Among bank holding companies, Citigroup Inc. remains the industry leader in generating insurance revenue, but rivals Wells Fargo & Co. and Bank of America Corp. are closing the gap.

According to data compiled by Michael White Associates of Radnor, Pa., and the American Bankers Insurance Association, Citi earned $3.2 billion in insurance-related income in 2008, down 9 percent from a year earlier but still significantly more than any of its competitors. Wells held on to the No. 2 position in the top 50 rankings, reporting insurance income of $1.83 billion, up nearly 20 percent from a year earlier, thanks in large part to its acquisition of Wachovia Corp.

The biggest mover in the latest rankings was BofA. Though it only jumped two notches, from No. 5 to No. 3, its insurance income nearly tripled from a year earlier, to $1.82 billion. BofA beefed up its insurance operations when it bought Countrywide Financial and absorbed the mortgage giant's Balboa Insurance Group, said Michael White, who consults banks on insurance issues.

Citi, Wells and BofA were among seven holdovers from the prior year's top 10. The others were BB&T Corp., HSBC North America Holdings Inc., JPMorgan Chase & Co., and Regions Financial Corp.

The three newcomers to the top 10 were BancorpSouth Inc., SunTrust Banks Inc., and Huntington Bancshares Inc.

The rankings are based on data reported to the Federal Reserve Board by bank holding companies with at least $500 million of consolidated assets. They do not include MetLife because the insurance giant "does not engage in significant banking activities," according to White.

While community and regional bank holding companies made significant strides in generating insurance brokerage income, the bank brokerage market is still dominated by large institutions.

According to data compiled by Michael White Associates and Prudential Financial Inc., 10 institutions accounted for 93.7 percent of the banking industry's insurance income in 2008. However, while that group saw a 4.2 percent decline in brokerage income from the prior year, to $11.07 billion, institutions with less than $10 billion of assets reported a 6.3 percent increase, to nearly $731 million. Within that group, institutions with $1 billion to $10 billion of assets performed best, achieving 8.4 percent growth in brokerage income, according to White.

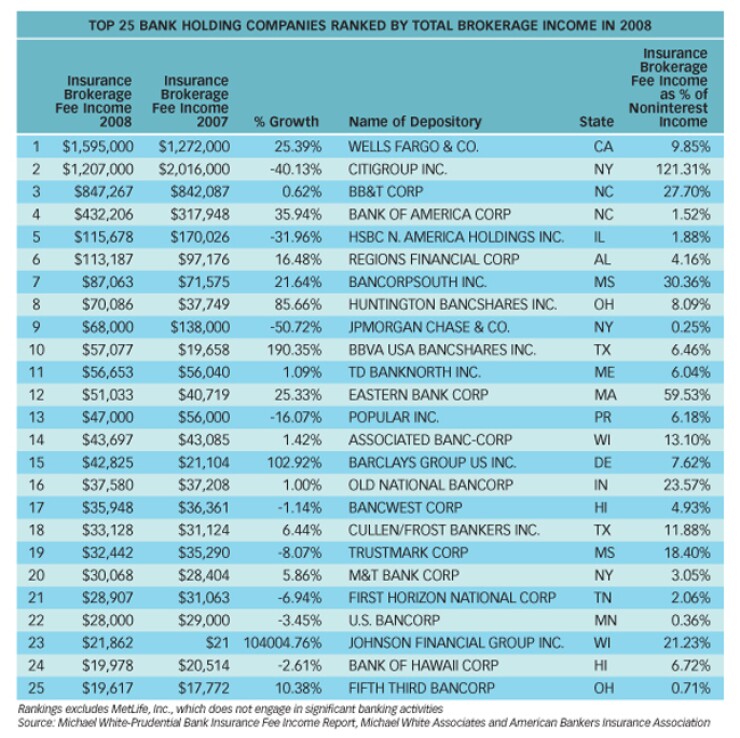

At Wells, brokerage income increased 25.4 percent year-over-year and accounted for nearly 10 percent of its total noninterest income. Citi's brokerage income fell by more than 40 percent, while BofA's increased 36 percent, to $432 million.

Sixty-five of the top 100 bank holding companies in insurance brokerage income reported income gains in 2008, White said.

Among the top 10 (other than Citi, whose figures were skewed by its hefty annual loss) BancorpSouth generated the most brokerage income as a total of fee income.

The $87 million it earned from brokerage fees totaled 30.4 percent of its overall fee income in 2008. Other bank holding companies in the top 25 with a double-digit ratio of brokerage income to fee income were: BB&T, Eastern Bank Corp., Associated Banc-Corp, Old National Bancorp, Cullen/Frost Bankers Inc., Trustmark Corp. and Johnson Financial Group Inc.

Overall, bank holding companies' total insurance income, which includes fees from brokerage and underwriting activities, increased 7.2 percent year-over-year, to almost $10.9 billion. Nearly 67 percent of 880 bank holding companies earned at least some insurance-related revenue in 2008. Including MetLife, total insurance income fell 2.6 percent year-over-year, to $42.5 billion.