NEW YORK — The digital wave is here, and

Such an attitude could ultimately force those banks to find buyers.

That’s the view of Frank Sorrentino, chairman and CEO of the $5.2 billion-asset ConnectOne Bancorp in Englewood Cliffs, N.J.

Sorrentino, speaking at the American Bankers Association’s annual conference Monday, urged bankers to invest in areas such as cloud computing, digital loan applications and online deposit-gathering, or risk being left behind as customer preferences continue to change.

Asked during a follow-up interview if community banks’ reluctance — or inability — to spend heavily on tech could spur a wave of M&A, Sorrentino, whose

“The bank we bought didn’t feel like they had the infrastructure in place to continue to grow and service their clients,” Sorrentino said, pointing to ConnectOne’s pending purchase of the $520 million-asset Greater Hudson Bank, located just north of New York. “And they have a great client base.”

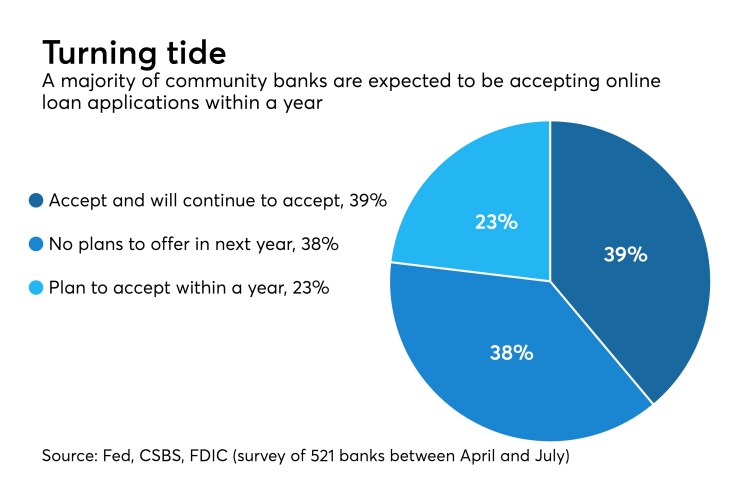

Community banks are warming up to certain online services.

About three-fourths of the 521 community banks surveyed by the Federal Reserve, Conference of Bank Supervisors and Federal Deposit Insurance Corp. plan to offer online loan applications within a year, based on polling that took place between April and July.

But less than a quarter of small banks plan to offer online loan closings or automated loan underwriting within the next year.

ConnectOne expects to complete the Greater Hudson acquisition in January. After that, Sorrentino said he again expects to be an acquirer around New York, where ConnectOne has added branches in Manhattan, Queens and Long Island.

“Being a bigger organization that has the ability to provide that [tech] infrastructure — a lot of which we have in place today, and we will continue to invest in in the future — is dramatic for” Greater Hudson, Sorrentino said in the interview.

Bank consolidation has slowly accelerated in banking in recent years.

The number of banks fell by 9% from 2013 to 2015, to 6,348 institutions, according to the Federal Deposit Insurance Corp. The total fell by another 10.4% between the end of 2015 and mid-2018, to 5,542 banks.

A range of factors go into a decision to sell. The inability of small banks to keep pace with costly tech upgrades, along with the disadvantage that comes when competitors make improvements, is an increasingly important factor, Sorrentino said.

“The small banks are going to have a really tough time,” he said.

Still, many tech upgrades — such as moving core systems to the cloud — are relatively inexpensive compared with the cost of building a new system.

ConnectOne, which focuses primarily on commercial real estate and construction lending, uses Google cloud for its contacts, Oracle for its financial platform, and nCino for its loan operating system.

A key benefit of cloud computing is being able to access systems at all times, even if physical branches or data systems are damaged or unreachable. ConnectOne spent $2.2 million on data processing services in the first half of this year, according to its call report.

ConnectOne’s biggest tech priorities involve digital loan applications and deposit-taking systems, Sorrentino said, pointing to a

Using nCino technology, which runs on Salesforce, ConnectOne will no longer have to ask existing customers for duplicate financial documents such as their tax returns when they apply for new loans or other products, Sorrentino said. The new system should also reduce turnaround times on loan applications.

“That’s a big challenge today, and we’re working hard to root it out,” Sorrentino said.