Las Vegas' reputation as a community banking desert may be about to change.

The housing crisis of a decade ago hit the tourism mecca's construction-fueled economy very hard, along with its banks, which had loaded up on land acquisition and development loans.

A dozen Nevada banks failed from 2008 to 2013, with eight of those in the Las Vegas area. Nevada lost more than half of its state-chartered depository institutions during the crisis years — the highest percentage in the country, said George Burns, the state’s commissioner of financial institutions.

Those that survived suffered losses and shed assets. The city currently isn’t the headquarters to any independent, publicly traded banks.

But the area’s economy appears to be more diversified now and on the upswing. Community bankers say they are hopeful about new lending opportunities — and of their potential to snag market share from larger rivals that dominate the market.

Las Vegas "was the poster child for everything that was wrong prior to the Great Recession,” said John Miller, who is part of an investor group that is seeking regulatory permission to open Sterling Bank.

“I think we got unfortunately categorized as a high-risk environment," says Miller, who would be CEO of the de novo. "There is a strengthening that has taken place.”

That strengthening, he and others say, comes from changes made by civic and business officials — and at banks themselves.

Economic rebuild

Before the financial crisis, real estate values soared in Las Vegas in part because of the booming construction industry, said John Guedry, CEO of Bank of Nevada, which is part of Western Alliance Bancorp. But these hyperinflated housing prices were not sustainable and once the housing meltdown struck, the market collapsed. The city lost 190,000 construction jobs, or more than 14% of its total employment base, Guedry said.

About six years ago, with the state still lagging the rest of the nation in terms of its recovery, the Nevada government developed a plan with its regional economic agencies and the Brookings Institution to diversify away from its heavy reliance on gaming and tourism. It also looked at how it to leverage assets that it has in areas like renewable energy and minerals, Guedry said.

This led Nevada to push for more universities to open up medical schools to address the state’s shortage of doctors, as an example of one change, Guedry said. The state’s rich deposits of lithium, an important component of batteries, helped lure the electric car company Tesla to open a plant in Nevada, as well.

The city recently got a professional hockey team, the Vegas Golden Knights, and the Oakland Raiders pro football team plans on relocating there as well.

Yet the complete transformation is likely to take at least a generation, Guedry said. Las Vegas' unemployment still tops 5%, according to the Bureau of Labor Statistics in October. Nationally that number was 4.1%.

“Most people have a view of Las Vegas that you either work in a casino or you are a dancer,” Guedry said. “But it is like any other community. There is a community of 2.5 million people with churches and schools and businesses. We are on the precipice of being a community that people no longer relocate to but are where people are actually from.”

New banking approach

Meanwhile, Nevada bankers have turned to “robust underwriting standards while making loans to the most creditworthy” customers, which is reflected in some of the lowest past due rates in the nation, Burns said.

Concentrations in commercial real estate remain far below pre-crisis levels, and for the last 18 months or so, the state’s banks have all been stable with satisfactory regulatory ratings and no enforcement orders, Burns said.

“We are positioned for expansion, but not the Wild West expansion prior to 2008,” Burns said. “The thing with Nevada, and particularly Las Vegas, was it had never faced a major downturn before.”

Given this diversification and the improving economics, bankers are optimistic about their lending opportunities. Commercial real estate lending for small businesses, including Small Business Administration owner-occupied loans, along with retail and industrial are doing better, said James York, president and CEO of the $104 million-asset Valley Bank of Nevada in North Las Vegas.

There is also more demand for commercial and industrial lending, including fixed-asset and equipment purchases, tenant improvements and account receivable financing, York said. Recent tax reform that allows businesses to accelerate the depreciation expense of their equipment is “adding fuel to the fire,” he said.

“As a banker that has helped see our bank through the greatest recession our generation will most likely know, I am changed forever,” York said. “Las Vegas has been an economic greenhouse of learning for bankers and businesses. We are interested in growing at a slower and more sustainable rate and have a long term outlook for ourselves and our clients.”

Taking on the big guys

Small banks face big challenges ahead.

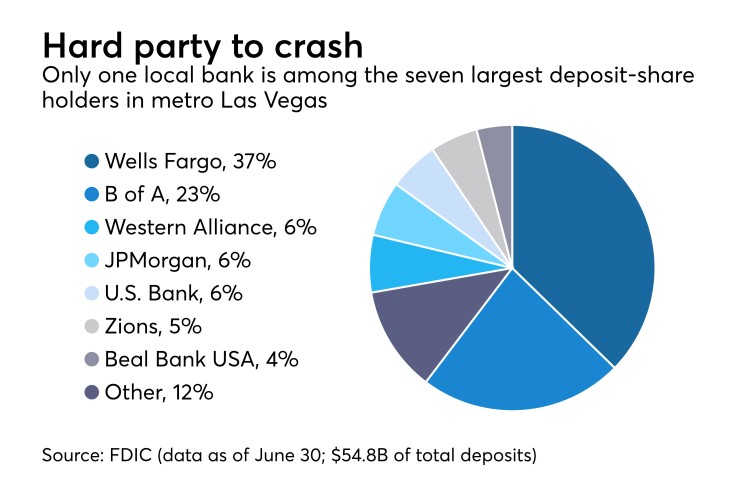

Much of the state’s deposits are concentrated within the hands of money center and large regional banks. Only one independently owned bank headquartered in Nevada is in the top 10 in terms of deposit market share in Las Vegas, according to Federal Deposit Insurance Corp. data from June 30. In contrast, seven out the top 10 deposit holders in Kansas City, which has a similar population size as Las Vegas, are community banks.

“Community banks have always had a niche in being able to meet the needs of small businesses and Main Street businesses that are sometimes overlooked by the large institutions,” said James Swanson, president and CEO of Bank Strategies, a consulting firm. “That opportunity still exists, and there are fewer community banks than there used to be.”

The team behind Sterling sees the high level of concentration as more of an opportunity rather than an obstacle, Miller said. The proposed bank will focus on commercial customers, particularly small businesses, while emphasizing that lending decisions will be made locally. That should allow them to operate efficiently and quickly for clients, Miller said.

If Sterling is successful, it would be the second de novo approved in Nevada since 2011. Charles Schwab Trust Bank’s application was also approved in December. Overall, there has been a recent uptick in proposed de novos nationally, though activity still remains far below the levels prior to the financial crisis. Regulators are focusing on ensuring that new banks have the proper expertise at the board and management levels, said Burns, who noted that before the financial crisis some banks were allowed to start where the CEO’s prior experience was being a branch manager.

“Regulators are cognizant of the lessons from the Great Recession,” said Walter Mix III, managing director and financial series practice group leader at Berkeley Research Group and the former California banking commissioner. “That includes proper governance and risk management. De novo banks will definitely need to have well-qualified management and boards and have the proper capital to execute on their business plan.”

Local bankers seem to have mixed reactions to the prospect of another bank in their city. Sterling would be another competitor, but an OK by regulators would show how far Las Vegas has come from the depths of the crisis.

“Do we need a new bank? As an existing bank, I might say no,” said Arvind Menon, president and CEO of the $773 million-asset Meadows Bank. “I don’t want more competition. But in the heyday, we had a lot more community banks so it doesn’t hurt to have another bank open up.”