Lenders who successfully lobbied for more time to make Paycheck Protection Program loans now want more money to be made available for the program.

Though the PPP’s expiration date was

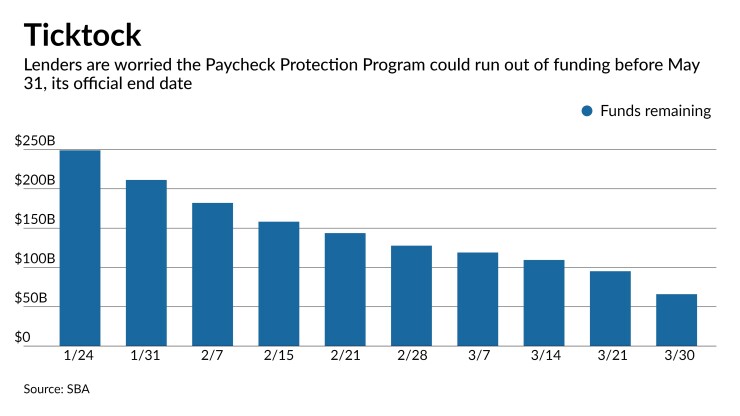

The amount of available funds could drop substantially if thousands of applications stalled by error codes make their way through the Small Business Administration’s portal. And a number of banks that stopped making PPP loans resumed operations when the extension was passed.

The government “will disappoint a lot of people if it is unable to get its act together in terms of getting the money in play,” Biz2Credit CEO Rohit Arora said.

“If there’s enough demand to exhaust funding, there’s a very good argument to top it off,” said John Asbury, president and CEO of the $19.6 billion-asset Atlantic Union Bankshares in Richmond, Va.

The Biden administration’s decision to let sole proprietors, independent contractors and other small-scale entrepreneurs

“We’re seeing our pace increase” because of the administration’s change, said

“We’ve had the two biggest weeks we’ve had so far the last two weeks, over 20,000 loans,” Sidhu added. “We would expect this week to be just as big, if not bigger. The volume of loans has kicked up because people are coming off the sidelines.”

The PPP was designed to offer forgivable loans of up to $10 million to small businesses with 500 or fewer employees. Because loan amounts were derived initially using a borrower’s pre-pandemic profit, the smallest firms, which typically operate on thinner margins, were effectively shut out during the first phase, which lasted from April 3 to Aug. 8.

The SBA approved 5.2 million loans totaling $525 billion in the first phase, for an average loan size of $101,000. Congress authorized $284 billion in funding when the PPP was

To limit instances of fraud, Biz2Credit, the biggest PPP lender by total loans made in the current phase, has been encouraging small businesses to work with accountants to get their affairs in order before applying.

Arora said he is worried that funding could be exhausted out before many applicants with “genuine paperwork” are in a position to seek SBA approval. “My concern is by the time they’re ready, the money will have already run out,” he said.

Atlantic Union, one of many banks that stopped making PPP loans when the sunset date was looming, had a dozen applications come in immediately after reopening its portal late Tuesday.

“To see that we already had applications coming in means people were checking the website and pinging any bookmarked links they might have had,” said Alison Holt-Fuller, Atlantic Union’s head of product and enterprise first line risk management.

With an extension in place, Atlantic Union intends to keep processing applications until the program closes or funds run out.

“It’s a very popular program,” Asbury said. “There’s a lot of popular support for it.”

While bankers are starting to discuss increased funding, Sidhu said, interest from lawmakers has been tepid.

“We’re hearing that no one is talking about topping off,” Sidhu said. “But we’re not going to give up.”