Big banks are beating small banks convincingly in the fight for city dwellers’ deposits, but small banks are winning deposit share in rural markets, according to a Bank Policy Institute research note released Wednesday.

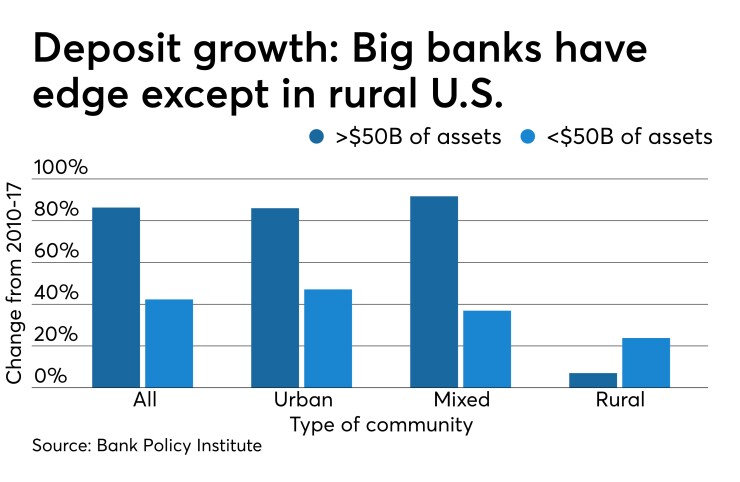

Between 2010 and 2017, banks over $50 billion in assets far outpaced smaller banks in aggregate deposit growth — 86% to 42% — and in urban areas by a similar margin. When it comes to rural communities, however, deposits at smaller banks grew at a faster rate — 24% to 7% for big banks.

The problem for community banks is that rural markets are shrinking and cities are growing. Little disagreement exists about the numbers themselves, but exactly why small banks are falling behind is as sore a subject as ever.

The BPI, a trade group for the 43 largest financial services companies, said

“Because larger banks have more extensive branch networks in urban areas, one would expect those banks to hold a larger share of deposits and experience deposit growth commensurate with population growth in their geographic footprint,” the organization wrote in its report.

Community banking lobbyists dispute that interpretation.

“There’s a lot more nuance to it. We very much have amongst the megabank institutions this concept of ‘too big to fail,’ ” said Rebecca Romero Rainey, president and CEO of the Independent Community Bankers of America. “There is a disproportionate regulatory burden on community banks in this country, and the megabanks continue to benefit from that.”

The fresh numbers, and the heated debate that comes with them, could draw attention to the deposit divide at a time when the economic gap between the two Americas — rural and urban — is a hot issue. They could feed everything from 2020 election campaign rhetoric to in-depth policy debate about big-bank versus small-bank supervision.

To arrive at its conclusions, the BPI analyzed deposit growth in urban, rural and mixed communities between 2010 and 2017 across branches that existed in both those years. It found deposit growth of 88% in urban communities, 70% in mixed communities and 28% in rural communities over that time frame.

It then looked at deposits nationwide at banks over and below $50 billion in assets, as well as where those deposits were concentrated. Larger banks held 70% of deposits nationwide, virtually all of which were in urban and mixed communities.

Smaller banks held the remaining 30% of deposits nationwide, the BPI said. A greater percentage of their own deposits were in urban communities, but they had more rural deposits than big banks did. However, those rural deposits represented only about 2.2% of deposits nationwide.

“Small banks are getting a larger slice of a small and shrinking pie, and a smaller slice of a large and growing pie,” the BPI said of these figures.

The institute concluded that big banks are seeing stronger deposit growth for two primary reasons. First, big banks have invested more money into new products and services, which have helped them attract more customers, especially millennials.

Several of those bigger banks have developed their own online banking brands, in a bid to boost deposits from rate-sensitive and tech-savvy consumers. Citizens Financial, for example,

The second reason is simple demographics, the BPI said. More new jobs have been created in the 20 largest markets in the U.S., and almost half the total population growth has occurred in those areas as well. Big banks have benefited from those trends simply by virtue of being in those markets.

“There’s a really simple explanation why we are observing stronger growth at large banks, and that’s driven by technology and demographics,” said Francisco Covas, head of research at the institute and co-author of the note.

Don Musso, president and CEO of the consulting firm FinPro in New Jersey, said there is a little more to it than that. He said that bigger banks have been paying more for deposits in recent years.

That trend is reflected in Federal Deposit Insurance Corp. data on the cost of funding earning assets. At banks with more than $50 billion of assets, the cost of funds more than doubled from 2014 to 2018 to 91 basis points. It rose just 60% to 75 basis points at banks with assets below $50 billion during that same period.

Also, Musso said, it’s typically larger institutions that partner with universities, thus increasing their reach to younger consumers.

Musso, who works with community banks, also said that smaller banks have an advantage when it comes to smaller communities.

“Community banks win on relationship,” he said. They "cannot go toe-to-toe with the big banks on delivery channels. ... In a rural area, relationship plays really well.”

He said that community banks undertaking efforts in customer segmentation and social media outreach are doing reasonably well with deposit gathering. But he said that community banks have to be willing to adapt to the current environment, adding, “Business as usual is not going to make it.”

Business strategies aside, many community bankers says it all comes down to a choice: Does a banking company, regardless of size, have a clear sense of its community and stay loyal to it?

Timothy K. Zimmerman, CEO at Standard AVB Financial Corp. in Monroeville, Pa., near Pittsburgh, said his $972 million-asset company is doing just fine competing against big banks for urban deposits.

Zimmerman, who just finished serving as chairman of the ICBA, added that community banks have not abandoned small towns and rural communities the way money center banks have, which may account for the disparity in deposit growth.

"If big banks have changed their mix because they've concentrated in urban areas, that's a decision they've made," Zimmerman said Wednesday at a small-bank conference in Nashville, Tenn. "I'm proud that community banks haven't pulled out of these markets."

John Reosti contributed to this article.