-

Business activity in the banking sector improved significantly in September, rising for the fourth consecutive month, according to industry executives surveyed for American Banker's latest Index of Banking Activity.

November 6 -

Business activity in the banking sector increased in August for the third straight month, according to industry executives surveyed for American Banker's latest Index of Banking Activity.

September 28 -

Business activity in the banking sector increased in July for the second straight month, according to industry executives surveyed for American Banker's latest Index of Banking Activity.

August 31

Business activity in the banking sector accelerated slightly in October, rising for the fifth straight month, according to industry executives surveyed for American Banker's latest Index of Banking Activity.

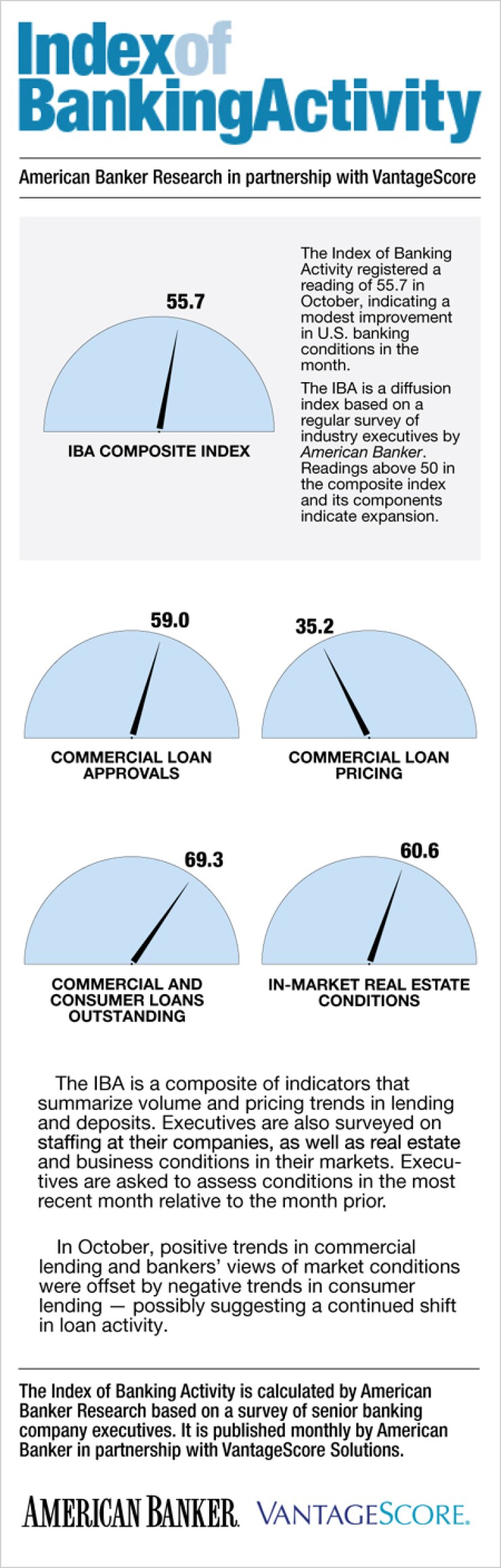

The IBA's October overall reading of 55.7 compared to 55.4 in September. The IBA is a product of American Banker's regular surveys of bank executives and is published in partnership with VantageScore Solutions. The October index was based on 232 responses.

Improved commercial lending activity set the tone for the month. Commercial loan applications appeared to flow into banks at an accelerated pace; October's reading of to 60.1 compared to 52.7 a month earlier. Approvals for those applications had a reading of 59, showing more momentum compared to September's reading of 55.

The IBA is a diffusion index. Readings above 50 in the composite indicate a monthly expansion of activity and readings below 50 point to contraction. (For contrary indicators, such as the components that track loan delinquencies and loan-rejection rates, a reading above 50 is considered evidence of deterioration in business activity.) The further from 50 a reading is, the stronger the indicated change.

The pace of consumer applications cooled slightly, coming in at a reading of 50.3 in October from 50.9 a month earlier. But the reading for approvals rose to 59 from 55 in September.

Credit quality continued to improve, albeit at a slower rate. It is unclear if Hurricane Sandy, which hit the Mid-Atlantic and Northeast hard during the month, influenced the results.

Pricing trends were mixed. Bankers reported better pricing for consumer loans but admitted that rates were lowered on the commercial side, compared to September.

Bankers also took a more positive view of overall business conditions; that reading increased to 58 from 55 a month earlier. The only exception was real estate. The October reading for real estate fell to 60.6 from 61.4 in September.

The composite index is a simple average of readings on a range of indicators based on responses to survey questions on topics that include volume and pricing trends in commercial and consumer lending, loan balances outstanding, and deposit account activity.

Executives are also asked about staffing levels at their institutions, as well as business and real estate conditions in markets where they do business. Every effort is made to make sure that the breakdown of companies included in the executive panel is representative of the industry on a number-of-institution basis.

Values for each component of the index are equal to the percentage of responses indicating increased activity plus one-half of those indicating "no change." Component scores are then averaged to arrive at a composite (when calculating the composite, contrary indicators such as delinquencies are scored inversely — the component figure is subtracted from 100).