Mergers and acquisitions volume remains subdued and failures have tapered, but activity since the middle of last year has still been sufficient to rearrange many markets across the country.

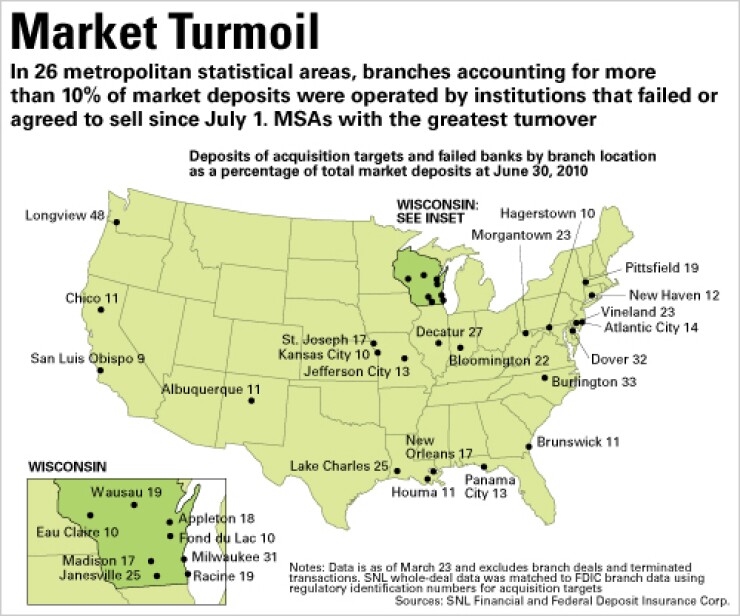

In 26 metropolitan statistical areas, branches accounting for more than 10% of market deposits were operated by institutions that agreed to sell or failed since July 1 (see map). The figure was at least 5% for another 32 MSAs. (The analysis here was constructed by linking regulatory branch data to a list of whole deals provided by SNL Financial and Federal Deposit Insurance Corp. records on bank failures. Branch deals were not considered.)

Being the locus of heavy turnover does not necessarily mean buyers are zeroing in on a particular market.

About half the deposits in the Longview, Wash., MSA changed hands when Cowlitz Bank, which had been the market's largest institution, failed in July. (Heritage Financial Corp. of Olympia, Wash., bought most of Cowlitz Bank from the FDIC. MSAs are geographic units defined by the federal government that encompass socially and economically integrated regions with urban cores of at least 50,000 people.)

Most of the churn in the Janesville, Wis., and the Appleton, Wis., MSAs reflects

In the Kansas City MSA, three failures and four deals, including M&I's agreement to sell and NBH Holdings Corp.'s purchase of most of Bank Midwest, added up to turnover of almost 10%. NBH, a Boston startup that

The activity in the MSA in and around New Orleans was made up of

But whether they are M&A hot spots in the sense that buyers are crowding in — and although taking deposits from competitors attempting to absorb acquisitions is

[IMGCAP(1)]