Countrywide Cuts

Countrywide Financial Corp. disclosed Wednesday what is expected to be the first wave in a series of major job cuts after a long period of expansion.

The Calabasas, Calif., mortgage giant reported that its work force declined by 0.61% from August's total, to 55,564 employees last month. It was the biggest monthly drop since February and only the fourth in the last 13 months. Last month's biggest decline was in the "corporate overhead and other" category, which shrank by 2.07%, to 7,167 employees. Loan origination workers fell 0.91%, to 32,013, and servicing staff slipped 0.62%, to 6,959.

Countrywide told employees in an internal memo last month that it would cut staff by 5% to 10% in the next few months. Angelo Mozilo, the chief executive, said at a September conference with analysts that the company would cut some general and administrative workers in servicing. Some analysts have predicted there would be a lot more cuts.

Also Wednesday, Countrywide said that its mortgage fundings fell 22.44% in September from a year earlier, to $38 billion.

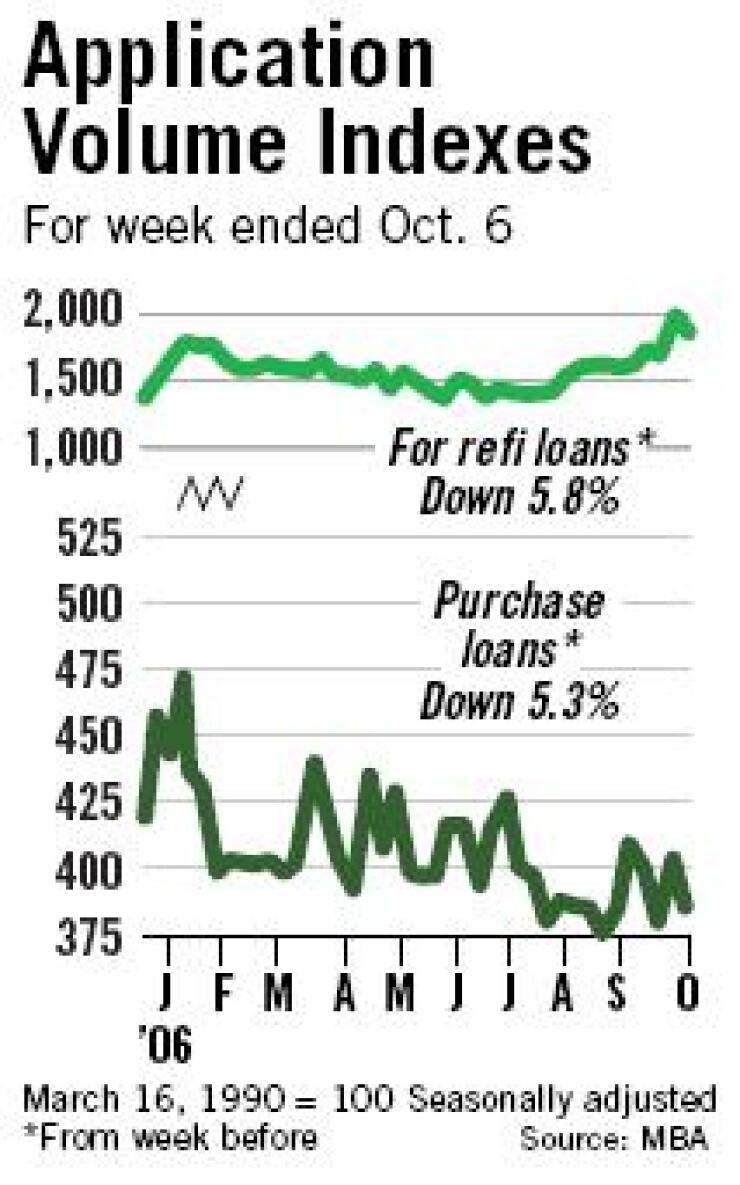

Originations of loans to buy homes fell 21.73% to $18 billion. Average daily mortgage loan application activity dropped 6.66%, to $2.8 billion.

Countrywide's servicing portfolio grew 19% from a year earlier, to $1.24 trillion at Sept. 30. The portfolio's delinquency rate grew by 35 basis points from Aug. 31, to 4.5%. The lender attributed the rise to fewer business days in September and portfolio seasoning.

Storm Watch

Moody's Investors Service warned in a report released this week that commercial real estate lenders should be "cautious" before letting borrowers reduce their windstorm insurance coverage.

Daniel Rubock, an analyst at the rating agency, said in a press release issued Monday that some borrowers are presenting "probable maximum loss" studies to justify not obtaining coverage for the full replacement value of their properties.

The lack of full windstorm insurance coverage, he said, could hurt commercial mortgage-backed securities' credit and subordination levels.

'Ponzi' Plea

The Securities and Exchange Commission said it has a plea agreement with the former president of National Consumer Mortgage LLC in Orange, Calif., who was charged with operating a $30 million Ponzi scheme - using investors' money to pay off more than $10 million of gambling debts and finance a lavish lifestyle.

In a complaint filed last week in U.S. District Court for the Central District of California, the SEC said Salvatore Favata solicited 200 people at church gatherings and investment seminars, promising them returns of 30% to 60% on cash they took out of their homes by refinancing.

The investors were told their money would be used to fund loans to homeowners who could not qualify for traditional mortgages, the SEC said. A 65% loan-to-value ratio would keep defaults low, Mr. Favata allegedly told the investors.

In a deal Friday with the U.S. Attorney's Office for the Central District of California, Mr. Favata agreed to plead guilty to one count of mail fraud, to pay more than $20 million in restitution, and to forfeit his home, the SEC said. He faces a possible 60-month prison sentence. Though he did not admit wrongdoing, he also agreed not to associate with any broker or dealer.

In a press release issued Tuesday, Peter H. Bresnan, the SEC's deputy director of enforcement, said, "This case exemplifies how fraudsters can take advantage of existing market conditions - here, California's booming real estate market - to entice investors with the false promise of double-digit returns."

Special Payout

Luminent Mortgage Capital Inc., a San Francisco investor in mortgage-backed securities and loans, has announced it will pay a special dividend of 7.5 cents a share and will sell five million shares of stock in a public secondary offering.

Underwriters are to be given a 30-day option to buy up to an additional 750,000 shares. Chairman and chief executive Gail Seneca said in a press release Tuesday that the company's strong returns "have not been fully reflected in the quarterly dividends paid thus far in 2006."