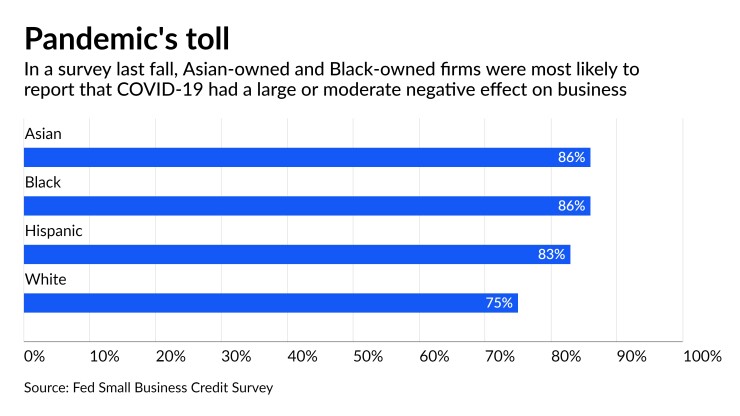

Small businesses owned by Asian, Black and Hispanic Americans reported more negative impacts from the pandemic, and fewer options to improve their financial conditions, than their white counterparts, according to new Federal Reserve Bank research.

Asian-owned and Black-owned firms provided the worst outlook, with nearly half of such businesses saying the COVID-19 pandemic had a “large negative effect” on their performance, the survey found.

The Federal Reserve Banks’ annual Small Business Credit Survey, which focuses on firms owned by people of color, canvassed nearly 11,000 businesses with fewer than 500 employees between last September and November. The survey looked at trends for Asian-, Black-, Hispanic- and white-owned businesses.

“During the pandemic, in many cases, having access to financing was critical to a business’s survival,” Ann Marie Wiersch, one of the report’s authors, said during an interview. “We need to think about how firms within the small-business sector are facing different types of challenges.”

Seventy-nine percent of Asian-owned small businesses said in the survey that their revenues had not yet reached 2019 levels. The same was true for 72% of Black-owned firms and 67% of Hispanic firms. Some 59% of white-owned firms reported that their revenues were not yet at pre-pandemic levels.

Wiersch, a community development policy advisor at the Cleveland Fed, called those findings a “continuation of past trends” seen in previous Fed surveys.

Two-thirds of Black-owned firms that did not seek financial assistance during the pandemic said that they did not think their business would qualify for government-sponsored lending such as the Paycheck Protection Program, with around half of Asian and Hispanic companies and only 43% of white firms saying the same, according to the survey.

“Even among firms with good credit scores, firms owned by people of color were less likely than white-owned firms to have received all of the financing for which they applied,” the Fed report stated.

Hispanic-owned firms were more likely to report holding debt, though in smaller amounts than Asian, Black and white-owned businesses, the survey found.

Nearly half of the Black-owned and Hispanic-owned businesses said they applied for financing last year, compared with 38% of Asian-owned businesses and 33% of white-owned firms. But firms owned by people of color sought smaller amounts of financing than white-owned firms, the Fed found.

One of the most notable shifts during the pandemic involved Asian-owned firms. The percentage of Asian-owned businesses that reported experiencing a financial challenge over the previous 12 months spiked from 70% in 2019 to lead the four demographic groups at 95% last year.

Business owners are seeing their cash flow strained by the highest inflation in 40 years and mounting costs to borrow money.

“There is a trend of Asian-owned firms struggling following the beginning of the pandemic,” said Lucas Misera, the report’s co-author and a policy analyst at the Cleveland Fed.

Misera noted that Asian-owned firms were more likely to report weak sales from businesses focused on leisure and hospitality services, which had a hard time retaining in-person customers at the start of the pandemic.

“Small businesses are a collection of different types of firms,” Wiersch said. “We can’t treat small businesses like one uniform set of companies. It’s important to pull out and understand those different sets of challenges.”