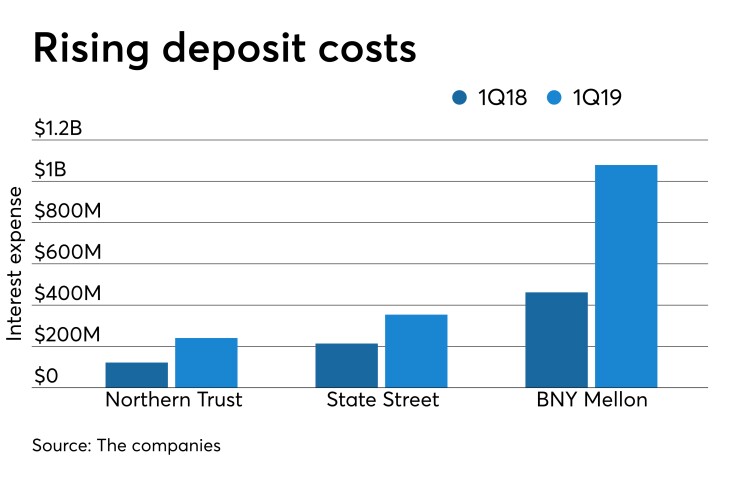

First-quarter results are in for the big custody banks, and one thing was glaring at all three: Deposit costs took a heavy toll.

Even though the Federal Reserve has indicated it will pause on interest rate hikes for the foreseeable future, banks are still seeing increases in funding costs. The main reason is large corporate clients are moving their money into higher-rate products, especially at the custody banks.

State Street and Northern Trust on Tuesday each reported a decline in quarterly profits, and last week Bank of New York Mellon

Custody banks get hit hard by rising rates because they have a high percentage of institutional investors that are very sophisticated about where they park their money, said Marty Mosby, an analyst at Vining Sparks.

“As rates have gotten higher, those institutional money managers are looking for alternative sources for higher yields,” Mosby said.

Earnings at the $250 billion-asset State Street fell 25% from a year earlier to $452 million. The Boston company’s earnings per share of $1.24, which exclude several one-time costs, were 5 cents higher than the mean estimate of analysts compiled by FactSet Research Systems.

While State Street's net interest income rose by 5% to $673 million, interest expense jumped by 65% to $354 million as customers moved money out of zero-rate deposit accounts.

Non-interest-bearing deposits fell 38% to $35 billion, while deposits that pay interest to U.S. customers rose by 14% to $63 billion. Average total deposits declined by 6% to $155 billion. The company's net interest margin was just 1.54% in the first quarter.

“Unpacking our client deposit behavior this quarter, I would note that average total deposits have generally trended lower as our asset manager and asset owner clients are being more discerning,” Eric Aboaf, State Street's chief financial officer, said during a conference call Tuesday to discuss quarterly results.

State Street also reported reduced client activity, including lower revenue from asset servicing and management, and equity markets. That led to a 6% decline in fee revenue to $2.3 billion.

“Our performance this quarter reflects the continued challenging conditions in the industry,” CEO Ronald O’Hanley said in a press release.

Noninterest expense rose by 1% to $2.3 billion, which included $9 million of one-time costs tied to State Street’s

At Northern Trust in Chicago, earnings fell by 9% to $326 million. The $122 billion-asset company’s earnings per share of $1.48 were a penny better than FactSet’s mean estimate.

Northern Trust’s net interest income rose by 10% to to $422 million.

But its interest expense nearly doubled to $241 million. Interest-bearing deposits fell by 4% to $74 billion. Non-interest-bearing deposits declined by 22% to $22 billion.

Biff Bowman, Northern Trust's chief financial officer, cast the issue as one that all banks are confronting.

“That's a trend that we see in our industry amongst our competitors,” Bowman said during his company's quarterly conference call.

However, Bowman noted that about half of the money that left Northern Trust’s non-interest-bearing deposit category in the quarter came from one unnamed client, which he suggested might limit runoff in the second quarter.

Still, the level of competition to retain low-interest or zero-interest deposits remains extremely high, Bowman said.

“We have competitive pricing in the institutional space today, but we have to observe the market,” he said. "Our clients probably are aware of the market pricing. So, we’ll remain competitive. That’s all I can say.”

Noninterest expense increased by 3% to $1 billion on higher salaries and employee benefits as well as fees for technical services. Northern Trust also incurred $12.3 million of severance-related and restructuring charges.

Mosby said he expects the upward pressure on deposit pricing to subside starting in the third quarter, if the Fed continues to avoid rate hikes.