-

First Mariner Bancorp has warned investors that it is in danger of failing.

March 30 -

Beneficial Mutual Bancorp gained a 25% stake in Liberty Bell Bank after its former chairman Michael Kwasnik defaulted on a loan. Kwasnik had used the stake in recent years to stymie Liberty Bell while trying to take over the bank.

March 22 -

Republic Bancorp and the FDIC seemed to have put last year's legal tussle to rest after reaching an agreement to transfer ownership of Tennessee Commerce Bank.

January 30 -

With its future in doubt, the company hires investment banks to help it explore its options.

November 1

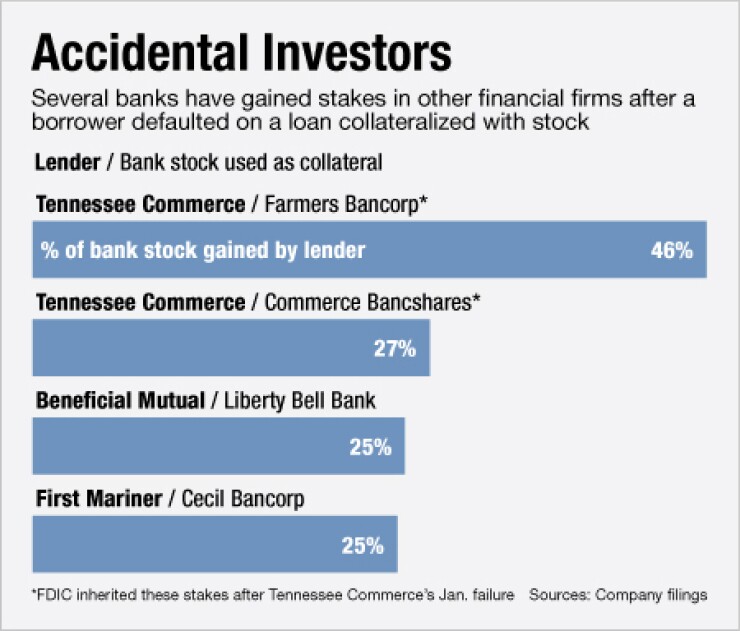

A number of banking companies are becoming accidental investors in other financial firms.

First Mariner Bancorp in Baltimore inherited about 1.9 million shares in Cecil Bancorp last month after a borrower defaulted on a loan that used the stock as collateral.

First Mariner now must figure out what to do with the 24.9% stake in its Elkton, Md., rival, even as it

"It looks like these guys have sadly stepped in every cow pie in the pasture," says Kip Weissman, a partner at Luse Gorman Pomerenk & Schick. "It's a tough way to go, but First Mariner took the collateral and deeply needs it to be worth something."

Executives at First Mariner would not comment, though the company is not alone in wondering what to do with stock it had no intention of ever owning.

Banks often made loans to individuals, who in turn pledged stock as collateral. The practice gained little notice until lenders felt the sting of rising defaults and plunging valuations for the stocks. The one-two punch has left lenders perplexed on how to unload assets that might be as hard to sell as foreclosed real estate.

Even the Federal Deposit Insurance Corp. faces this dilemma. In January, the agency gained large stakes in two banks after the failure of original creditor Tennessee Commerce. Republic Bancorp, which

A spokesman for the FDIC was not immediately available for comment.

As defaults continue, more banks run the risk of new ownership or new regulation on debt-to-equity collections.

"There's an incredible amount of loans secured by bank securities ... but it raises all sorts of challenges" especially if a lender fails, says Lawrence Kaplan, a lawyer at Paul Hastings. "At the end of day if this comes up more and more, you could see some regulatory guidance come out."

First Mariner isn't the only bank looking to sell holdings in another bank. In March, Beneficial Mutual Bancorp in Philadelphia

Lower stock valuations and numerous rules on stock ownerships have limited the number of interested, qualified buyers.

"It's tricky because you need the financial resources to do this and no one out there is ready to write the check," Weissman says. "The [stock] could be worth something, but a purely contingent asset is not going to get you anything for years."

In the case of Cecil, the company's shares have stayed below $1 each since late October, closing at 65 cents on Tuesday. That may be insufficient to cover what the borrower owed on the loan, industry observers say.

"I suspect [First Mariner] is going to have to take a loss on it if they have not already taken it," says Chip MacDonald, a partner at Jones Day in Atlanta.

There are other challenges for the new owners. Once shares are sold, they are no longer considered a previously contracted debt. For instance, any investor with more than 24.9% of a company's voting shares must be an approved bank holding company, limiting the number of private investors that could buy the entire block of stock.

Kaplan adds that private equity firms typically want controlling stakes, which limits the options for banks like First Mariner that would try to sell a smaller stake.

Weissman says bank stocks once held as collateral would be more liquid if they were broken up and sold as less than 10% stakes. That could still become a challenge for struggling banks like First Mariner.

"It's a complex puzzle where it's going to take some time to unwind and the [Federal Reserve] will be intimately involved" along with the FDIC should First Mariner fail, he says. "They do not want to have one bank's fortunes based on another bank's stock price."

First Mariner has a pending agreement with New York hedge fund Priam Capital I that is contingent on the company raising $124 million. In March, First Mariner said in its annual report that it has no more capital for its bank and that it is "unknown" if Priam remains committed.

Due to

The FDIC is trying to sell the stakes. The two banks could also attempt a recapitalization to help unwind the FDIC's shares but that would also require extensive approval with the FDIC. In such a case, the banking companies essentially "have to vote to dilute themselves," he says.

Because of current market challenges, lawyers says it is likely that the FDIC will give First Mariner more time to unload the Cecil shares to a third party. The Cecil shares could be the best protection for First Mariner "because the FDIC does not want to deal with selling the shares," Kaplan says.