Providian Financial Corp. has agreed to sell $447 million of high-risk credit card loans.

On Tuesday, the San Francisco lender said the sale would improve the credit quality of its portfolio and would have a "modestly" beneficial effect on earnings this quarter.

The deal is expected to close this quarter.

Alan Elias, a spokesman for Providian, said the small gain expected from the sale showed that "the market was strong for these assets." All the loans had Fair Issac scores below 600, he said.

Mr. Elias would not identify the buyer or say how much it is paying, but he did say Providian would release more information March 3, when it conducts an investor presentation.

Providian will probably revise its full-year earnings guidance at the investor presentation next month "to take this sale into consideration," Mr. Elias said.

Two analysts suggested the same likely buyer: CompuCredit Corp. of Atlanta, which bought $1.2 billion of credit card loans from Providian in 2002 and has said it is looking for acquisitions.

A spokesman for CompuCredit, which specializes in buying subprime portfolios, did not return a phone call seeking comment.

Frank B. Martien, a principal with the Linthicum, Md., investment banking company First Annapolis Consulting, said the sale could mean Providian is cleaning up its subprime portfolio and preparing to sell itself.

It is not unusual for banks to sell subprime loans shortly before selling themselves or their card business, Mr. Martien said. "They could have had discussions with a top 10 issuer, and they could have said, 'We need you to clean out the portfolio.' "

Providian would not discuss the speculation.

It has long been rumored as a likely takeover target. Last year Barclays PLC was rumored to be in the market to buy Providian, but nothing came of it at the time. In December, Barclays acquired Juniper Financial Corp. and gained a foothold in the U.S. card-issuing business.

Mr. Martien said another possible acquirer of the portfolio is Cardholder Management Services LLC, which issues cards through its Salt Lake City subsidiary, Merrick Bank, and once bought a $1.3 billion portfolio from Providian.

JPMorgan Chase & Co. has purchased subprime portfolios, including one from Providian, in the past but has been a less active subprime buyer recently, he said.

Analysts also offered their views of Providian's assertion about the loan sale's effect on earnings.

Robert K. Hammer, the chairman and chief executive officer of R.K. Hammer Investment Bankers of Thousand Oaks, Calif., said that even though subprime portfolios typically sell at a discount, "the earnings improvement that results from them no longer having the risk is greater than the discount they had to take to sell it."

Mr. Martien said that the sale could improve earnings, because the discount might be less than the portfolio's chargeoff rate, which could be 25% to 30%.

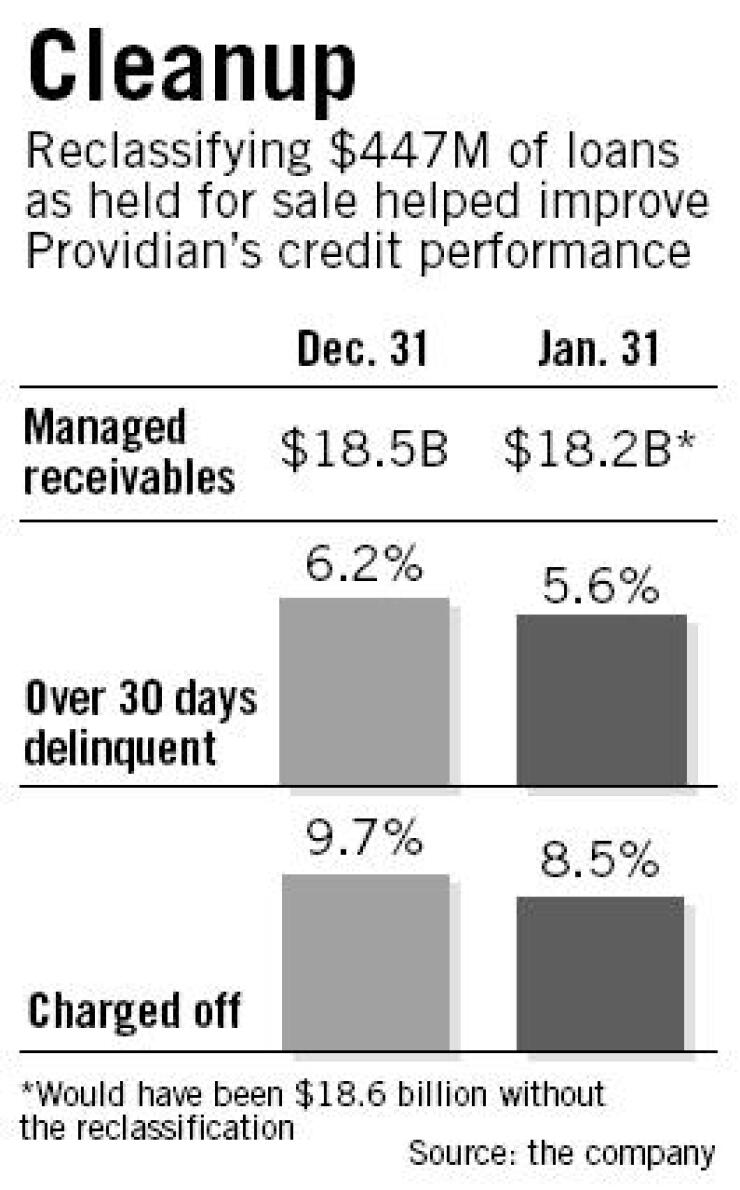

Providian said that it classified the loans as "loans held for sale" as of Jan. 1, and that removing them from its managed portfolio resulted in a 126-basis-point decrease in its net chargeoff rate.

On Tuesday, Providian reported that its January managed chargeoff rate fell 119 basis points from December, to 8.54%.

Also Tuesday, MBNA Corp. reported that its January managed net credit loss rate rose 39 basis points from December, to 4.63%. Managed loans declined 2.7%, to $118.3 billion. Fulcrum Global Partners downgraded the Wilmington, Del., issuer to "neutral," from "buy."