-

First Scottsdale Bank (FSB) in Scottsdale, Ariz., and CBOA Financial (CBOF) in Tucson, Ariz., have terminated plans to merge.

October 25 -

First Scottsdale Bank had $80 million in assets, but then it agreed to buy a $224 million-asset competitor and outbid five others to acquire a $45 million-asset bank from the FDIC.

April 22 -

First Scottsdale Bank in Arizona is buying a larger lender in Tucson, the Phoenix Business Journal reported Tuesday.

February 26 -

Oxford Bank in Michigan has terminated its planned sale to Level One Bancorp due to regulatory delays and an improvement in Oxford's financial condition.

May 31

First Scottsdale Bank in Arizona is taking some time to be a bank that makes loans, rather than a bank that makes acquisitions.

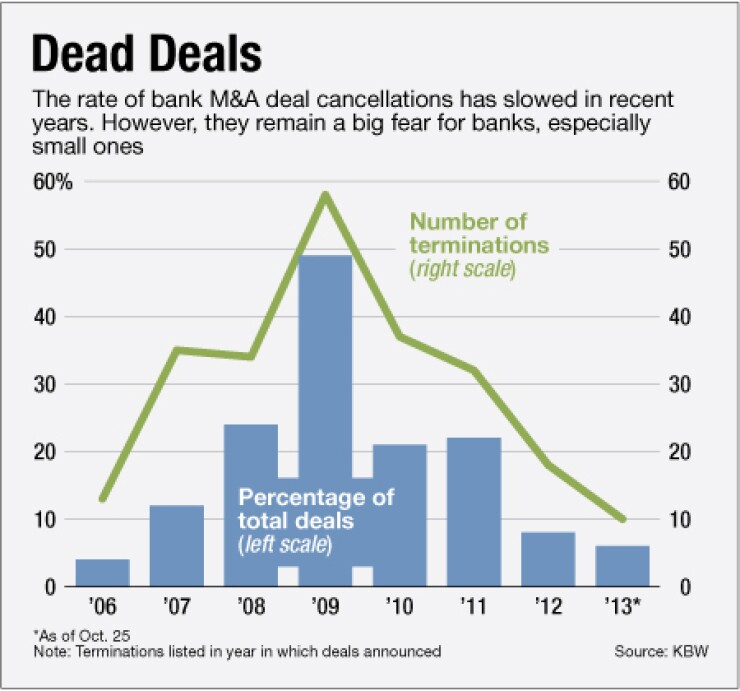

It's a decision more small banks may imitate once they realize how expensive and complicated consolidation really is.

The $119 million-asset bank announced last week the

First Scottsdale had raised $11.5 million to do the deal, which was

"We need to sit for six months and do organic growth," Vogel says. "Acquisitions cost a lot of money in investment banking and attorney fees, and you have your whole team involved with due diligence and it takes them out of play. They can't be out booking loans, so that is what we are going to do for now."

Vogel's comments demonstrate a conundrum facing small banks. Pressure is mounting on them to get larger. Most have seen that as a reason to sell themselves to larger banks. Of course, there are those like Vogel who would rather be the buyer.

Dealmaking has always been tough for small banks, advisors say, because the costs and time associated with buying a bank are burdensome. In the current environment, where asset quality and regulatory scrutiny add difficulty to any deal, the process is exhausting.

"The odds are against small banks," says Charles Crowley, a managing director at the investment banking firm Boenning & Scattergood. "They have capital constraints and often have to raise additional capital. That makes it harder because most sellers frown on those kinds of financing contingencies."

Crowley was unfamiliar with the deal between First Scottsdale and CBOA but said "if you do announce a transaction and it falls apart, the amount of time and money spent is material and probably leaves a bad taste in your mouth."

First Scottsdale was designed to be a consolidator. Vogel and his team acquired First National Scottsdale Bank from a struggling Kansas company in 2010 and has been eyeing acquisitions since then. Besides the CBOA deal, the bank acquired the failed $45 million-asset Gold Canyon Bank in Arizona from the Federal Deposit Insurance Corp. earlier this year.

Vogel, who previously served as Arizona market president for BBVA Compass Bancshares, isn't ruling out deals entirely.

"There is one on the radar screen, but they are a patient player," he says. "We've got the team. We built Compass' operations from zero to a billion [in assets]. We know how to run a multibillion-dollar company, so acquisitions are never going to be totally out of the picture."

Vogel says the loan environment in Arizona is improving, too, making it a good time to focus on bringing in borrowers.

"The fourth quarter should be strong," he says. "We will see some loan growth. We have $11 million or $12 million in the pipeline."

The improving market is what emboldened CBOA to try to stay independent, says John S. Lewis, CBOA's chief executive. The bank's nonperforming assets made up 5.6% of its total assets at the end of the second quarter, but Lewis says the company senses improvements in the economy and its customers' well-being.

"The deal had gone on a long time," Lewis says. "But there was a renewed energy on our team to go it on our own."

CBOA will look to raise an unspecified amount of additional capital to help it comply with a regulatory order, Lewis says. He expects it to be done in two phases, with the first around the beginning of the year.

Both sides are keeping their options with each other open.

"They did an outstanding job on their side. This was an issue of deal fatigue," Lewis says. "It would have been a nice merged bank with a good market presence in Tucson and Scottsdale. There might be more of an opportunity down the road."