Trinity Capital in Los Alamos, N.M., didn’t think of Enterprise Financial Services in Clayton, Mo., as a potential suitor when it decided to sell itself.

The $1.3 billion-asset parent of Los Alamos National Bank reached out to seven banks last summer, but it was a mid-September overture from the $5.5 billion-asset Enterprise that caught the company and its investment bank by surprise.

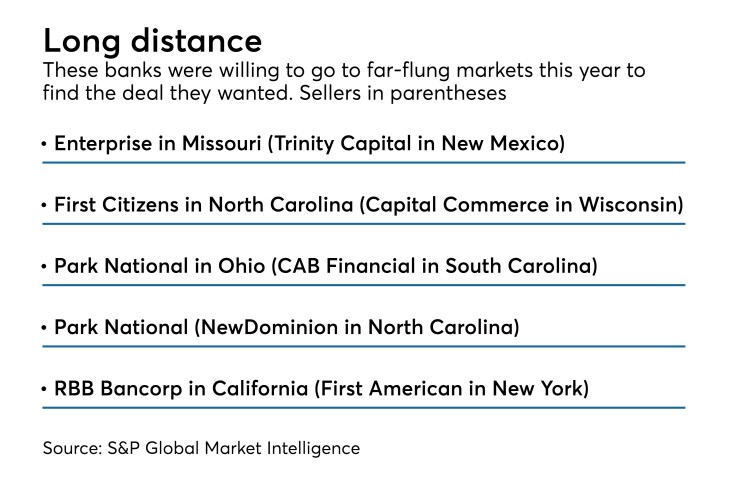

More than a thousand miles separate the companies’ headquarters. The deal will provide Enterprise with its first branches in New Mexico.

“Enterprise had not been identified by the Trinity board … as a potential merger partner because of the perception that the [Los Alamos] franchise was outside of Enterprise’s desired markets,” the companies disclosed in

A proactive approach by Enterprise paid off; the companies agreed to merge last month. The disclosures support the notion that acquirers keen on entering far-flung markets must take initiative scouting targets, many of which may not be aware of their interest.

Trinity’s board first discussed selling in June, based on a realization that the bank, formed in 1963, had strong core deposits and a low loan-to-deposit ratio that stood at 65% on Sept. 30. There was a belief that cheap funding would be desirable to a buyer, given rising interest rates.

Those talks began four months after the Federal Reserve freed Trinity from a 2013 regulatory order that required it to provide updates on capital and cash flows. A separate order from the Office of the Comptroller of the Currency, addressing underwriting and internal controls, was lifted late last year.

Trinity formed a special committee that included its chairman, James Goodwin Jr., and CEO John Gulas. Tony Scavuzzo of Castle Creek Capital and James Deutsch of Patriot Financial Partners were also on the committee. Castle Creek and Patriot each own about 9.9% of Trinity’s voting stock.

By July, the board, following a recommendation from the committee, asked Trinity’s investment bank to contact five potential acquirers. Three of the institutions entered into confidentiality agreements. The investment bank reached out to two more institutions; one of those signed documents to obtain more information.

Trinity’s chairman and management team were in the process of meeting two of the suitors when Enterprise reached out on Sept. 18 to express an interest, the filing said. Within a day, Enterprise had signed a confidentiality agreement to gain access to an electronic data room.

Trinity received three initial offers on Sept. 26.

Enterprise proposed paying $250 million, or $12.25 a share, with cash accounting for up to 15% of the consideration.

Another party proposed an all-stock deal valued at roughly $221 million. A third suitor offered about $252 million, with 85% of the consideration involving stock.

The fixed exchange ratios varied, ranging from a 10-day volume weighted average price to a 20-day average. Enterprise’s offer had a 15-day volume weighted average.

Trinity’s directors had a “robust discussion” about the offers during an Oct. 1 meeting, considering factors such as each suitor’s M&A experience and ability to complete a deal, historic dividend payments, perceived culture, board representation and the pro forma ownership of Trinity investors, the filing said.

Trinity’s board “determined that pursuing a potential business combination with Enterprise at that time was more likely to maximize Trinity shareholder value” than staying independent or accepting the other offers, the filing said.

Still, Trinity asked Enterprise to boost its offer in exchange for an exclusivity agreement. Enterprise acquiesced, raising its bid to $12.30 a share, or $251 million, with a fixed exchange ratio of roughly 0.2 shares of its stock for each Trinity share.

The companies agreed to a 30-day exclusivity period on Oct. 5.

The parties continued to negotiate the finer points of the deal. Notably, Trinity’s balance sheet must have at least $868.9 million in non-maturity deposits when the deal closes, an amount equal to 79% of total deposits at Sept. 30.

The boards of each company unanimously voted for the merger on Nov. 1, and it was announced later that day.

The acquisition, which is expected to close early next year, priced Trinity at 202% of its tangible book value. Trinity is the biggest bank in Los Alamos and the fourth-biggest bank in Santa Fe, N.M., by deposit market share.

Trinity "has a deep history and commitment to … employees, customers and communities that is demonstrated by a dominant market share and extraordinary customer loyalty,” Jim Lally, Enterprise’s president and CEO, said in a press release announcing the deal.

Scavuzzo and Deutsch will join Enterprise’s board.

Enterprise expects the deal to be immediately accretive to its 2019 diluted earnings per share, excluding merger-related expenses. It should take three years for Enterprise to earn back any dilution to its tangible book value.

Enterprise expects to cut about a third of Trinity’s annual noninterest expense, or roughly $13 million. The company said it will likely incur about $15.5 million in merger-related expenses.