-

Investors have hammered acquirer shares after recent deal announcements, perhaps signaling a rapid end to the "buyer's market" that prevailed through much of the crisis.

March 4

There's no shortage of irony in bank M&A.

From mid-November to late January, Synovus Financial Corp.'s shares soared as much as 54%, to $2.99, from an 11-month low of $1.94, largely on takeover speculation, experts say. For Synovus' shareholders, all well and good, except no deal has happened yet, and the run-up may in fact be why.

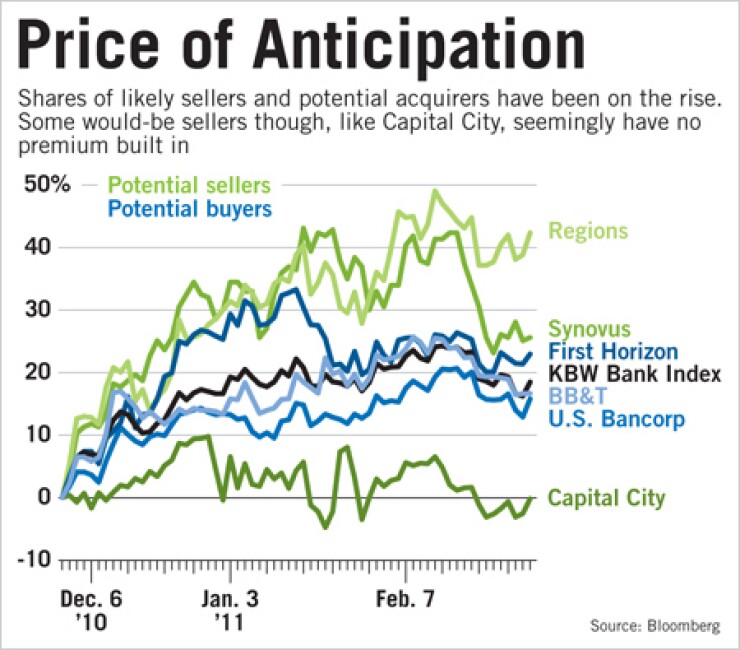

And it's not just Synovus. Bank stocks are up across the board this year, with giddy investors anticipating a flurry of M&A activity, following a few high-profile deals in December and January. But that increase in share prices has actually slowed what could have otherwise been a steady pipeline of deals, experts say.

"People are putting the cart before the horse," said Mike Turner, a senior vice president and research analyst at Compass Point Research and Trading LLC, referring to investors gratuitously driving up valuations. "They're seeing the deals get announced at yearend and are saying 'Who's next? Who's next?' and nobody runs the numbers."

The higher prices have made it more difficult for would-be acquirers to justify purchases, given the slow-going economy and heightened regulatory capital requirements. At the same time, potential sellers are holding out, hoping they can negotiate an even higher price.

Experts still generally believe conditions are right for an uptick in mergers and acquisitions this year. But what was expected to be a flood of deals may be more of a slow trickle until expectations and valuations are better aligned.

"This could be a historical time for acquisitions coming off such a big downturn for the group," said Kevin Fitzsimmons, an analyst at Sandler O'Neill & Partners LP. "The pace of how it's going to occur is tough to say. … When some transactions get announced it begets more speculation for more transactions because it gets everyone talking about it, and you start getting a barometer of what sellers could trade at, so it's almost a little bit of a vicious circle."

The deals between Bank of Montreal and Marshall & Ilsley Corp., and Sterling Bancshares Inc. and Comerica Inc., were two in particular that raised expectations for the kind of price banks could warrant.

Bank of Montreal agreed to pay $7.75 a share, or $41 billion, for Milwaukee-based M&I, a 34% premium over the closing stock price on Dec. 16, the day before the deal was announced. Comerica, meanwhile, agreed to buy Sterling on Jan. 18. for $10 a share, or a 30% premium to its closing price on the prior trading day.

Some potential buyers, like First Horizon National Corp., have been taken aback by such prices.

"I would say that some of the pricing we have seen more recently … is more aggressive than we would have expected at this point in the cycle," said Bryan Jordan, the bank's president and chief executive, during First Horizon's fourth-quarter earnings call.

Ultimately, potential sellers, like Synovus, may not be able to negotiate a deal as quickly as some anticipated, simply because their price has gotten too high.

"We do not believe Synovus is likely to be acquired near-term," Turner wrote in a research note Jan. 31. "We do not believe the economics for some of the rumored acquirers fit with their strategy at the current price."

That said, "a potential deal becomes increasingly attractive at a lower price," Turner wrote.

Greg Hudgison, a spokesman for Synovus, of Columbus, Ga., said the bank does not comment on analyst notes or speculation.

Some would-be sellers may also be holding out because they don't want to do a distressed sale, market experts said.

Saddled with credit losses, Synovus is still bleeding money and is one of the few remaining regional bank holders of government bailout funds. But its credit metrics have been improving, and it's been aggressive in ridding itself of troubled assets.

"I think the sellers are starting to see improvements in a lot of different parts," said Anton Schutz, the president of Mendon Capital Advisors Corp., which own Synovus stock. "You've seen a couple of deals that were very expensive, and that is certainly going to raise sellers' expectations."

The entire situation has left markets jittery. Though Synovus has been considered a target for months, a news report Feb. 23 that Synovus was considering a sale sent the stock bouncing between $2.55 and $2.74, ending the day down 3.8%, at $2.55. (It closed Friday at $2.53.)

Fitzsimmons said he expects the market to remain on edge for the foreseeable future.

"You're probably going to have those weeks where everyone gets all wrapped up about M&A and people buy the targets," he said. On the other hand, "investors on certain weeks, they seem to be more inclined … [to] buy the buyers. You have these fits and starts of how to play the M&A theme."

Since the beginning of December, the KBW Bank index, which tracks 24 large-cap banking stocks, had risen 17% through Friday. That outpaces the Standard & Poor's 500 index, which is up 12% since then.

A major pullback in bank stocks across the board isn't necessarily the answer, though, in driving more deals, analysts warned.

"If you're a buyer and you want to buy somebody else with stock, if there's a pullback in price, there's a possibility that you'll get them at a cheaper price," said Jason O'Donnell, a senior research analyst at Boenning & Scattergood Inc. "But if your price goes down, too, that's not helpful. … We want a natural market."

And currently, the market isn't very efficient at accurately pricing banks, Schutz said.

For example, some banks that would appear to be sellers, such as 1st United Bancorp Inc., CenterState Banks Inc. and Capital City Bank Group Inc., have "seemingly no premium in them," he said.

Still, the pace of deals is moving along. So far, 20 whole bank and thrift deals have been announced this year, compared with 16 deals announced during the same time frame last year, according to SNL Financial.

"There has to be more M&A activity," Fitzsimmons said. "It just makes sense because you have a combination of weaker players that will ultimately conclude that it makes sense to partner up with a larger player. But you also have larger, stronger banks that have excess capital that are looking for ways to use it."