Epidemiology is the study of a population's health and well-being and its models are used to forecast the progress of epidemics moving through a large population. Recasting a standard epidemiological model for community banking, we can forecast the segment's mortality rate over the next 10 years as small banks succumb to the effects of changes in demographics and consumer appetites for technology, as well as industry- and institution-specific "diseases."

In the past 20 years, community banks have lost most of their consumer loan volume to credit unions and finance companies. Fee income and commercial loans have kept these banks afloat but opt-in overdraft regulations combined with large writeoffs of CRE loans undermine the last profitable business lines of most small institutions.

These banks are also overwhelmed by the changing architecture of financial services as customers demand more channels of access (social media, mobile) and banks seek the bandwidth, budget and C-level support for these touch points. The reliance of banks on overdraft fee income has also driven many working-class accountholders out of the bank and into huge retailers like Wal-Mart and Kroger that offer lower-cost alternatives to checking accounts. These unbanked and underbanked Americans won't come back.

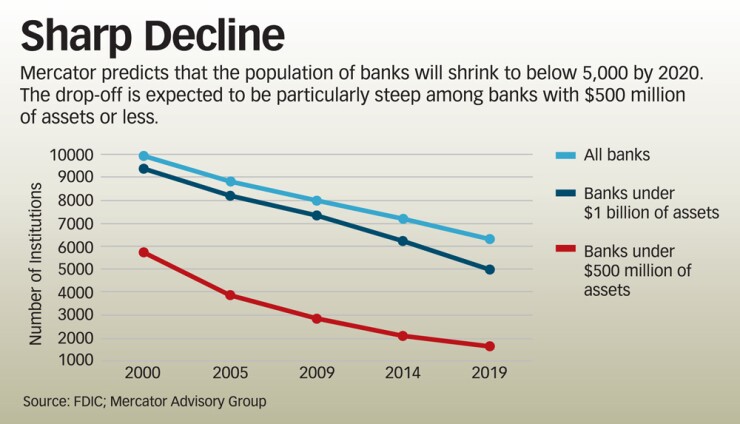

Forecasting the impact of these disease agents on community banks, we conclude that by 2020 the number of banks with $1 billion of assets or less will shrink nearly one-third and the number with assets of $500 million or less will drop 58 percent. At that rate of attrition, only 5,000 community banks will be left standing, and the loss of about 2,400 community banks will have enormous implications for small towns—particularly agricultural communities that rely on local banks. And as community banks vanish and their customers roll up to large regional and national banks, vendors to the industry will encounter rising cost of sales as they begin to compete for the business of fewer banks.

Surviving and even thriving in the midst of this epidemic will require smaller banks and their vendors to focus singularly on targeted responses to these agents of transformation.

It's not too late, but 2021 will be here before you know it.