Business abandoned by some the nation’s largest mortgage lenders as they have

Still, the

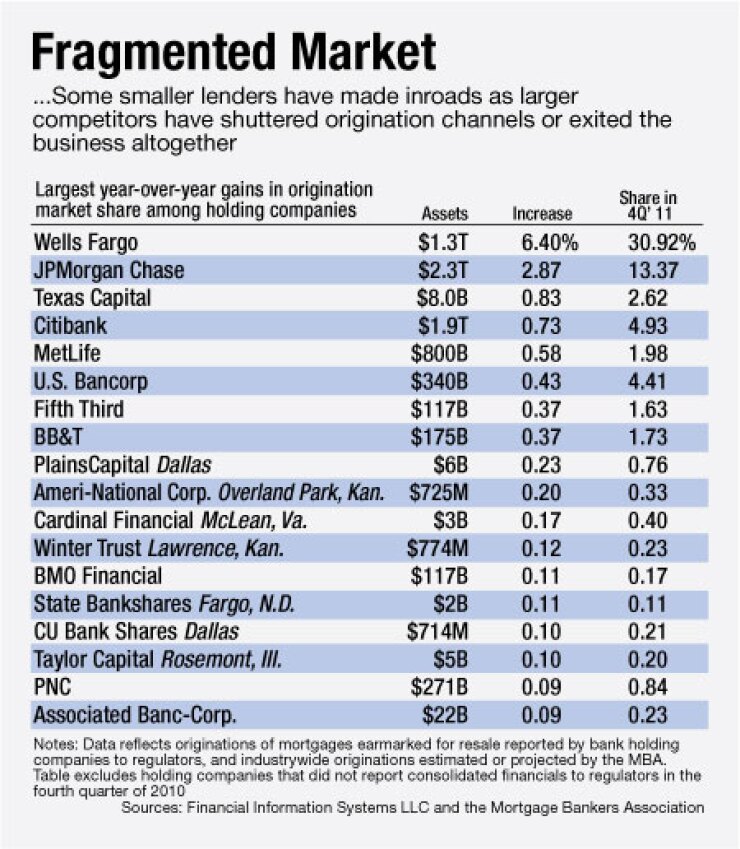

Eleven of the 21 holding companies that increased their share of mortgage originations the most in the fourth quarter from the year prior had less than $10 billion of assets, according to regulatory financial reports. Together, they took an additional 2 percentage points of the market, a piece larger than eighth-ranked MetLife Inc.’s share during the period.

Seventh-place Texas Capital Bancshares Inc. in Dallas increased its share by 0.83 percentage points, to 2.62%. That put the $8.1 billion asset company just behind $2.1 trillion-asset Bank of America Corp.’s 3.55% share.

Cardinal Financial Corp. in McLean, Va., with $2.6 billion of assets, roughly doubled its share to 0.4%, and the $5.7 billion-asset PlainsCapital Corp. in Dallas increased its share by about half, to 0.76%. Production at both institutions ranked in the top 15 among bank holding companies during the fourth quarter.

(Volumes used here reflect originations of mortgages earmarked for resale, and market share is based on estimates and projections of industrywide production made by the Mortgage Bankers Association.)

B of A’s retreat has been behind the largest shift in the rankings. The company

A major reason for the pullback has been the company’s effort to reduce intangible assets associated with revenues generated from servicing mortgages. Such assets will be allowed to account for no more than 10% of core Tier 1 capital under the Basel III rules. (B of A’s mortgage servicing rights have fallen in half from the year prior to about 5% of Tier 1 common equity calculated under the current rules in the fourth quarter, though much of the decrease was driven by a drop in the value of the assets themselves because of declining interest rates.)

Much of the share ceded by B of A has been absorbed by Wells Fargo & Co., however, leaving the bank oligopoly that emerged during the recession at about the same size overall. Crisis-driven consolidation helped put about 60% of originations in the hands of six bank holding companies by the first half of 2009, though the group’s share has since fluctuated from period to period.

Still, the reconfiguration of the industry is far from over. MetLife just announced it would