-

Companies like OnDeck and Lending Club are under pressure to keep finding new borrowers, but there are signs that customer acquisition costs are rising amid heavier competition.

May 6 -

Like General Motors extending credit to car dealers, Google will use Lending Club to finance resellers, service providers, and consultants in its supply chain while putting to work a portion of the tech giant's cash war chest.

January 26 -

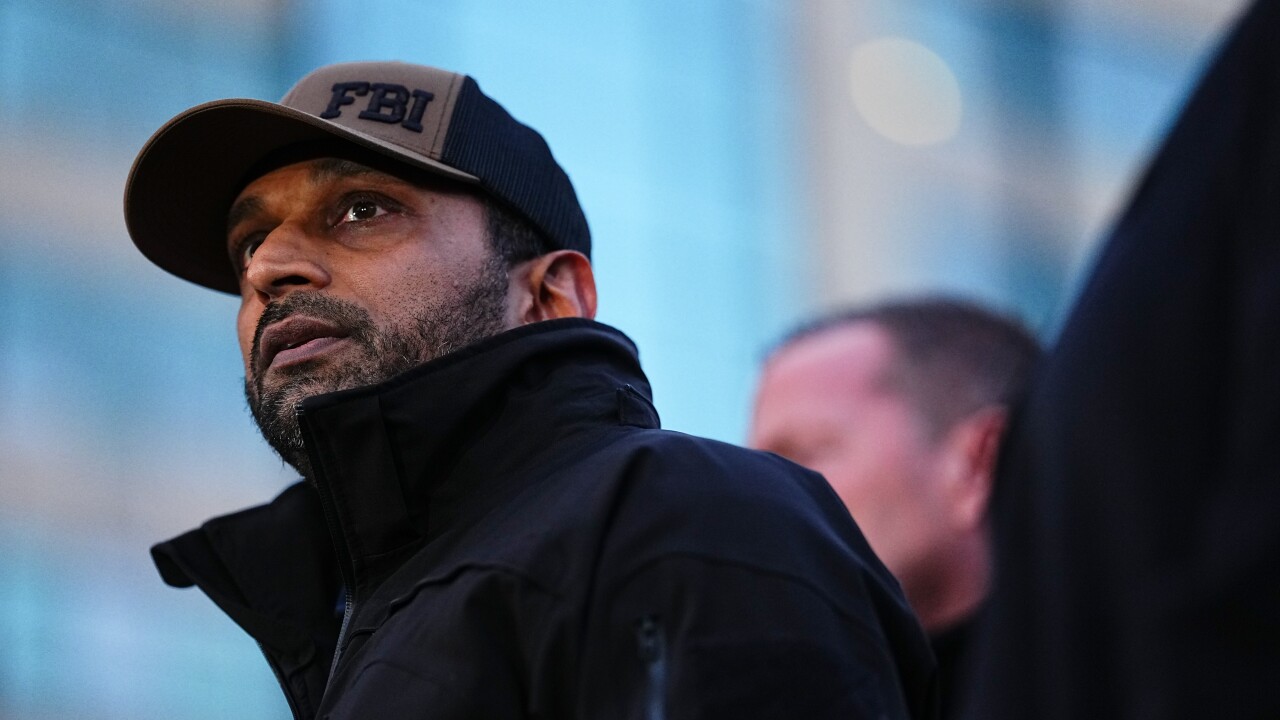

Under Roy Malone's direction, Golden Pacific Bancorp last year introduced an online lending platform that vastly speeds up the approval process for borrowers seeking Small Business Administration loans ranging from $5,000 to $150,000.

June 2

Sam's Club sells the concept of one-stop shopping to small-business owners, who buy everything from office furniture to printer ink at the membership-based retailer. Now they can also shop for a deal on a $300,000 loan.

The Walmart-owned retailer recently launched new partnerships with two online lenders that will allow Sam's Club customers to apply for discounted loans.

The Sam's Club deals highlight how local bank branches are becoming less important as hubs of small-business financing. They also show how online lenders are using partnerships with more established companies to find new borrowers.

Like many other retailers, Sam's Club has long offered a branded credit card to its members. The Sam's Club business card, issued by Synchrony Bank, usually comes with an $8,000-$15,000 credit line.

But under the new partnerships, Sam's Club members are eligible to borrow much bigger amounts. Business loans from Lending Club range from $15,000 to $300,000. Loans from SmartBiz, a division of San Francisco-based Better Finance, range from $5,000 to $350,000. The SmartBiz loans are backed by the Small Business Administration.

[Coming this November:

Borrowers who apply through Sam's Club get a 20% discount on loan fees, compared with what they would pay if they went to lendingclub.com or smartbizloans.com. The speed at which loans can be approved is also part of what both companies are selling to small-business owners. Lending Club states that it can fund loans as quickly as two days after the application is completed, while SmartBiz promises funding in as little as a week.

For the two lenders, which are trying to increase their business lending, Sam's Club offers a new channel for acquiring customers. The loans will be marketed in Sam's Club stores and online.

For Sam's Club, the two deals represent a new way to make the retail chain indispensable in their customers' lives. "So this is really a member benefit, versus us driving sales," said Seong Ohm, a senior vice president at Sam's Club.

Sam's Club already has partnerships with other companies that offer services to small-business owners, such as the legal advice site LegalZoom and the health insurer Aetna.

Small-business loans are another service that Sam's Club is "trying to cross-sell to offer value to their clients," said Ami Kassar, chief executive of MultiFunding, a firm that helps small businesses obtain credit.

But surely the warehouse retail club will not complain if small businesses use their loan proceeds to buy additional inventory from Sam's Club.

Tom Green, vice president of small business at San Francisco-based Lending Club, said that he expects a slightly higher percentage of the Sam's Club loans will be used for inventory financing than is the case with the lender's other small-business loans.

Whatever benefits Sam's Club gets from the two deals, they will not come in the form of direct payments from Lending Club and SmartBiz. Both lenders said that they will not be paying a referral fee to Sam's Club.

Instead, the money that the two lenders are spending on the deals will take the form of discounts to borrowers. On a $100,000 SmartBiz loan, the Sam's Club discount would be $800, said Evan Singer, general manager of SmartBiz.

"Our goal with Sam's Club is to serve their customers, and get as many businesses in SBA loans as we can," he said.

While small-business owners will not be walking into a bank branch to apply for these loans, banks are not cut out of the Sam's Club loans entirely. SmartBiz originates SBA loans on behalf of three banks, including Golden Pacific Bancorp in Sacramento, Calif. And banks are among the investors in loans originated on Lending Club's online platform.

The Sam's Club partnerships are part of a flurry of recent deals in which online small-business lenders are paying one way or the other for referrals from firms that have existing relationships with potential borrowers. Earlier this year, Lending Club announced deals with Google and the Chinese e-commerce giant Alibaba.

The referral deals come as Lending Club and other so-called marketplace lenders