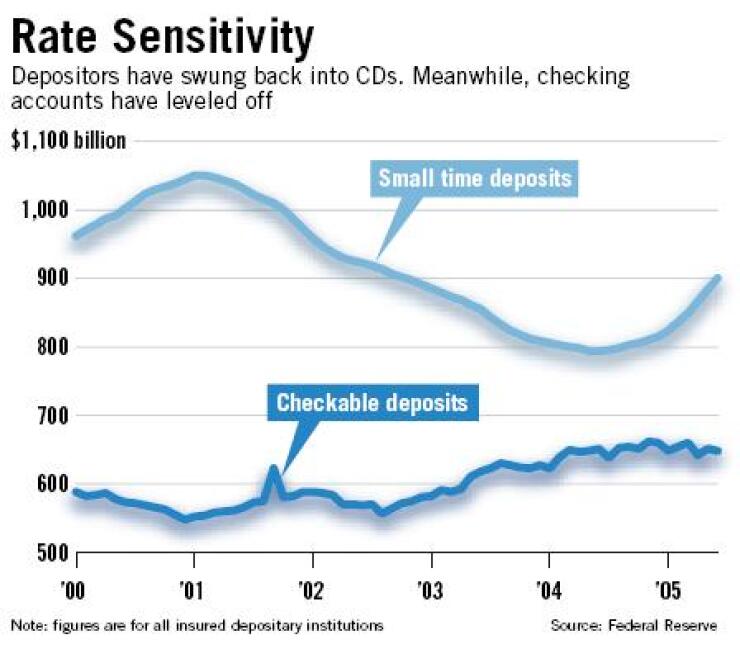

A year ago many community banks were touting how they had adeptly lowered funding costs by deemphasizing certificates of deposit and attracting lower-cost transactional deposits.

What a difference a rise in interest rates makes.

Now, suddenly, banks are courting CD money again. In an about-face from the last dozen or so quarters, banks large and small reported significant gains in CD deposits and declines or slowdowns in transactional deposits in the quarter that ended June 30.

And with rates likely to climb even more, observers expect this trend to continue at least through the year.

“Rates are becoming more meaningful now,” said Stephen Covington, an analyst with Stifel Nicolaus & Co. Inc. in St. Louis. “Typically, when rates are low, money becomes lazy — and suddenly, when you can get 3% or 4%, money starts to move.”

Because pricing competition for checking accounts is still fierce, many banks are promoting free checking less aggressively and focusing instead on CDs. They also see CDs as a lower-priced alternative to Federal Home Loan bank advances.

Many banks stopped actively promoting CDs three years ago, when demand and interest rates started to fall. (Rates eventually dropped to historic lows.) Rather than earn less than 2% on CDs, customers preferred accounts from which they could move their money easily to other investments.

Banks, though, did not necessarily see this as a bad thing. Indeed, in presentations to investors the last couple of years, bankers routinely pointed out how the move away from CDs had lowered their cost of funds.

That is changing.

At WesBanco Inc. in Wheeling, W.Va., total deposits were up 12%, or $330 million, in the second quarter, largely because of a surge in CDs. The $4.5 billion-asset company said its customers are moving their money out of money market accounts into CDs because they can get about 250 basis points more interest than they did a year ago.

In the 12 months through June 2004, balances in WesBanco certificates of deposit had declined 4.3%. In the next year, as the company’s no-interest demand deposits rose 11%, its CD balances jumped 49.8%.

Because of rising interest rates and the renewed appeal of CDs, the $10 billion-asset MAF Bancorp Inc. in Clarendon, Ill., held a promotion in late April that attracted new CD accounts. By the end of June deposits were 6.3% higher than a year earlier.

Christopher Marinac, an analyst with FIG Partners LLC in Atlanta, said many other banks are also turning to CDs because increased competition for checking and savings accounts is forcing them to pay up for transactional deposits.

Transactional deposits are attractive because banks pay little if any interest on them and they generate a large chunk of banks’ fee income, Mr. Marinac said. But “now that rates are going up a bit, banks are finding it’s easier to get CD money,” he said.

Harbor Florida Bancshares Inc. in Fort Pierce is actively promoting CDs again.

President Michael J. Brown Sr. told American Banker last year that, like many other banks in deposit-rich Florida, Harbor was devoting more marketing resources to checking and savings accounts. But now, he said, “if you pay CD-like rates for transactional accounts, you may legally have transactional accounts, but it’s not any different from a CD.”

Harbor Florida, with $1.2 billion of assets, said its midyear CD balances were $74 million higher than a year earlier. That was nearly four times the growth in the preceding 12 months.

Harbor’s transactional deposits rose even more, by $172 million — but that was roughly as much as in the previous 12 months. The company attributed the transactional increase mostly to short-term deposits of disaster-relief funds and insurance proceeds from hurricane damage.

Banks consider CDs much more attractive than Federal Home Loan bank borrowings. Richard D. Weiss, an analyst with Janney Montgomery Scott LLC in Philadelphia, said he has seen many banks get rid of the advances in hopes of replacing them with CDs.

“When rates go up, banks prefer to put out CDs, because rates go up a lot slower than Federal Home Loan bank advances,” he said.

The $848 million-asset Home Federal Bancorp in Columbus, Ind., said in its earnings statement that in June, retail CDs cost significantly less than Federal Home Loan bank borrowings.

Consequently, it said, it planned to chase retail CDs harder in the next two quarters, by offering rates higher than on other retail deposits — but lower than its Home Loan bank charges.