-

The agency's Semiannual Risk Perspective pinpointed compliance and operational risk as potential problems for big banks while it outlined a different set of challenges for midsize and community banks.

June 30 -

More than half of borrowers with home equity lines of credit that will reset this year have seriously underwater properties, and that risk is likely to grow further next year.

March 5 -

Capital One, Discover and American Express all boosted their loss provisions in the third quarter. But there are also reasons to think the credit environment remains relatively benign.

October 24

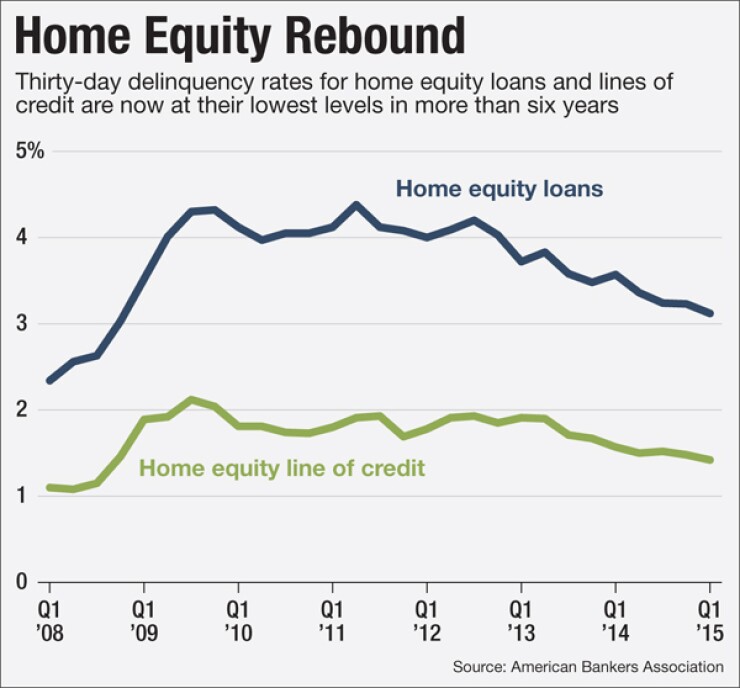

Late payments on home equity credit lines hit their lowest level in more than six years, defying warnings about the looming aftershocks of loose bubble-era lending standards.

The percentage of borrowers who were at least 30 days delinquent on a home equity line of credit dipped to 1.42% in the first quarter, its lowest mark since the third quarter of 2008, according to new data from the American Bankers Association.

The late-payment rate for closed-end home equity loans also fell to its lowest level since the financial crisis.

The ABA chalked up the improvements to rising incomes and rebounding home prices.

"As property values improve, fewer people have negative equity in their homes," ABA Chief Economist James Chessen said in a press release. "Greater household wealth and income gives consumers more breathing room to meet their financial obligations."

In recent months, analysts and regulators have been voicing concern about the coming impact of a wave of interest rate hikes for home equity lines of credit that were originated before the financial crisis.

Many of those loans featured 10 years of interest-only payments, after which borrowers are on the hook for larger amounts. The loans were based on the value of people's homes at the time they were originated, and in many cases, home values remain lower today than they were a decade ago.

Last month, the Office of the Comptroller of the Currency, in its twice-yearly report on risk in the banking system,

And in a March report, RealtyTrac found that 56% of the home equity credit lines potentially resetting to fully amortizing monthly payments between 2015 and 2018 are seriously underwater, meaning that the home owner's total mortgage obligations are at least 25% higher than the property's value.

Daren Blomquist, a RealtyTrac vice president, said Wednesday that the falling delinquency rate likely reflects the fact that both homeowners and banks have been taking steps to head off trouble. Those moves may include loan modifications and short sales.

Still, Blomquist cautioned that a rise in delinquency rates is likely still on the horizon.

"I would expect at least some uptick," he said. "The worst year for this is really 2016. You have the highest number of resetting HELOCs in that year, as well as the higher percentage of them that are underwater."

Overall, the ABA's quarterly report on consumer loans was a mixed bag.

The 30-day late payment rate for bank-issued credit card loans fell slightly from 2.52% in the fourth quarter of last year to 2.49%.

Delinquency rates on personal loans and so-called indirect auto loans, which are arranged at car dealers, both ticked up during the first quarter.

Also Wednesday, the Federal Reserve Board announced that U.S. consumer credit outstanding rose by a seasonally adjusted annual rate of 5.7% in May. That was down slightly from a 7.6% annualized growth rate in April, but roughly in line with the first-quarter trend.