Peapack-Gladstone Financial in Bedminster, N.J., plans to boost fee revenue by building a business many other community banks pass over.

The $4.7 billion-asset company recently formed an investment banking division. Eric Waser, who had been in charge of commercial lending operations, was tapped to lead the effort.

Peapack, which is used to competing against community banks for business loans, will likely find itself bumping up against bigger institutions as it looks to expand in areas such as advisory services and structured finance.

“Clearly some of the super-regionals and money centers have these capabilities,” Waser said. “We’re not aware of any banks under $20 billion in assets in the mid-Atlantic region that have the breadth we have on the investment banking side.”

That could change.

Other community banks with a similar profile are likely to follow Peapack's lead and explore a wider role in investment banking, according to Robert Kafafian, president and CEO of Kafafian Group, a Parsippany, N.J., consulting firm.

"It's a sign of things to come," Kafafian said. "More and more banks are looking for alternative ways to serve clients."

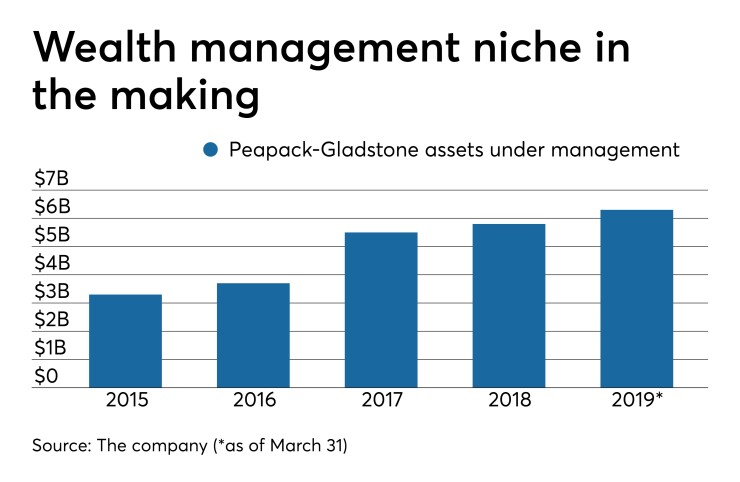

The move comes after Peapack spent several years building its wealth management capabilities. Since the start of 2017 it has bought three boutique firms and created a separate brand, Peapack Private, which reported $6.3 billion in assets under management on March 31.

Investment banking seemed an obvious extension.

“We believe it’s a natural and compelling fit for what we do on the wealth side. “Clearly, we pride ourselves on what John Babcock has done," Waser said, referring to Peapack Private's president. ... "In just about every situation where there's an investment banking client, there’s a connection to our wealth group.”

The $5.2 billion-asset Washington Trust Bancorp in Westerly, R.I., is also moving in a similar direction, creating a private client group in January to offer customized solutions to high-net-worth clients. Like Peapack, Washington Trust wants to offer advisory services, though it is stopping short of creating a full-fledged investment bank.

“We perceive that in the communities we serve in Southern New England, the need is growing for that kind of relationship-advice quarterback," said Mark Gim, Washington Trust's president and chief operating officer.

"Investment banking isn’t on our near- or medium-term horizon, because we think there are some real specialization, risk-tolerance barriers that don’t fall necessarily within our risk envelope,” Gim added. "Because our focus is relationship-oriented, as opposed to transactional, we feel the best way we can help our clients ... is to link them to the right resources that allow them to achieve whatever their financial goals are."

Still, Peapack’s approach could work for it given the markets it serves, Gim said.

“In different markets there might be greater demand for formalized services that might be well-served by establishing a specialty niche in investment banking,” Gim said. Peapack "may see a very different demand for business opportunities than we might, or a bank in Topeka, Kansas or Idaho might."

At Peapack, investment banking grew out of a February 2018 initiative to offer strategic advice to small and midsize companies with needs beyond credit and deposit services. Waser, for instance, pointed to clients with $75 million in annual revenue that could be considered too small to get the attention of larger investment banks.

Peapack characterizes its services as customized structured finance, with advice remaining a key component.

“It’s a great platform here,” said Kevin Bodnar, head of corporate advisory for Peapack's investment banking team. “Delivering high-quality, independent, objective, unbiased advice is what our middle-market clients and their shareholders are really looking for.”

The investment banking team is helping Peapack lenders spot referral opportunities. Specifically, lenders are being trained to learn more about their clients long-term objectives. At the same time, Peapack is looking for clients outside its portfolio, too.

“We have deep relationships with what I call centers of influence, the attorneys, the accountants that are the other advisers to the owners and the companies,” Bodnar said. “They see the difference in what we’re [offering] and bring us in to different opportunities.

To be sure, Peapack still views itself primarily as a commercial lender. It’s commercial-and-industrial portfolio has more than doubled since late 2016, totaling $1.4 billion at Dec. 31.

“I would challenge anyone as to who’s been more successful in growing commercial market share in the tri-state area,” Waser said.

In that context, Peapack's move into investment banking can be viewed as "more of an ancillary service," according to Kafafian.

"It's an extension of investment banking services to corporate clients,” Kafafian said. "Oftentimes, the business entity is tied to the wealth of the owner, and the wealth is managed by the bank."

Joe Fenech, an analyst at Hovde Group, agreed, writing an in email that the effort "doesn't strike me as an investment banking operation in the sense that we think of it." Still, Fenech believes the effort will likely lead to higher noninterest expenses as Waser builds out his group.

Though the investment banking division is barely two months old, “we expect to be successful,” Waser said. “I would envision that as we become even more successful producing revenue, we’ll continue to reinvest in the business. That’s the plan from the top of the company down.”