-

The state's banking market is still seriously impaired, but foreign banks are increasingly attracted to it for the same reason — and their arrival may feed the turnaround.

June 23 -

There are two big unknowns in PNC Financial Services Group Inc.'s deal for RBC Bank: The final price, and how PNC will pay for it.

June 20 -

For Capital One Financial Corp.'s planned acquisition of ING Direct to pay off, the lender will have to follow quickly with another deal, and the economy must not falter.

June 17

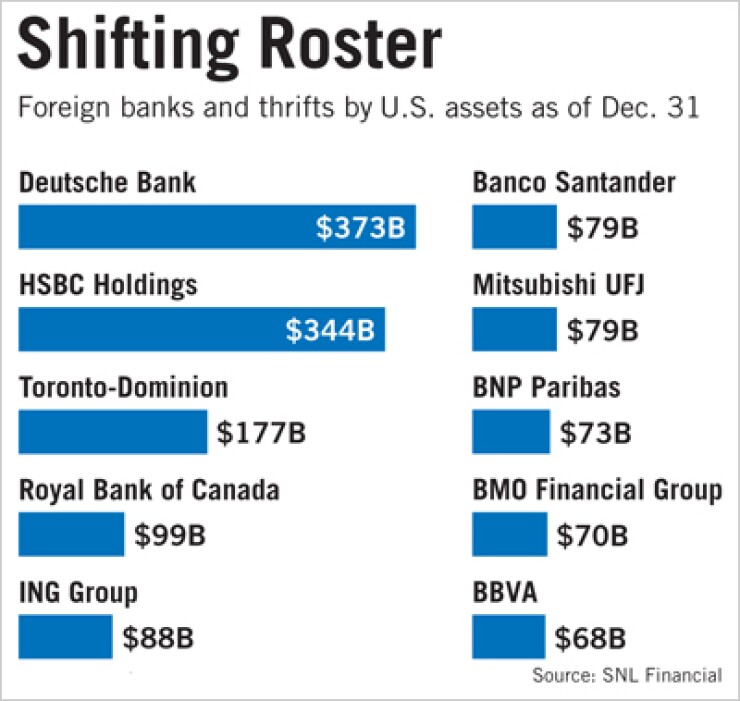

Royal Bank of Canada and ING Group NV both agreed to sell their U.S. banks in the past week. How many more international banks could follow their retreat?

A few, experts say. Eight other foreign banks own major U.S. banks, and three of them are considered candidates to unload some or all of their stateside operations.

One is officially exploring its options: HSBC Holdings PLC of London. The other two experts peg as potential sellers are Edinburgh's Royal Bank of Scotland Group PLC and BNP Paribas of Paris.

The other foreigners that own a top 50 U.S. bank have the means and desire to take a bigger piece of the U.S. market, experts say. That includes Sovereign Bank owner Banco Santander SAS and BBVA Compass owner Banco Bilbao Vizcaya Argentaria SA.

Marty Mosby, an analyst with Guggenheim Partners LP, said that outside of a few "unique situations," most international banks here are not "ready to start exiting."

International banks are reluctant to leave the U.S. because the country's long-term prospects are good and its economy is in better shape than other parts of the world, experts in investment banking and private equity said. Most of the major foreign banks with a stateside presence have been buyers in recent years, not sellers.

But some institutions, such as BNP Paribas, the owner of BancWest Corp. of San Francisco, may not have a choice but to sell.

Moody's Investors Service raised market speculation that BancWest could go up for sale after putting its two banking units on review for possible downgrades. BNP Paribas credit rating could fall because of its exposure to the financial crisis in Greece, Moody's said. That could make it harder for it to support its U.S. bank, Moody's said.

ING had to divest its online U.S. bank under orders from regulators; Capital One Financial Group Inc. is buying it. Royal Bank of Canada's long-running problems with RBC Bank of Raleigh, N.C., led to an agreement to sell it to PNC Financial Services Group Inc.

HSBC is fielding offers for a large chunk of its 475-branch U.S. retail bank as it changes its strategy in the U.S. It is scaling back on retail and consumer banking but wants to maintain a commercial banking and capital markets presence.

BNP Paribas or others could follow its lead in shrinking in the states if the European debt crisis deepens and investors or regulators demand they increase capital and reduce risk, experts say. A San Francisco business paper and the Street.com suggested last week that U.S. Bancorp would be a natural buyer for BancWest, which has more than 700 branches on the West Coast.

U.S. Bancorp has been expanding in California after buying some failed banks there. The Minneapolis company has said it would consider large deals. BancWest is attractive because it operates in areas with good growth demographics. Its agriculture and commercial lending portfolios are assets other banks would also be interested in.

"If BNP Paribas has to write off its Greek exposure, it could well look to that investment as one that it would have to divest," said Gary Townsend, Hill-Townsend Capital LLC's chief executive.

Royal Bank of Scotland is less likely to make any moves in the near future with Citizens Financial Group Inc., a $130 billion-asset company with 1,500 branches in 12 states, experts say. RBS seems committed to staying the course for the time being with Citizens, which returned to profitability in 2010 after losing about $1.7 billion the two previous years.

Citizens did not return a call for comment. Spokesmen for HSBC and BancWest declined to comment.