Since the launch of the Sapphire Reserve credit card two years ago, JPMorgan Chase has tapped into millennials’ obsession with rewards, offering big bonuses for affluent customers willing to pay a $450 annual fee.

The company on Thursday officially unveiled a product aimed at turning those well-heeled credit card customers into depositors, unveiling a premier checking account under the Sapphire Reserve brand that comes with a 60,000-point bonus.

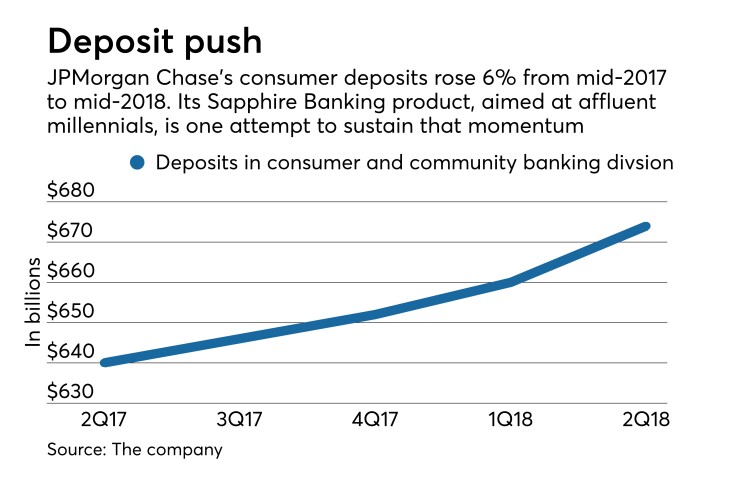

For JPMorgan, the announcement illustrates one of the targeted ways the company — the industry’s biggest by assets — is looking to expand. Like other megabanks, JPMorgan is prohibited from buying another bank due to its size and deposit market share. Plus, there are few corners of banking and finance where the $2.6 trillion-asset company does not already have a presence.

So growing, instead, involves finding “granular and surgical” ways to increase market share and attract lucrative clients, according to Chief Financial Officer Marianne Lake.

“Sapphire Banking is a really good example of that,” Lake said, speaking at an investor conference Thursday in New York.

Under the new Sapphire banking account, customers are required to keep a minimum of $75,000 in qualifying deposits or investments. In return, they pay no fees on ATMs, wire transfers or other banking services. They also receive a series of special benefits for concerts and sporting events, early ticket sales, access to Sapphire lounges and premium seating.

“The opportunity is about creating better interoperability across businesses, across the products and across the channels,” she said. While it remains to be seen how many customers open Sapphire bank accounts, “it’s very important for us because we’ve taken this amazing cohort of customers that we’ve talked about a lot, and we’re going to be deepening relationships with them.”

During the conference, which was sponsored by Barclays, Lake also discussed the company’s updated projections for its 2018 results.

Notably, she said that net interest income is expected to be about $55.5 billion this year, an increase from the company’s previous expectation of between $54 billion and $55 billion.

A big reason for the increase is that deposit rates have not increased by as much as JPMorgan had anticipated. While customers will start demanding higher deposit rates down the road, rates are just a slice of what they look for in choosing a primary bank, Lake said.

“I do think that prices are only going to be one part.” she said. “If you are someone who believes that the value proposition in totality of being a Sapphire Banking customer is really good for you, then price will be important, but so will all the other things that are adding value to you.”

Additionally, Lake said that fees, which were expected to increase by 7% from a year earlier, will likely coming in “a percentage point higher” thanks to commercial and investment banking fees year to date.

Expenses, meanwhile, are also expected to increase slightly, to $63.5 billion, thanks to costs associated with transactions, brokerage clearing and performance incentives.