-

The gap between healthy banks and those that remain in the doldrums will fuel acquisition activity in the coming years, a Virginia investment management firm predicts.

February 8 -

In an improving economy, many of the policies and procedures that were imposed on banks in 2008 have become counterproductive, and are hurting rather than helping the industry.

February 8

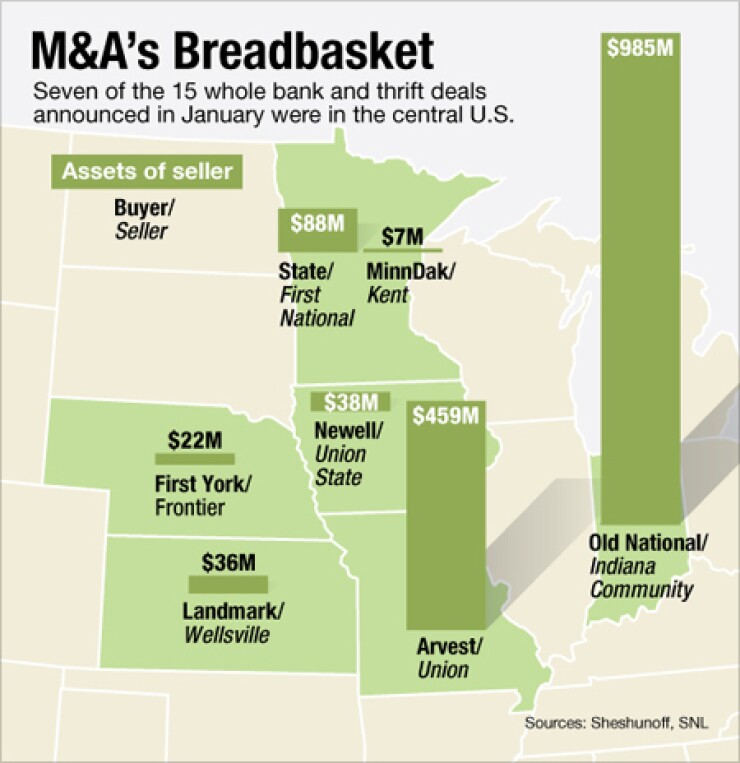

A surge of small-bank deals in the Midwest this year raises the question: Has the much predicted merger wave started building in the heartland?

The answer depends what you think consolidation among the country's 7,400 banks will look like if and when it comes.

If you think it starts with simply more banks changing hands, then the middle of the country could prove to be the source: There have been at least 10 whole bank takeovers and a handful of other branch and business-line sales in 2012 in Indiana, Missouri, Montana, Iowa and Kansas.

But those deals — according to one widely held view — are clearly not the start of the boom Wall Street has been waiting for since at least 2009. The people that run, own and sell major banks tend to say true consolidation will be here when potential buyers opt to sell.

In other words, a frothy M&A market is one in which outfits with buying power instead opt to cash out at a good price.

That is not what is happening in the Midwest or anywhere else right now. Banks with selling potential are being sold at an increasing rate. There were just five small-bank takeovers announced in the Midwest in December and none in November, according to Sheshunoff & Co. and SNL Financial. That compares with at least three so far in February, and seven in January.

The trend developing in the Midwest mimics spurts that have occurred in the Northeast and California for at least six months. Privately held or lightly traded public banks with just a few branches and less than $500 million of assets are selling to banks three or four times their size.

Why is there more activity in the Midwest right now? The simplest explanations would be the economy and regulatory environment. Manufacturing activity and business confidence is rising across the region. But the interest rate outlook is brutal, and overseers are playing hardball with small banks with loan issues and bailout debt.

The relative economic health of the New York-to-Boston corridor enabled

A firming economy seems to be letting healthy Midwestern players act on pent-up merger ambitions through tiny, low-risk purchases in familiar markets. The definition of low-risk varies by target. Some recent Midwestern sellers have good profits and a few bad loans, but are hobbled by a lack of scale and diversity. That would describe the single-branch, 14-employee Bank of Birch Tree in Missouri, which on Feb. 1 agreed to sell itself for an undisclosed amount to Landrum Co. of Columbia, Mo., which has 20 branches and $1.68 billion of assets.

Other sellers are profitable, but not enough to pay back the Troubled Asset Relief Program

Another seller with profit problems and Tarp outstanding was Indiana Community Bancorp of Columbus, Ind., which announced Jan. 25 that it had