Bankers in this climate recognize that in order to get capital, they often have to give a little something first. Still, offering a 9% annual interest rate for a decade is a cost only a handful of bankers are willing to bear.

Community West Bancshares in Goleta, Calif., is one such bank. It is raising $8 million by offering convertible subordinated debentures to investors to avoid a highly dilutive capital-raising.

As a strategy, "it's the cleanest, most pure and hardest form of capital, if you will. But it's also the one with certainly the most cost to it, at least when stock prices are down," said Jeff Davis, a managing director at Guggenheim Securities LLC. "Like anything in life, there are trade-offs."

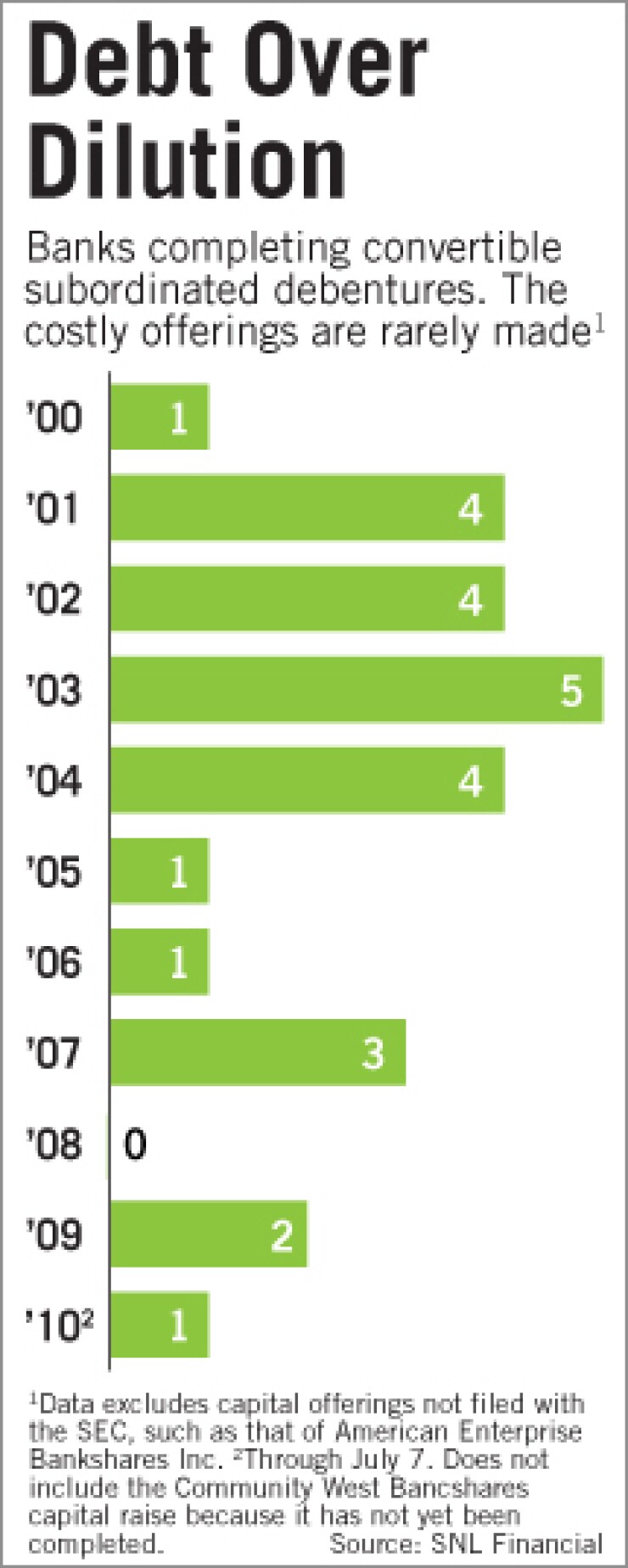

The debt-based approach isn't used much because it's so costly, crimping in turn how much capital can be raised. But it is gaining attention from companies that want to avoid diluting shareholders' stakes.

"I think sometimes people don't think creatively, and they go with the common approach," Lynda Nahra, the president, chief executive and director of the $677 million-asset Community West, said in an interview last week.

The capital-raising effort, scheduled to close on Aug. 8, is intended to fuel organic growth; the bank is considered well-capitalized by regulatory standards.

Rather than fight the crowds seeking capital via the public equity markets, a few smaller bank-holding companies like Community West are taking on debt and downstreaming it as capital to their bank. Holding companies with assets of less than $500 million can take on such debt without having to hold additional capital against it.

Convertible subordinated notes work under the assumption that by the time shareholders convert their holdings into common stock, the company's stock price will be higher than its current price — especially in a down cycle. The other assumption is that the company will become profitable and will be able to pay off all the debt.

Community West, for example, is giving shareholders the option of converting at $3.50 before July 1, 2013, with the price increasing incrementally thereafter. Its shares were trading at $2.72 on July 8. Had the company opted for a common stock offering, Nahra said it would have been quite dilutive to existing shareholders.

Yet because of the cost of this strategy, few are employing it. Columbia Commercial Bancorp in Hillsboro, Ore., has been the only bank holding company to complete a capital-raising effort through convertible subordinated debentures so far this year, according to data provided by SNL Financial LC. The parent company of Columbia Community Bank raised $3 million as a convertible subordinated note in March and downstreamed $2.6 million to its bank as capital in an effort to meet its agreement with regulators to raise its capital levels.

"When times are tough and liquidity is not there, the ability to go out and attract capital is limited," Rick Roby, president and CEO of the $391 million-asset Columbia Commercial, said in an interview.

Indeed, Davis said more small community banks are expected to raise capital in this manner because many need it to pay off their Troubled Asset Relief Program funds.

Still, some banks would rather face the public markets than deal with more costly debt.

"To me, it doesn't pay to issue a coupon instrument that's convertible," said Manny Mehose, chairman of Green Bancorp Inc. in Houston. "It's more costly capital, and if there's a coupon attached to it, it cuts into profitability."

The $536 million-asset parent company of Green Bank earlier this month said it raised $100 million in equity capital through three investor groups to expand its loan operations and pursue bank and branch deals. Mehose, who has helped other community banks with debt-based efforts in his 22 years in the industry, said he did not consider any other way of raising capital this time.

"Our whole strategy was to bring in true partners that would be on board and could raise additional capital in the future," he said.

Convertible notes can still be dilutive, he said, as at some point shareholders will convert to common stock. Yet proponents maintain that this approach is not as dilutive as a common stock offering at current prices.

Using subordinated debentures is also constraining in that a bank cannot typically raise as much. That is why most of the banks that have gone this route recently have raised less than $10 million.

"It's expensive, but it's a bargain in this storm we're going through," said Bennett Brown, president of the $209 million-asset American Enterprise Bank of Florida in Jacksonville.

The parent, American Enterprise Bankshares Inc., raised $6 million in late 2009 through convertible subordinated notes with a 7.5% interest rate. The note matures in its seventh year.

Bennett said nearly all of the capital came from existing shareholders and bank customers.

"[The shareholders] had knowledge of us, they trusted in us and they had liquidity," he said. "We've had investors call us and ask when we're going to offer it again."