M&T Bank reported strong commercial loan growth in the first quarter, but the Buffalo, N.Y., bank is struggling a bit to attract enough deposits to meet its growing loan demand.

Total deposits at the $120 billion-asset M&T declined 1% in the first quarter from a year earlier, to $90.5 billion, driven by a 6% decline in non-interest-bearing deposits. At the same time, loans increased 1% and would have climbed much higher had the company not been intentionally shrinking its residential mortgage portfolio.

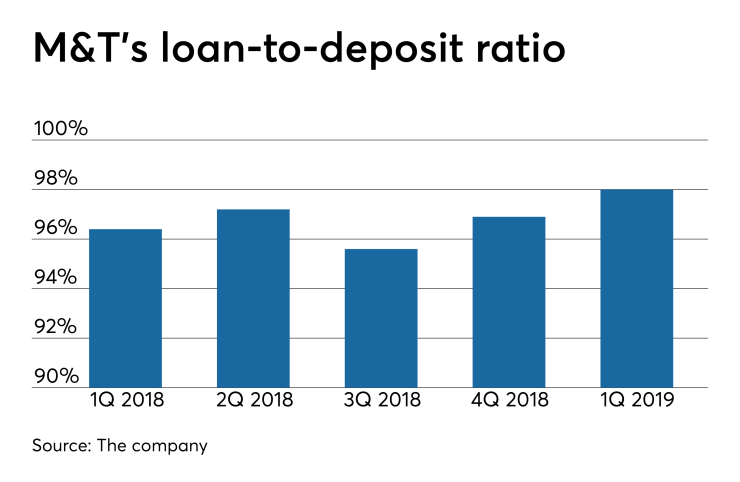

The net result is that the bank’s loan-to-deposit ratio stood at 98% at March 31, up from 96.4% a year earlier, an increase that prompted some analysts to question if the deposit growth can keep pace with loan growth going forward.

“Are you guys comfortable letting that [ratio] go above 100%?” Peter Winter, an analyst at Wedbush Securities, asked M&T executives on the bank’s quarterly earnings call Monday.

“We would be comfortable with the loan-to-deposit ratio going over 100% for a quarter, maybe even two or three,” said Chief Financial Officer Darren King. “We don’t choose to run at the kind of levels we were at before the crisis” — when the ratio was often well above 100%. “But as we look at the balance sheet and go quarter to quarter, we definitely have enough liquidity to fund loan growth.”

King did not lay out a plan or outlook for deposit growth during the bank’s quarterly earnings call on Monday, but he characterized its deposit story as “more of a remixing than a real decrease.”

While overall deposits declined slightly, that was driven by a 6% drop in non-interest-bearing deposits from the year-ago quarter. King said this happened because more customers moved money out of non-interest-bearing accounts and into other types of accounts, like one- and two-year certificates of deposit. Over that same time, M&T’s interest expense increased 65% to $176.2 million, reflecting higher deposit costs.

While some analysts expressed concern about the decline in deposits, others said it’s not uncommon for demand deposits in particular to decline in the first quarter before rebounding in subsequent quarters. PNC Financial Services Group saw a similar decline in non-interest-bearing deposits when it reported earnings Friday.

“You never like to explain to an investor why deposits are going down, but it’s going to happen to every bank this quarter,” said Brian Klock, an analyst with Keefe, Bruyette & Woods.

Commercial lending drove total loan growth of 1% in the first quarter. Commercial and industrial loans rose 6% year over year to $23.1 billion, and commercial real estate loans rose 3% to $34.7 billion. Home mortgages fell 12% to $16.8 billion, while other consumer loans rose 6% to $14.1 billion.

M&T is projecting overall loans to grow at a low single-digit rate through the rest of 2019. King said that growth in commercial loans and other consumer loans should offset the residential mortgages that M&T has been running off since it acquired Hudson City Bancorp in 2015.

Credit quality remained strong as well in the quarter. M&T lowered its provision for credit losses by 49% year over year, to $22 million, as net charge-offs declined 45%. Loans placed on nonaccrual status increased 2% to $882 million, representing 0.99% of total loans, the same as last year.

King also commented that while competition for commercial loans is still intense, M&T did see less competition from nonbank lenders in the first quarter.

“In terms of pricing and or structure there hasn't been a notable move this quarter compared to what we would have seen over the course of last year,” he said.

Net income rose 37% from last year to $483 million. Its earnings per share of $3.35 were 5 cents higher than the mean estimate of analysts surveyed by Fact Set Research Systems.

Net interest income increased 8% to $1.06 billion, and the net interest margin expanded by 12 basis points to 4.04%.

Noninterest income rose 9% to $501 million, boosted partly by a 9% increase in mortgage banking revenues, which totaled $95 million.

Noninterest expenses declined 4% to $894 million.